Investors are taking on more risk and there are myriad ways to do this in the investment trust universe, with emerging markets, healthcare, space, private equity and smaller companies all strong options, according to experts.

Yesterday, the closely watched Bank of America survey revealed optimism has spiked among investors with allocations to stocks jumping amid a record pullback from bonds.

Annabel Brodie-Smith, communications director of the Association of Investment Companies (AIC), said there is a place for some adventurous options within a diversified portfolio, but these should be “small satellite holdings” and only if investors “have the appetite” for it.

Below, experts suggest a range of sectors and trusts for investors who want to add some spice to their portfolio.

UK smaller companies

Sticking with more traditional asset classes, Deutsche Numis investment companies analyst, Gavin Trodd said Odyssean Investment Trust might be one to consider.

The concentrated portfolio of 15 to 20 UK small and micro-caps takes a private equity style approach to public markets, with managers Stuart Widdowson and Ed Wielechowski building up “meaningful stakes in businesses that have fallen out of favour and are trading at discounts to their intrinsic value”.

“They seek companies that can benefit from self-help opportunities and where the manager can generate value through engagement,” said Trodd.

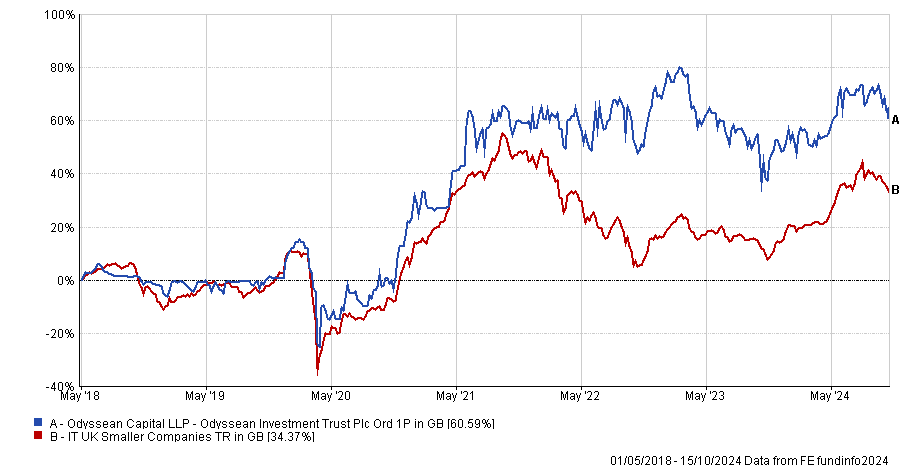

This has worked well since the trust was launched in 2018, with initial investors making 60.6% over this time, almost double the 34.4% made by the IT UK Smaller Companies peer group.

Performance of fund vs sector since launch

Source: FE Analytics

“Performance since launch has been exceptional, although investors need to be comfortable that performance may differ significantly from small-cap indices over short periods, given the concentrated portfolio of 15 to 25 positions, reflected in a period of underperformance in 2023,” Trodd said.

“We believe that the stock-picking record speaks for itself and that Odyssean represents an attractive and differentiated addition to a portfolio.”

Emerging markets

Another mainstream sector that may appeal to adventurous investors is emerging market equities, where Bestinvest managing director Jason Hollands chose Templeton Emerging Markets Investment Trust (TEMIT).

Although investors can access both this asset class and UK small-caps through open-ended funds, doing so through an investment trust structure “means that when markets endure periods of turbulence and some investors panic sell, the managers of the trust won’t be forced to liquidate holdings to meet redemptions”.

TEMIT was formerly run by emerging market guru Mark Mobius, who left to set up his own asset management firm Mobius Capital Partners. He was replaced by Carlos Hardenberg, who later joined Mobius Capital Partners, leaving the trust in the hands of current co-managers Chetan Sehgal and Andrew Ness.

“It has a very pragmatic and patient philosophy, investing in companies with sustainable earnings that are mispriced,” said Hollands.

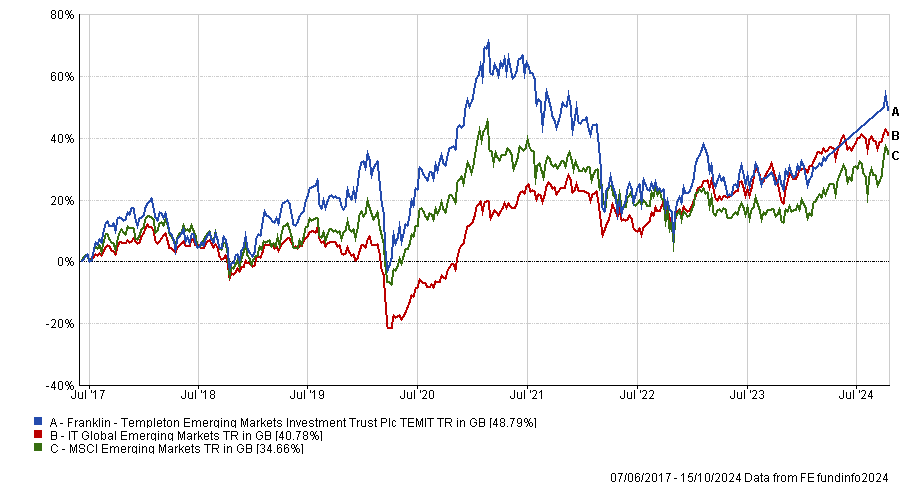

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

This trust is “very much the sector’s grandaddy having been launched in 1989,” he added. Since Sehgal was named co-manager in 2017 (Ness joined a year later), the trust has made 48.8%, the third best return in the IT Global Emerging Markets sector.

Healthcare

Turning to thematic investing, Trodd said RTW Biotech Opportunities was worth considering. The trust invests across the entire biotechnology market, from early-stage developers to more mature businesses.

“RTW Biotech Opportunities offers exposure to a sector that benefits from numerous tailwinds including increasing innovation and looming patent expiries which is likely to support further M&A activity,” he said.

Since its launch in 2019 the trust has made 39.9% versus the IT Biotechnology & Healthcare sector’s 24.8% average gain. It has been “fuelled by several companies delivering clinical successes and return generating liquidity events”, said Trodd.

The trust has made 65 investments since launch, of which 30 have either listed or been bought out through mergers or acquisitions, making the trust around double its initial investment.

Space

For those looking a little further ‘out there’, Shavar Halberstadt, research analyst at Winterflood Securities, suggested investors might want to consider investing in space.

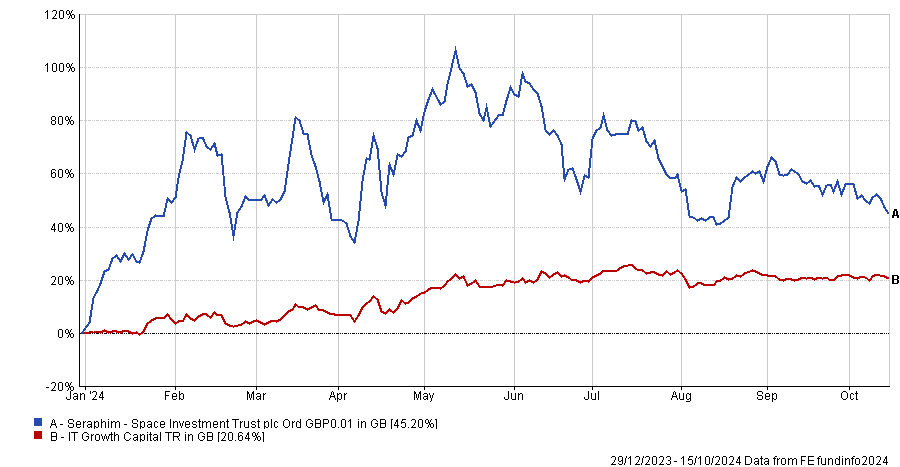

Seraphim Space Investment Trust is a technology company that has rocketed this year, up 45.2% in the year to date, although shares remain at a 48% discount to the net asset value (NAV).

Performance of fund vs sector over YTD

Source: FE Analytics

“A range of contract wins from government agencies should mean sticky revenue, while the fund’s listed holding in AST SpaceMobile has returned 295% so far this year, based on its partnerships with Verizon and AT&T,” said Halberstadt.

The trust is “supported by structural tailwinds including rising defence spending and climate change monitoring” as well as falling interest rate environment, which should benefit high-growth valuations and the IPO market.

Private equity

In the alternatives space, Iain Scouller, managing director of investment funds research at Stifel, said the private equity sector “provides investors access to a much broader range of companies than those listed on stock exchanges”.

However, many of these trusts are trading on wide discounts to their NAVs, typically of between 20% to 40%, which he said “offers some value”.

“We expect sales of companies from these portfolios to pick up over the next year and this should be good for investors – typically when an investment is sold, it is at a gain of 20% to 30% above its prior valuation, which results in an increase in the trust’s net asset value,” he noted.

He highlighted HgCapital Trust*, which focuses on software companies, as well as NB Private Equity, which invests mainly in the US and offers a dividend yield of about 5%, and CT Private Equity, which is more heavily weighted to UK and European companies.

Growth Capital

Lastly, Dan Boardman-Weston, chief executive of BRI Group, said there is “a plethora of opportunities” in the investment trust universe but investors should look to the IT Growth Capital sector – an oft-overlooked option.

Here he highlighted Molten Ventures and Chrysalis. The former backs promising early and mid-stage companies and has been on a strong run over the past year, up 80.1%, although it remains 60.9% down over three years.

Shares are on a 46% discount to the net asset value but this “will start to creep narrower due to some successful revaluations, and its recent inclusion back in the FTSE 250 should help also”.

Chrysalis “has had a slightly chequered past”, said Boardman-Weston but “a discount of about 37% is probably a little too cheap at the moment”.

*HgCapital Trust is an investor in FE fundinfo.