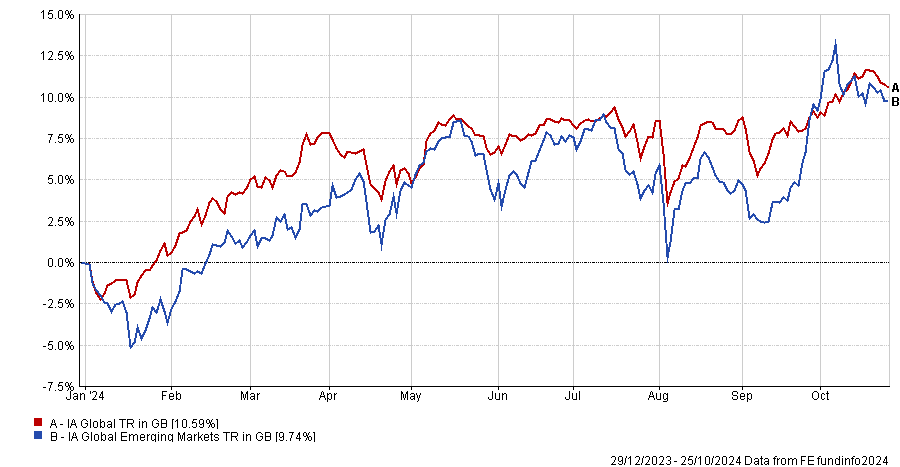

Emerging market funds are catching up with their developed market rivals over 2024 so far, leading to renewed confidence that the asset class could be on the brink of ending a long spell of underperformance.

The average fund in the IA Global Emerging Markets sector has made a 9.7% total return since the start of the year, putting it within spitting distance of the IA Global peer group’s 10.6% average returns.

This is in contrast to 2023, when the average global emerging markets fund made 4.3% and was more than 8 percentage points behind the IA Global sector, which was buoyed by the strong gains made by US-listed artificial intelligence stocks.

Performance of sectors over 2024 to date

Source: FE Analytics

Simon Evan‑Cook, manager of Downing Fox multi-asset funds, said: “We don’t do top-down allocation at Downing Fox, but if we did we’d probably have a larger allocation to emerging markets currently. A lot of that has to do with the positive views coming from the active managers we use: they’re seeing benign economic conditions paired with good companies available at cheap valuations.

“But I also have a soft spot for previously loved asset classes that have been out of favour for a decade and emerging market equities certainly fit that bill.”

Indeed, FE Analytics shows the MSCI Emerging Markets index has made an 81.8% total return over the past 10 years – putting it significantly behind the 227.6% return from the developed markets-focused MSCI World. What’s more, the MSCI Emerging Markets index has underperformed the MSCI World in eight of the past 10 calendar years (the exceptions being 2016 and 2017).

As Evan‑Cook noted, these have left them at more attractive valuations than the developed world, especially the US where a decade of outperformance from tech stocks has left some of the growthier parts of the market looking stretched.

He also gave “benign” economic growth as a reason for renewed optimism on emerging markets. China recently cheered investors with promises of fiscal and monetary stimulus to boost the world’s second-largest economy.

In its latest World Economic Outlook last week, the International Monetary Fund said it forecasts emerging market GDP to grow by 4.2% in both 2024 and 2025, with the fastest expansion expected from India (growing 7% then 6.5%) and China (4.8% then 4.5%).

The developed world, on the other hand, is tipped for GDP growth of just 1.8% in each of 2024 and 2025. The US economy is forecast to grow 2.8% this year and 2.2% next year; the UK just 1.1% and 1.5% in the two years (but still outpacing the likes of Germany, France, Italy and Japan).

Guido Giammattei, emerging markets equity manager at RBC Global Asset Management, said: “Returns in emerging market equities have tended over the past 35 years to excel in relative terms when earnings and GDP in emerging markets increase faster than in developed markets, and vice versa.

“This relationship broke down in 2023, as relatively fast emerging-market growth did not lead to equity-market outperformance. One reason for this breakdown was likely that the influence of AI-related stocks in developed markets, particularly the US, had an outsized impact on index returns. We would expect the relationship between emerging market and developed market equities to re-establish itself in the coming years as market compositions return to a more ‘normal’ state.”

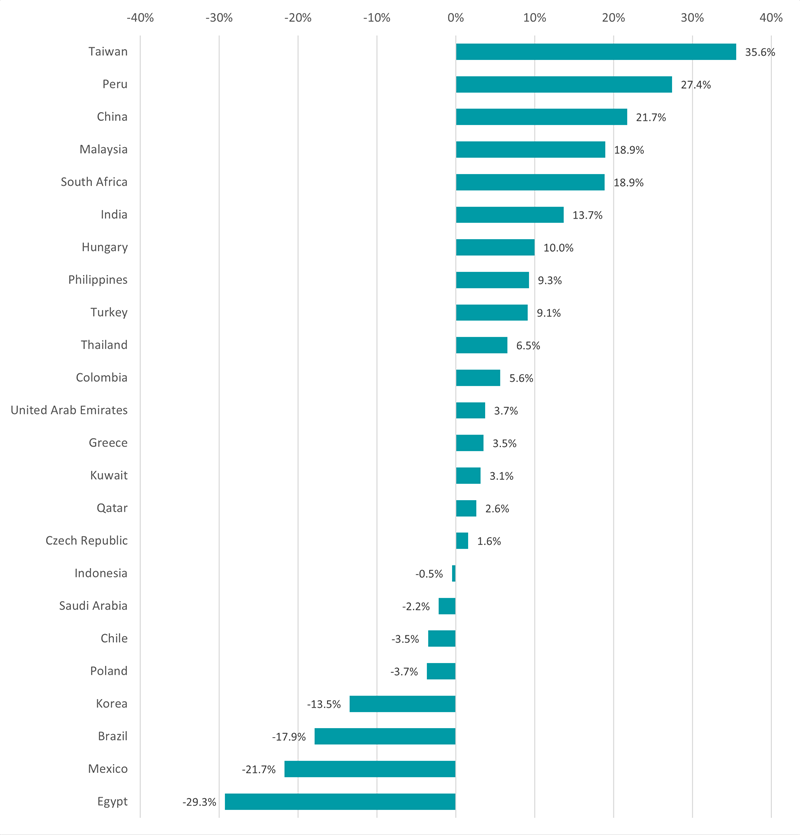

Performance of emerging market countries in 2024

Source: FinXL

Tahia Tahmin, emerging markets fund analyst at FE Investments, added: “Given the current macroeconomic environment with global growth remaining resilient and inflation generally getting close to target ranges, the outlook is favourable for emerging markets assets, which should benefit from a weaker dollar.

“Asia in particular is expected to be a major driver of growth, with China remaining the focus point as investors patiently await further details of fiscal measures to encourage consumer spending and stabilise the property market.”

However, she said investors should remain cautious for a more volatile market environment on the back of continued geopolitical risk and uncertainty surrounding upcoming elections.

Rob Morgan, chief analyst at Charles Stanley Direct, sees emerging markets as “an essential component of a long-term growth portfolio”, thanks to favourable demographic trends and some dynamic companies.

However, his enthusiasm for the asset class is currently tempered by high valuations in the Indian market and political and economic uncertainties in China. These are the two largest countries in the MSCI Emerging Markets index and, as the chart above shows, among the strongest performers this year.

Darius McDermott, managing director at Chelsea Financial Services, agrees that investors need to keep a close eye on potential headwinds when considering buying emerging market funds today.

For him, the strength of the US and the impact of China’s stimulus package are the critical factors to watch from here.

Should the dollar weaken further, emerging market companies would benefit as they tend to borrow in dollars but conduct business in their local currencies, which effectively reduces the burden of their interest payments and allows them to borrow at lower costs.

But the impact of China’s stimulus plans could be significant for the asset class, given the fact that the country accounts for around 28% of the MSCI Emerging Markets index.

“From a stock market perspective China has been a laggard for many years – until recently that is. Following the announcement of a huge stimulus package the market took off and is now up nicely year to date,” McDermott finished.

“It does remain to be seen if this is the start of a strong bull market or a bounce from very low levels, so you do need to take a view on this when investing in global emerging markets.”