Donald Trump, the 45th president of the United States, is the Republican candidate in the 2024 presidential election. This despite multiple run-ins with the law; indeed, he is the first former president to have been convicted of a crime. Known for his real estate empire, Trump made a name for himself as a businessman, reality TV star and public figure before entering politics.

His 2016 presidential campaign emphasised a populist, ‘outsider’ message and his term in office was marked by major controversies, including two impeachments: one over Ukraine-related issues and the other following the 6 January attack on the Capitol. After losing to Joe Biden in 2020, Trump claimed widespread voter fraud and continued to rally his base, calling the legal proceedings against him political persecution. His 2024 primary campaign enjoyed strong support despite these controversies, positioning him as a polarising figure with dedicated supporters.

Trump's businesses and brand have often been at the centre of public attention, contributing to his image as a self-made billionaire, despite frequent legal and financial problems throughout his career.

On what platform was Trump elected?

Here is a summary of Trump's positions on the main issues of his 2024 campaign:

Education: Trump is proposing radical reforms for schools, with measures such as the election of head teachers, or ‘principals’, by parents; the withdrawal of funding for schools teaching ‘critical race theory’; and an end to tenure for teachers. He also wants to encourage prayer in schools and allow teachers to carry concealed weapons. This approach aims to give power back to parents and promote ‘patriotic’ values within the education system.

Universities: Trump plans to revoke universities' current accreditations and replace them with bodies imposing values in line with those of his party. He is also proposing substantial fines for universities that he considers discriminate against students, with the idea of funding a free online academy covering a wide range of knowledge.

Climate change: Trump wants to take the US out of the Paris Agreement again and undo Biden's climate policies, including reducing emissions and the target of 67% electric vehicles by 2032. He plans to massively increase oil and gas production.

Department of Justice: Trump is promising to appoint 100 like-minded prosecutors and to investigate some progressive local prosecutors. He also wants to create a unit within the DOJ to defend the right to self defence and combat alleged anti-conservative bias in law schools and law firms.

Crime: Trump wants to increase police numbers and supports practices such as ‘stop-and-frisk’, the dismantling of gangs and drug rings, and the use the National Guard if local police fail to respond. Trump also advocates the death penalty for drug and human traffickers.

Immigration: Trump wants to ban illegal immigrants from receiving aid, abolish birthright citizenship for their children, reinstate a travel ban for certain countries and suspend visa programmes, including the lottery and family visas. He also plans to close the southern border to asylum seekers.

Economy: Trump is proposing to cut taxes and lift federal regulations. He also wants to introduce basic tariffs on foreign products to encourage American manufacturing, with increases in these tariffs for countries practising ‘unfair trade’ (see below).

Healthcare: Trump plans to require federal agencies to buy only drugs and medical devices made in the United States. He also wants the government to pay no more than the best price offered to other nations for drugs.

Foreign policy and defence: Trump is proposing to ask the European allies to reimburse the United States for the depletion of their arms stocks as a result of shipments to Ukraine. He also takes a tough stance against China, calling for new restrictions on Chinese-owned infrastructure in the United States and wants to build a missile defence shield.

Social Security: Unlike former Republicans, Trump says there will be no cuts to Social Security or Medicare.

Homeless: Trump is proposing to ban public camping by the homeless, offering them a choice between treatment or arrest, and to create ‘tent cities’ where they would be rehoused, with access to healthcare and social support.

Big Tech: In response to allegations of bias against conservatives, Trump is considering issuing an executive order banning any collaboration between federal agencies and other entities to ‘censor’ Americans, as well as prohibiting the use of federal funds to fight disinformation.

How much will the deficit increase over the next 10 years?

Trump's tax plan could add $7.5trn to the national debt by 2035, taking it to 142% of GDP, according to key estimates. In particular, he proposes to make the Tax Cuts and Jobs Act (TCJA) permanent, further reduce corporate tax and increase military spending.

These tax cuts and spending growth would considerably increase deficits. In the best-case scenario, Trump's plan would increase the debt by $1.45trn, but in the worst-case scenario, the debt could rise to $15.15trn.

Despite some proposed measures to compensate, such as new customs duties and cuts in certain government programmes, his plan does not sufficiently tackle the increase in the national debt, making the budgetary outlook precarious.

What attitude to adopt towards China?

When it comes to China, Trump adopts an intransigent stance, advocating economic decoupling, the imposition of high tariffs and the revocation of China's permanent trade status. He also proposes to limit Chinese acquisitions of US industries, maintain military deterrence by modernising nuclear weapons and strengthen ties with Taiwan.

Trump holds China responsible for problems such as fentanyl trafficking and the genocide of the Uyghurs, advocating punitive measures and strict negotiations with Chinese leaders.

What impact would Trump's triumph have on Europe?

With Trump in the White House, European products could face significant challenges, as the former president has made it clear that he would impose vast tariffs, potentially ranging from 10% on all imports to much higher levels on countries such as China, which could also affect European products. The European Union (EU) is preparing for a scenario in which Trump carries out his threats by creating a list of American products that it could target with retaliatory tariffs.

Although these new levies are not the EU's baseline scenario, they are seen as a necessary response to Trump's potential trade measures against the Union. Trump has a habit of surprising the EU with unexpected tariffs, as he did in 2018 by imposing duties on European steel and aluminium. The EU retaliated by targeting politically sensitive US companies such as Harley Davidson motorbikes and Levi Strauss jeans. Trump's return to power could be a copy and paste of 8 years ago.

In addition, Trump could also zero in on European taxes on digital services, which often affect American technology giants, further straining transatlantic trade relations.

The EU, already weakened by competition from cheaper Chinese electric vehicles and the end of its dependence on Russian gas, is facing a precarious situation. A trade war with the United States could further accelerate the continent's economic difficulties, particularly in its manufacturing sector, which has already been hit hard.

While the EU preferred to resolve trade disputes with the US through diplomatic channels, it is fully aware that the Biden administration has also maintained an ‘America First’ approach. His administration has introduced substantial subsidies for green technologies that encourage companies to shift their investments from Europe to the US, exacerbating the challenges facing Europe. The EU is therefore preparing for tough trade negotiations with the United States over the coming months ...

How much will higher tariffs cost?

Candidate Trump has proposed significant tariff increases as part of his presidential campaign; Taxfoundation estimates that if imposed, these tariff increases would raise taxes by an additional $524bn per year and reduce GDP by at least 0.8%, the capital stock by 0.7% and employment by 684,000 full-time equivalent jobs.

Taxfoundation's estimates do not take into account the effects of retaliation or the additional damage that would result from the outbreak of a global trade war.

Will tax cuts have an impact on the S&P 500?

During the election campaign, Trump's political approach, particularly with regard to corporate tax, could have a significant impact on the financial markets. If elected, Trump proposes to cut the corporate tax rate from 21% to 15% to stimulate business investment, increase profits and potentially boost job creation. This proposal is part of his wider economic philosophy of deregulation and tax cuts to fuel growth.

If Trump's proposals were implemented, it would likely lead to an increase in corporate after-tax profits, which could boost share prices, particularly in sectors such as energy, manufacturing and financial services. However, the markets have not yet fully priced in the possibility of a tax cut, probably because they are unsure of Trump's ability to obtain the Congressional approval needed to pass such legislation. Without a strong majority in Congress, Trump could find it difficult to implement his entire programme, particularly in key areas such as tax cuts.

In short, while Trump's proposed tax cuts could benefit markets by improving corporate profitability, political realities and legislative hurdles could limit the scope of these changes. Investors are keeping a close eye on whether his policies will gain ground in Congress.

All other things being equal, Bank of America estimates that Trump's proposal to lower the corporate tax rate from 21% to 15% would increase S&P 500 EPS by 4%.

How would the markets react to a divided Congress?

While investors do not yet have a clear view of how the markets will react after the elections, they can nevertheless take note of the historical performance of equities when Congress is divided between the parties. In fact, perhaps counter-intuitively, equities perform well when Congress is divided, with the S&P 500 averaging annual gains of over 17% in such scenarios.

According to analysts at LPL Financial, stocks have risen each of the last 11 times Congress has been divided, and 2024 could be the 12th. The reason is that Congressional gridlock reduces the likelihood of disruptive political changes, to the benefit of equities, generally.

In the current context, a divided Congress could also minimise the risk of major tax increases under a Harris administration. A divided government generally reassures the markets by providing a more predictable political environment. Analysts also note that while checks on power can be beneficial, cooperation is essential to meet the current economic challenges posed by the pandemic.

Since 1929, the most common configuration in Washington has been Democratic control of the White House and both houses of Congress, resulting in an average annual rise of 9.4% in the S&P 500 over 34 years. The second most common configuration saw Republicans in the White House and Democrats running both houses, with a lower annual return of 4.9% over 22 years. The best performance under divided government occurred with a Democratic President, Democratic Senate and Republican House, with an average rise of 13.6%, although this only lasted from 2011 to 2014 under Barack Obama.

How would the markets react to an entirely Republican Congress?

Historical performance shows that under an all-Republican Congress, the S&P 500 recorded an average year-on-year rise of 13.4%. This is often attributed to a more stable political environment, favouring pro-business policies. However, a divided Congress tends to outperform, with an average return of 17.2% over one year. This scenario is well received by the markets as it reduces the risk of disruptive political changes, thereby minimising the potential impact of tax hikes or strict regulations, particularly under a Harris administration.

Such legislative gridlock favours a more predictable political framework, which tends to reassure investors. Indeed, a divided Congress has historically led to annual gains for the S&P 500 in the last 11 similar scenarios, with increases observed on each occasion, creating a favourable environment for the financial markets and reducing the likelihood of economic disruption.

Which sectors could theoretically benefit from Trump's arrival?

The prospect of a second Trump term could significantly influence investor sentiment. It is estimated that a Trump win could have a slightly positive impact on economic growth in the short term, but this effect could be quickly cancelled out by imported inflation and tensions over monetary policy.

In terms of sectors, here's what we can say:

Fossil fuels: Trump is also likely to rescind the Environmental Protection Agency's (EPA) mandates for electric vehicle sales, which currently require 56% of new vehicles sold to be electric by 2032. He could also remove the tax incentives for electric vehicles under the Inflation Reduction Act.

Pharmaceuticals: Reducing the cost of drugs and boosting domestic production of essential medicines is another initiative that Trump could undertake, which could be advantageous for US pharmaceutical companies, particularly biotechs.

An end to conflict (really?!): Trump's desire for an ‘immediate end’ to the conflicts in the Middle East and Ukraine could benefit US construction companies but could have a negative impact on arms-related businesses.

Education: Trump plans to transfer control of education from the federal Department of Education to state governments, which he believes are better placed to tailor education policies to their communities. Education technology players could well benefit from this.

Small- & mid-caps: Small and mid-cap stocks should benefit from a Trump presidency because of his pro-business policies, which stimulate economic growth and create opportunities for these companies. In addition, small-caps benefit from the prospect of lower interest rates, which reduce borrowing costs for the many unprofitable companies in the sector that rely on debt finance.

Prisons: After Trump took office in 2017, then-attorney general Jeff Sessions signed an executive order rescinding an Obama-era directive to phase out the use of private prisons. This sent shares in the two largest private prison companies - CoreCivic and GEO Group - soaring, both reaching post-election peaks in April 2017. That sort of momentum could return.

Finally, European and Chinese equities could be initially negatively impacted. The European automotive industry would be particularly vulnerable to a potential trade war with the United States, because of tariffs. In addition, the luxury goods sector and European high-tech companies could also suffer from US trade retaliation. The short-term reaction of sectors in the event of a divided government under Trump is likely to be more or less the same. Consumer discretionary could come under negative pressure, as could renewables and ESG leaders.

A stock to follow

There will be plenty of companies to watch when the US markets open on Wednesday, but there may be one to keep a very (very) close eye on: Trump Media & Technology Group.

Trump Media & Technology Group Corp (TMTG) is an American media and technology company headquartered in Sarasota, Florida. It manages the Truth Social social media platform and Trump is its biggest shareholder. Founded by Andy Litinsky and Wes Moss in 2021, it went public on 26 March 2024, after merging with Digital World Acquisition Corp (DWAC), a special purpose acquisition company (SPAC). Trump owns nearly 57% of the company...

And what about the long term?

It is often difficult to separate investments from politics, but it is important not to attach too much importance to election results when making financial decisions. Indeed, election results have little impact on long-term investment returns. Despite the alarmist rhetoric surrounding presidential campaigns, financial markets tend to perform well, regardless of which party is in power.

To illustrate this, since 1950, the S&P 500 has generated a cumulative return of 359,416% (with dividends reinvested), covering 14 presidents, including seven Republicans and seven Democrats. In other words, a $1,000 investment in the S&P 500 in January 1950, with dividends reinvested, would be worth around $3,594,160 today. This figure shows that investors should not base their strategies on election results, but rather take a long-term view.

How will the dollar and cryptocurrencies evolve?

Once again, this is a difficult question, as there are many factors that explain the greenback's performance (the economy, debt and interest rates). While we can imagine that with a Trump victory the dollar will rise in the short term, in the medium term things don't seem quite so obvious. A further analysis of the past reveals the following trends:

Over the last six administrations, the dollar performed best under president Bill Clinton, gaining 19.61% of its value.

The dollar had its worst performance under president George W. Bush, losing 22.00% of its value.

Over the course of the Republican presidencies during this period, the dollar lost 36.17% of its value.

A Trump win should have a significant impact on the cryptocurrency market (in the short term) by fostering a more favourable environment for these currencies, as Trump has expressed a new enthusiasm for digital currencies. His administration could roll back some of the regulatory crackdowns of the Biden era and create initiatives such as a "strategic national Bitcoin stockpile", positioning the US as a global leader in the crypto space.

This relaxed regulatory approach could attract more investment and innovation to the crypto-currency sector, but it also raises concerns about increased fraud risks and insufficient consumer protection, as evidenced by the Securities and Exchange Commission's (SEC) scrutiny of the sector.

How will raw materials behave?

A Trump return to power could have a significant impact on commodity prices, not least because of his pro-coal, pro-mining and protectionist policies. If Trump repeals Biden's Inflation Reduction Act, it could benefit traditional energy commodities such as coal and oil, while potentially boosting demand for platinum group metals (PGMs) used in internal combustion engines. However, China's economic policies and growth trajectory remain a key driver of global commodity prices, meaning that while Donald Trump's policies could influence some sectors, the greater strength of China's economic dominance will continue to play a major role in shaping global commodity demand and price movements.

In addition, the intensification of trade tensions with China under Donald Trump could push prices even higher by disrupting global supply chains. Finally, it is conceivable that the uncertainties associated with the arrival of the ‘controversial man’ could benefit gold.

The crucial summary

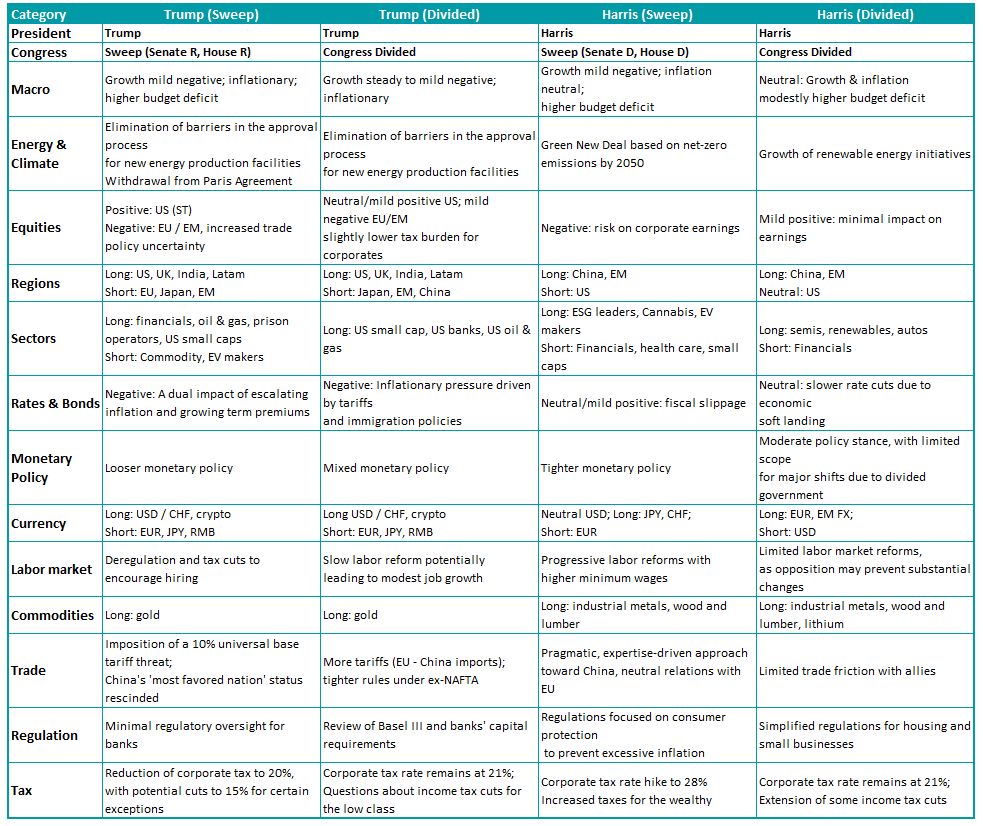

Below is a summary of the potential trends for different assets/regions if Trump takes the White House:

Source: John Plassard, Mirabaud

A Trump victory could lead to significant changes for the financial markets, with tax cuts for businesses, increased support for fossil fuels and a protectionist approach to trade. This policy could benefit certain sectors, notably energy, pharmaceuticals and small-caps, while posing risks for trade, particularly with Europe and China. Cryptocurrencies could benefit from Trump’s favourable stance, with potentially relaxed regulations. However, his programme of tax cuts and increased military spending could add to the national debt. Finally, a president Trump could also boost commodities such as coal and oil, while increasing demand for gold due to uncertainty.

John Plassard is senior investment specialist at Mirabaud Group. The views expressed above should not be taken as investment advice.