Markets prefer certainty and US equities have been rallying since it became clear on Thursday that Donald Trump would clinch an election victory.

Fund selectors, portfolio managers and traders are now turning their attention to which asset classes, sectors and funds are likely to prosper once Trump’s second term gets underway next year.

Trump’s policies are generally believed to be inflationary, from tariffs that will drive up prices to his pro-growth agenda. Banks would be a clear winner from inflation but longer term bonds are likely to struggle.

Tariffs and trade wars would penalise emerging markets, especially China, but American companies that rely on foreign imports, such as food retailers, could also suffer. On the other hand, domestic-focussed smaller US companies should fare better.

Against that backdrop, Trustnet asked fund selectors to suggest strategies that have the potential to outperform during the next four years.

M&G North American Value

Chris Metcalfe, IBOSS’ chief investment officer, expects the US equity market to continue performing strongly in the early part of Trump's second term, except for some renewable energy plays and companies that rely heavily on government subsidies. However, he expects headwinds to develop in the second half of Trump’s presidency as inflationary tariffs and policies create problems for the Federal Reserve.

M&G North American Value remains one of IBOSS’ top fund picks. “This fund comprises about 25% of our explicit US holdings and sits alongside an S&P 500 tracker and the Hermes US SMID Equity fund,” Metcalfe said.

“Daniel White has been the fund's lead manager for over a decade and it is fair to say that running value in the US has been one of the toughest gigs going. We think some value names have been overlooked in the past few years with the global obsession around the Magnificent Seven.”

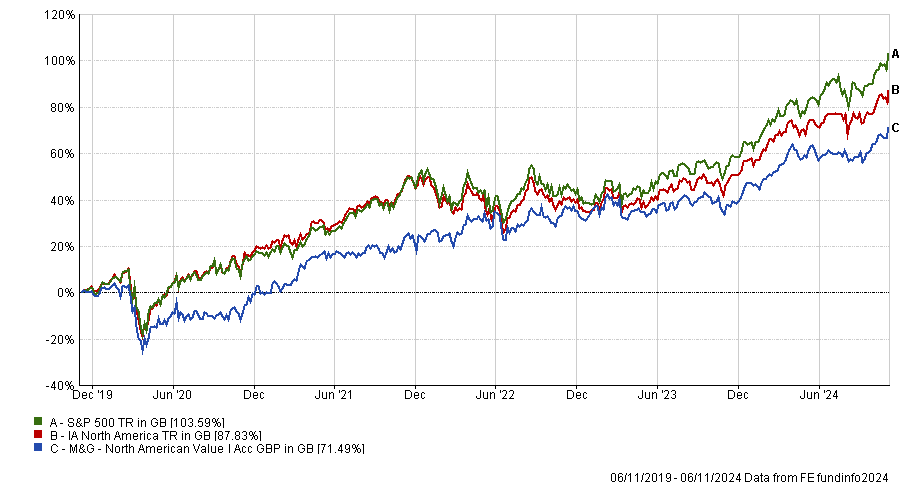

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund's biggest positions are Alphabet and Meta and its largest sector weight is technology, but its 15% allocation is considerably less than the benchmark’s 32% tech weighting.

White’s third-largest holding and biggest stock overweight is Oracle, which has been performing strongly since 2022.

Raymond James REAMs Unconstrained Bond

Joe Young, fund research analyst at Rathbones, expects the world to become more volatile and less certain. “New tariff and immigration policies place a question mark on the simple falling inflation and interest rate narrative. Proposed cuts to corporation tax, without an equal offsetting balance, are likely create a more challenging environment for treasuries as a larger deficit would lead to higher rates demanded,” he explained.

Elsewhere, conflicts in Ukraine and the Middle East could escalate at any time, impacting a range of asset classes and dampening risk appetite.

Investors therefore need dynamic strategies that can adapt to changing market conditions, such as the Raymond James REAMS Unconstrained Bond fund, he said.

Reams Asset Management’s fixed income team has a strict valuation discipline and reacts opportunistically to market dislocations, dialling the fund’s asset allocation and duration exposure up and down dynamically. The managers are happy to wait in cash and treasuries when valuations are full and then pounce when there’s a market sell-off, Young explained.

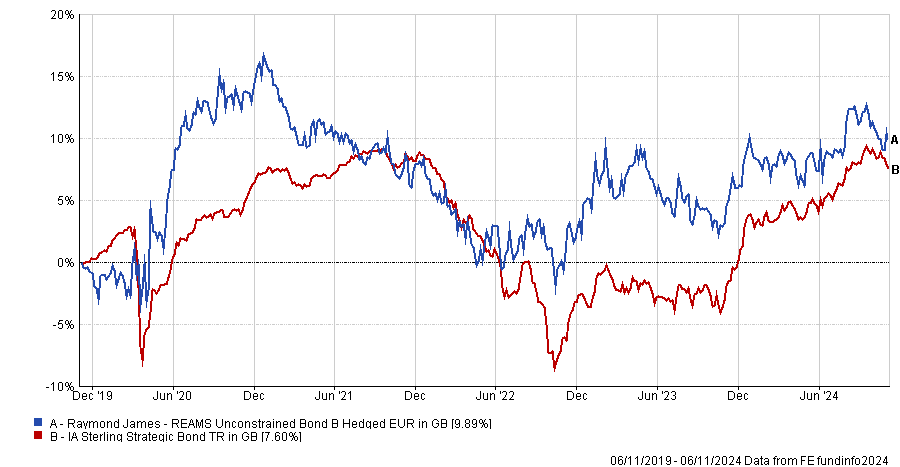

Performance of fund vs sector over 5yrs

Source: FE Analytics

This strategy could face headwinds if volatility is low or if areas where it has low exposure stage a rally but, overall, Young expects it to deliver smoother outperformance than competitors.

Premier Miton US Opportunities

A simple way to play the post-election relief rally would be a low-cost S&P 500 index fund, said Jason Hollands, managing director of Bestinvest.

In addition, small- and mid-cap funds such as Premier Miton US Opportunities stand to benefit from Trump’s efforts to boost the domestic economy. This fund would complement a large-cap tracker by providing diversification away from the Magnificent Seven, he said.

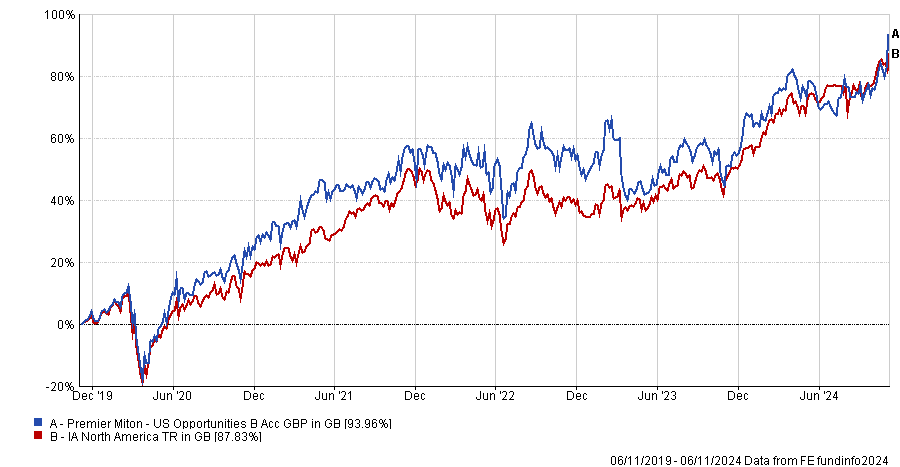

Performance of fund vs sector over 5yrs

Source: FE Analytics

Managed by Alex Knox and Hugh Grieves, its largest positions are in Graphic Packaging Holdings, which designs and produces consumer packaging, and CBRE Group, which specialises in commercial real estate services and investments.

Polar Capital Global Financials Trust

If Trump cuts corporate taxes and deregulates the financial services sector then banks stand to outperform, Hollands continued. Higher inflation would also increase banks’ profit margins as they would be able to lend money at higher rates.

Mergers and acquisitions might pick up now that the election outcome is known, which would bolster investment banks. Asset managers, meanwhile, usually do well in a rising equity market.

Therefore, Hollands suggested Polar Capital Global Financials Trust, which invests in banks, insurers and asset managers, with about half its portfolio in the US.

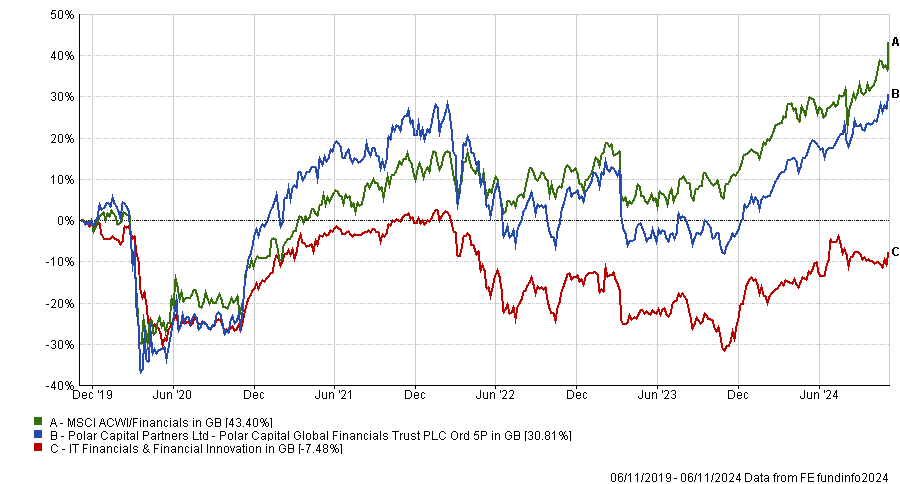

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

Amundi US Equity Fundamental Growth

Finally, Meera Hearnden, investment director at Parmenion, prefers not to select funds based on politics or a four-year view. “It is impossible to know at this stage which of Trump’s policies will materialise and to what degree and so it’s hard to make a call on which fund will benefit most,” she explained.

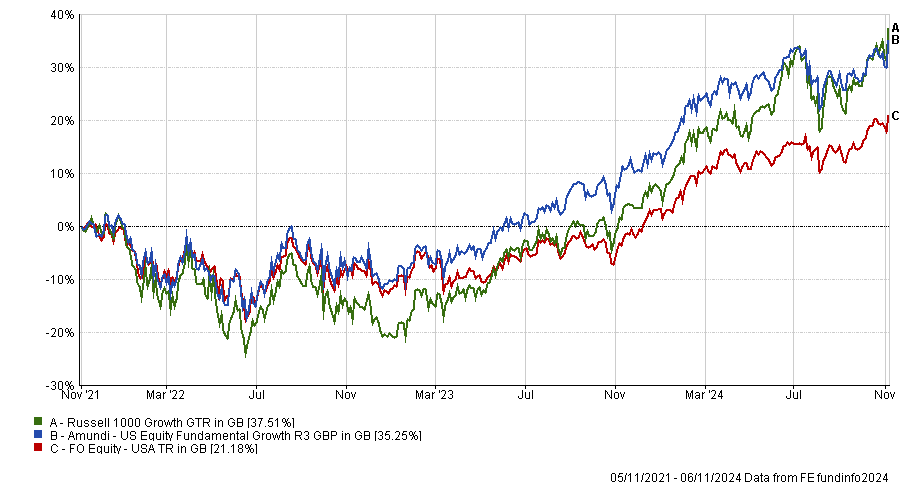

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

She holds Amundi US Equity Fundamental Growth, a fairly concentrated, large-cap growth fund with a strong valuation discipline and a focus on sustainable cash flow generation. Amundi picks stocks according to company fundamentals, not macroeconomics or politics, she added.