US equities did fairly well during Donald Trump's first term (Covid notwithstanding), which goes some way towards explaining his popularity this time, at a moment when Americans are emerging from a cost-of-living crisis and are worried about their economy.

The mood music in the US this week is optimistic, which bodes well.

As Kristina Hooper, chief global market strategist at Invesco, observed: “The US managed to avoid what markets feared the most: a contested election and prolonged uncertainty, which could likely have resulted in a significant sell-off. Instead, we have a decisive victory. Markets like clarity and I expect them to reward this in the short term.”

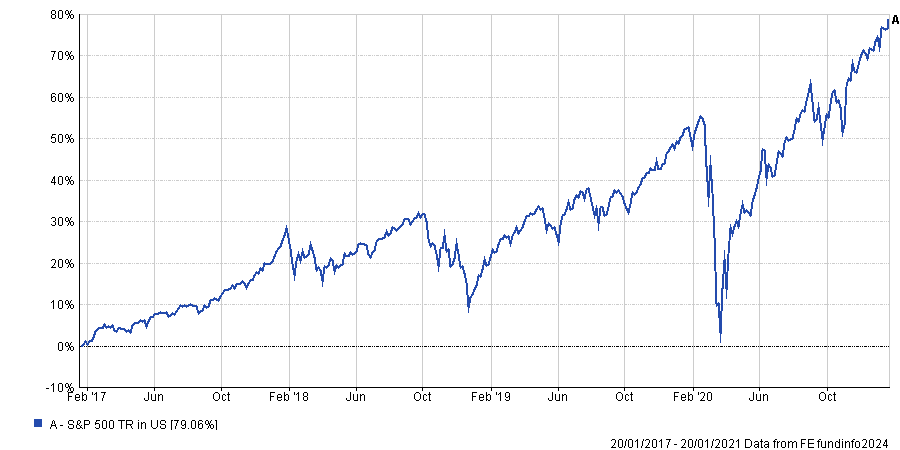

Performance of S&P 500 during Trump’s first term

Source: FE Analytics

Trump is likely to focus on extending the Tax Cuts and Jobs Act and cutting corporate taxes, which Hooper expects to be positively received by markets.

Yet presidents are not elected in a vacuum and interest rates arguably have a greater impact on investment performance.

Equities usually rally in a rate cutting cycle so long as the economy manages to avoid a recession, which appears to be the case thus far. US assets, especially stocks, also tend to do well in the year after an election.

“Markets clearly believe economic growth will be amplified by Trump administration policies. We can see it in the results of the Russell 2000 Index, which was up more than 4% just a few minutes into the 6 November trading session. However, I still believe support for stocks is more about Fed easing supporting growth,” Hooper said.

However, Trump’s policies on immigration and tariffs are expected to be inflationary, which might slow down the pace of rate cuts.

Two current headwinds that were not as prevalent in 2016 are the extreme concentration of the S&P 500 and the high valuations of its largest stocks. These factors prompted Goldman Sachs to predict that US equities would return just 3% per annum for the next decade or so.

Furthermore, Hooper thinks the euphoria in US stocks this week is overdone and there could be some retracing in the near term.

On the other hand, European and UK equities have overreacted in the other direction and could bounce back, she added.

Hooper will be looking to the Fed for clues about the future direction of the US economy and stock market but her base case is for an economic re-acceleration next year in the US and most other major economies, which should be supportive of risk assets.

Small- and mid-cap stocks in particular should be beneficiaries of this environment, she added.

Jason Hollands, managing director of Bestinvest, concurred and suggested Premier Miton US Opportunities, a multi-cap fund, for investors seeking to diversify away from the S&P 500’s mega-cap tech bias.

Trustnet senior reporter Matteo Anelli canvassed several other fund experts for investment ideas during Trump’s second term.

The person I agree with most is Joe Young, fund research analyst at Rathbones, who expects the world to become a more volatile and less certain place. Therefore, he thinks investors should opt for dynamic strategies that can quickly adapt to changing market conditions, such as the Raymond James REAMS Unconstrained Bond fund.