The Labour government’s first Budget on 30 October was a rollercoaster ride for UK equities. Pessimistic messaging ahead of the event about the parlous state of public finances and fears about taxes on AIM-listed stocks and capital gains weighed on the stock market.

Indeed, a record amount of money was pulled out of equity funds earlier this month, which was attributed primarily to the chancellor hiking capital gains tax (CGT).

Now that the clouds have cleared, investors still have plenty of concerns, such as the impact of increased national insurance contributions on businesses, but there are also reasons for optimism, including a more certain future for the beaten up AIM market.

Jason Hollands, managing director at Bestinvest, noted that a positive side effect of the chancellor’s decision to raise CGT is that investing in funds may become more appealing given that selling assets within funds does not incur CGT.

“In a world where CGT got quite a bit higher for basic rate taxpayers and the annual exemption has come down to £3000, I think there is more of a case now for people to own funds,” he said.

Below, experts suggested funds that could prosper following the Budget, with exposure to unappreciated opportunities in infrastructure, clean energy and AIM-listed stocks.

Amati UK Smaller Companies

Ben Yearsley, director at Fairview Investing, identified the £328m Amati UK Listed Smaller Companies as a fund worth watching. It has major holdings in growing UK businesses such as Trainline and AJ Bell.

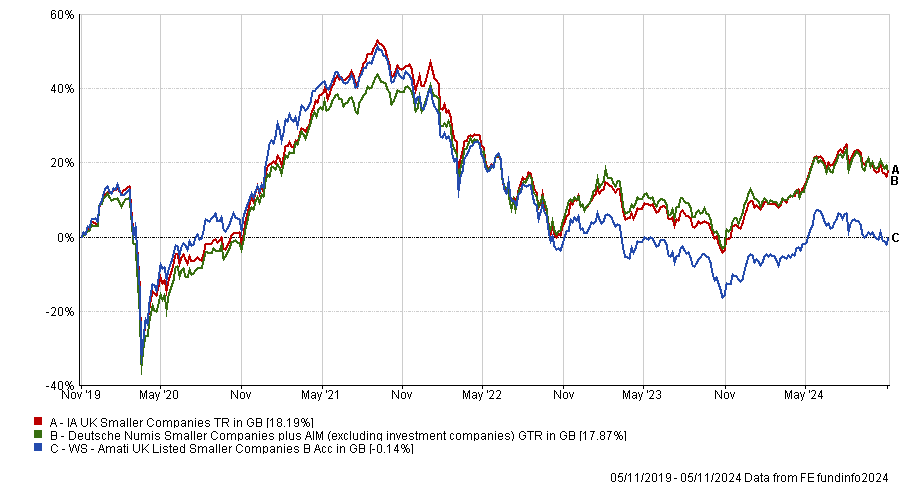

However, the fund has struggled in recent years, landing in the bottom quartile of the IA UK Smaller Companies sector over the past one, three and five years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

With 50% of the portfolio invested in the AIM market, Yearsley expects it to benefit from greater clarity regarding tax relief. “The outlook for AIM shares is probably better now than over the past few years. It is a cheap starting point and the tax uncertainty has been removed. From a share price perspective, the clouds have lifted,” he said.

Moreover, the strategy is featured in the Square Mile Academy of Funds. Analysts at Square Mile drew attention to the team's sound reputation. “The emphasis on higher quality companies with robust balance sheets should mean the fund holds up well during market stress,” they said.

“Overall, we feel this is a compelling proposition within the UK smaller companies space and we consider the portfolio managers to be excellent stewards of capital and investors who are highly attuned to their clients’ needs.”

VT Gravis Clean Energy Income

Next, Darius McDermott, managing director at Chelsea Financial Services and FundCalibre, recommended the £300m VT Gravis Clean Energy Income fund.

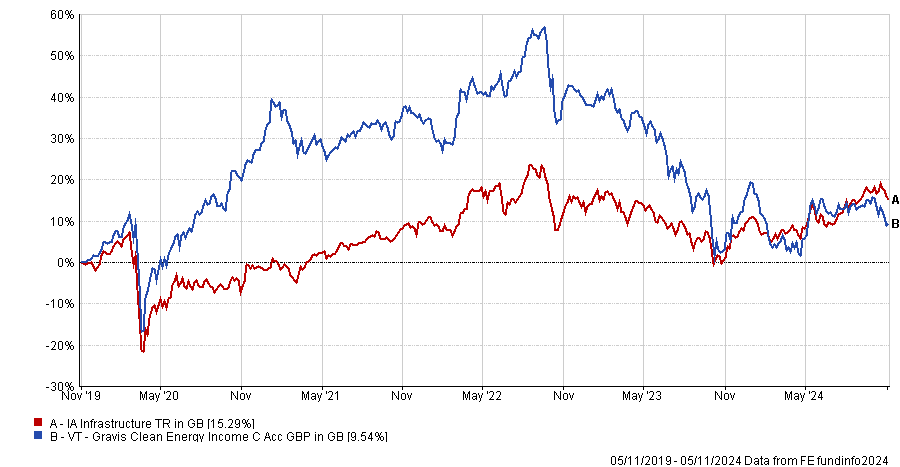

The fund has struggled in the IA Infrastructure sector in recent years, up by just 8.8% compared to a sector average of 16% over the past three years.

Performance of the fund vs sector over 3yrs

Source: FE Analytics

However, for McDermott, the relatively moderate clean energy investment promised in the Budget may encourage a turnaround in fortunes for this infrastructure laggard.

The Budget allocated just £100m to Great British Energy for renewable energy production over the next two years, well below the £8bn by 2029 pledged during the election campaign.

This limited funding “could prove promising” for green infrastructure strategies such as VT Gravis as “the private sector may now have to assume a larger role in meeting the country's infrastructure needs”, FundCalibre’s managing director said.

“With approximately 50% of its portfolio dedicated to UK assets, the fund is well-positioned to benefit from any increase in private sector investment into the space.”

The fund has been backed by RSMR analysts, who have commended the strategy for its attractive and dependable cash flow and focus on investing in mature technologies. With clean technology at the forefront of many nations’ agendas, the fund has appealing long-term growth potential.

The Renewables Infrastructure Group

Hollands expects clean energy investment trusts to be a big beneficiary of the government prioritising infrastructure investment and recommended the £2.6bn Renewables Infrastructure Group.

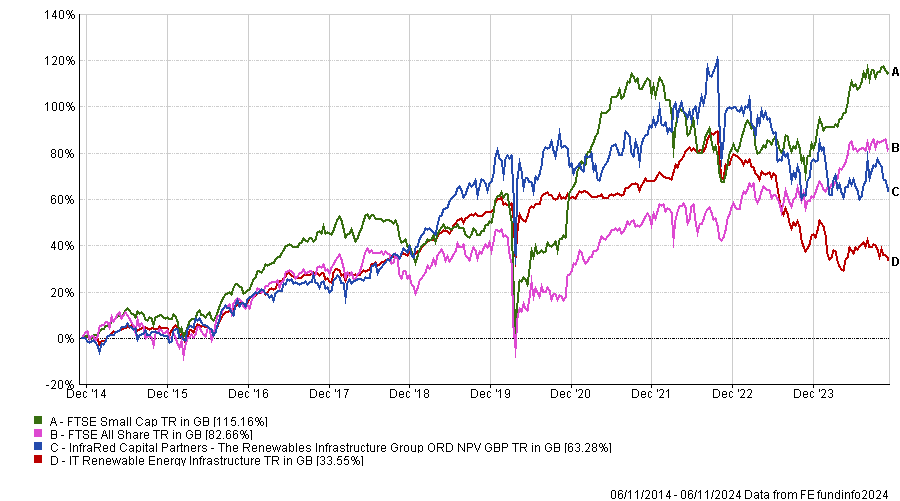

Performance of trust vs sector and benchmarks over 5yrs

Source: FE Analytics

Over the past 10 years, the trust has returned 63.3%, better than the 33.6% averaged by the IT Renewable Energy sector. However, the fund has lagged its peers more recently and has declined in value over the past one, three and five years.

Despite recent performance, with a 62% holding in UK-based companies, including offshore wind farms such as Hornsea One and Beatrice, Hollands believes it is well-positioned to benefit from a rally in the green energy sector.