Underperformance is a natural part of active fund management as investment styles go in and out of favour, according to Simon Evan-Cook, manager of the VT Downing Fox range of funds.

While some investors might lose patience after a period of poor performance, there are valid reasons to stick with an underperforming strategy. When market conditions change, out-of-favour portfolios can enjoy a resurgence, rewarding loyal investors.

Below, fund selectors pick strategies they believe are poised for a resurgence, with experienced management teams that can stand the test of time.

VT Castlebay UK Equity

Starting with Evan-Cook, he recommended the £159m VT Castlebay UK Equity fund.

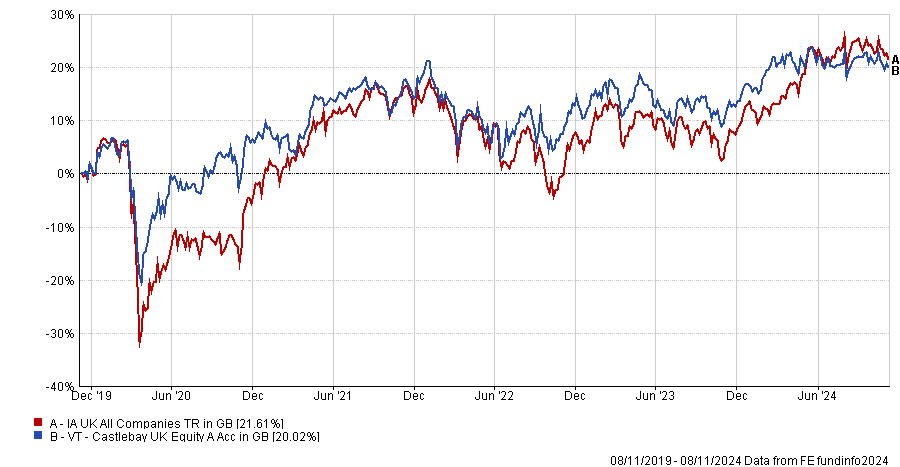

The portfolio has struggled over the past five years, rising by just 20% compared to the 21.7% average in the IA UK All Companies sector. It put in another third-quartile effort over three years and declined to the bottom quartile over the past 12 months.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Despite this poor performance, Evan-Cook believes the fund is ready for a turnaround, partly because of the highly experienced management team headed up by FE fundinfo Alpha Manager David Ridland, who has worked in fund management for over two decades.

Evan Cook said: “Ridland runs what you might call a 'Warren Buffet' style approach, essentially finding the highest quality companies to ensure you’re not overpaying.”

The problem was that this approach “didn’t work at all” over the past few years, Evan-Cook admitted, with the best-performing UK funds typically investing in big energy stocks or, in some cases, small companies.

Nevertheless, he argued the approach remained valid and made for a great long-term play.

“This is an approach that I am very confident will work over time, and over 10 years, the fund will make well above the returns of any single share investment,” he concluded.

Fundsmith Equity

Analysts at interactive investor and RBC Brewin Dolphin felt that Terry Smith’s £23bn Fundsmith Equity fund was ready for a resurgence.

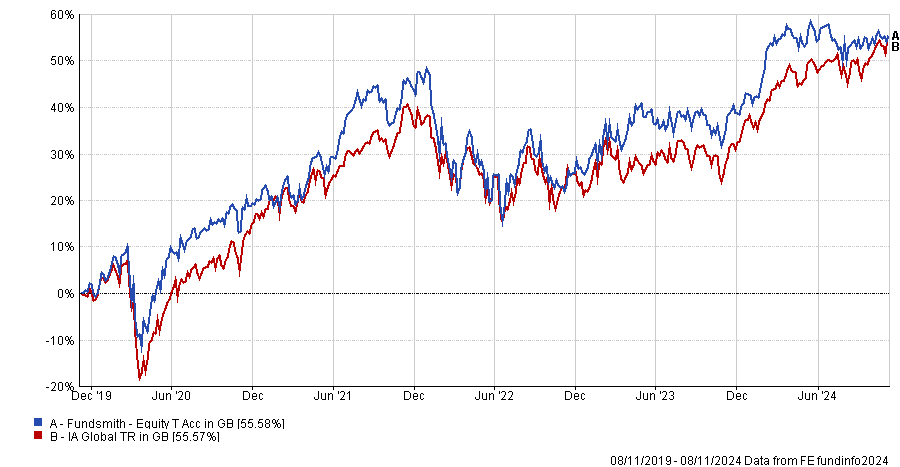

Led by one of the most respected names in modern fund management, the portfolio's performance has worsened over the past five years. Indeed, a return of 55.6%, which failed to outperform the sector average, caused it to slide into the third quartile over the past half-decade.

Over the past year it has languished in the bottom quartile, returning 12.8%.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

However, experts remain confident that this decline is a short-term phenomenon and that Smith’s flagship fund remains a solid long-term investment.

Indeed, John Moore, senior investment manager at RBC Brewin Dolphin, said recent underperformance perhaps owes more to the benchmark structure than Smith's strategy. As Moore noted, the highly concentrated nature of companies at the top of the MSCI World index meant that the fund's decision not to own Magnificent Seven stocks, such as Nvidia and Apple, would have caused a drag on performance.

For Moore, Smith's strategy is generally effective and usually focuses on strong companies with solid balance sheets that can be expected to compound in the long term.

“There are no obvious challenges to the quality of the businesses Fundsmith holds, it is more about the time horizon of the investments,” he said.

Alex Watts, fund analyst at interactive investor, added: “With quality being a factor that tended to outperform over the long term, and market returns beginning to broaden away from narrow tech leaders, there is scope for Smith’s stock picking to be rewarded and the fund’s relative performance to pick up.”

Stonehage Fleming Global Best Ideas Equity

Finally, Watts also recommended that investors watch the £1.9bn Stonehage Fleming Global Best Ideas Equity fund, led by Alpha Manager Gerrit Smit.

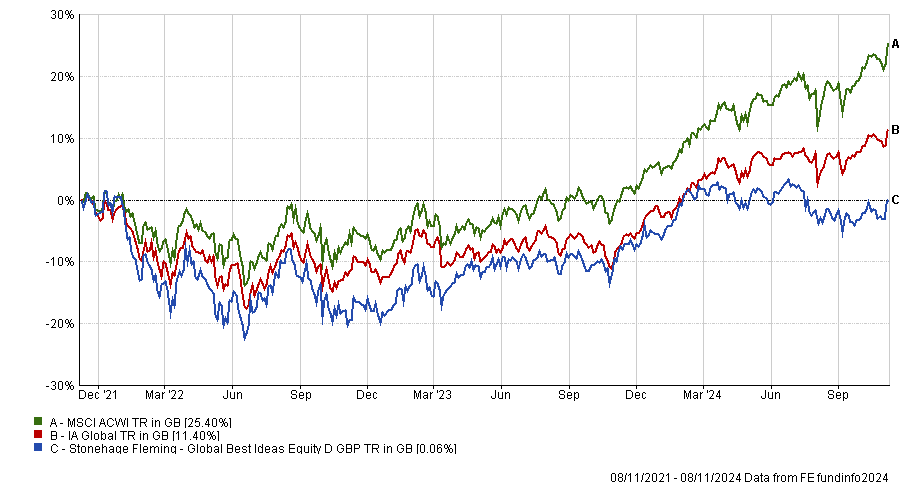

Smit’s strategy has faced challenges in the near term, with bottom quartile returns of -0.4% and 8.7% over the past three years and one year.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Watts encouraged investors to keep the faith. “The fund’s strength lies in the team’s potential and record as differentiated stock pickers,” he argued. The team’s bottom-up approach to stock picking usually ensures the portfolio is composed of strong companies with solid fundamentals, which gives the fund great long-term growth potential.

“Smit is happy to diverge from his benchmark and has succeeded throughout his tenure in finding alpha amongst differentiated areas,” Watts added. For example, Smit has held onto stocks such as Visa for several years, which has enjoyed a 73% growth in share value over the past five years.

Indeed, with a first-quartile effort of 211.3% over 10 years, one of the best results in the peer group, Watts concluded that investors should not allow themselves to dismiss the fund due to recent poor results.