Investors have started researching funds in areas such as multi-asset, financials and global equity income while spending less time on global growth strategies in the second half of 2024, analysis of Trustnet factsheet views suggests.

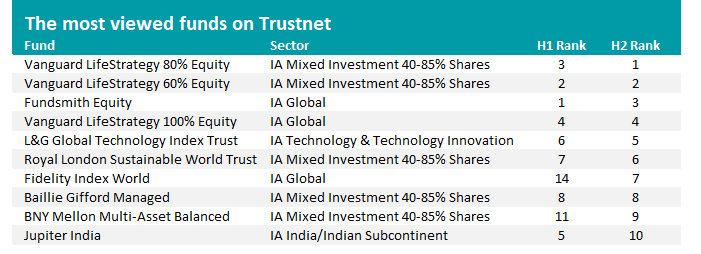

The most heavily researched fund on Trustnet since 1 July has been Vanguard LifeStrategy 80% Equity, which resides in the IA Mixed Investment 40-85% Shares sector. This represents a promotion from third place in the opening half of 2024.

Source: Trustnet, Google Analytics

As the table above shows, there has been some movement in the most-viewed fund factsheets over the two halves of the year, although it is more of a shuffle than a radical overhaul: Fundsmith Equity has fallen from first place to third, L&G Global Technology Index Trust and Royal London Sustainable World Trust have inched up the leaderboard, BNY Mellon Multi-Asset Balanced and Fidelity Index World have moved into the top 10 and Jupiter India has slipped.

Given that the top 10 most-researched funds can be fairly static and concentrated on the larger funds, a more insightful exercise is to look at the change in the overall share of factsheet views that each fund has captured over the two periods. By doing this, we can identify the funds that Trustnet users are spending more time researching, outside of the bigger names.

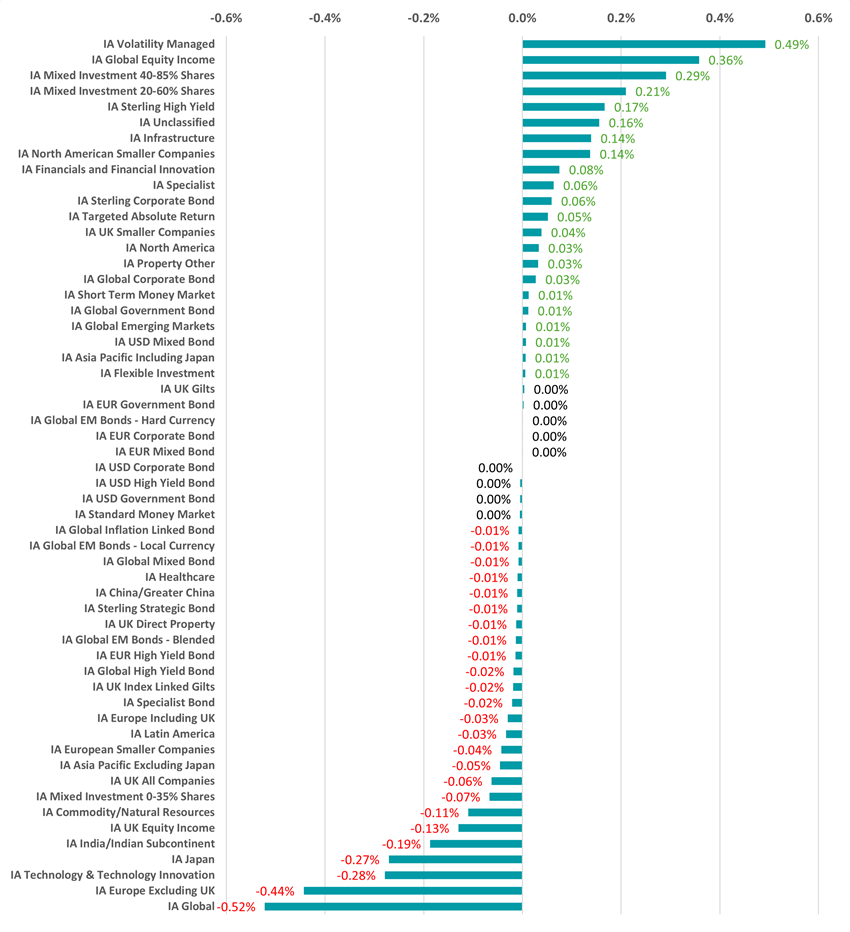

With this in mind, here’s how the research going into the Investment Association’s fund sectors has shifted between the first and second half of 2024:

Source: Trustnet, Google Analytics

The IA Volatility Managed sector has benefited from the biggest increase in research share between the two periods. In the first half of 2024, 5.6% of pageviews went to IA Volatility Managed funds but this climbed to 6.1% in the second half.

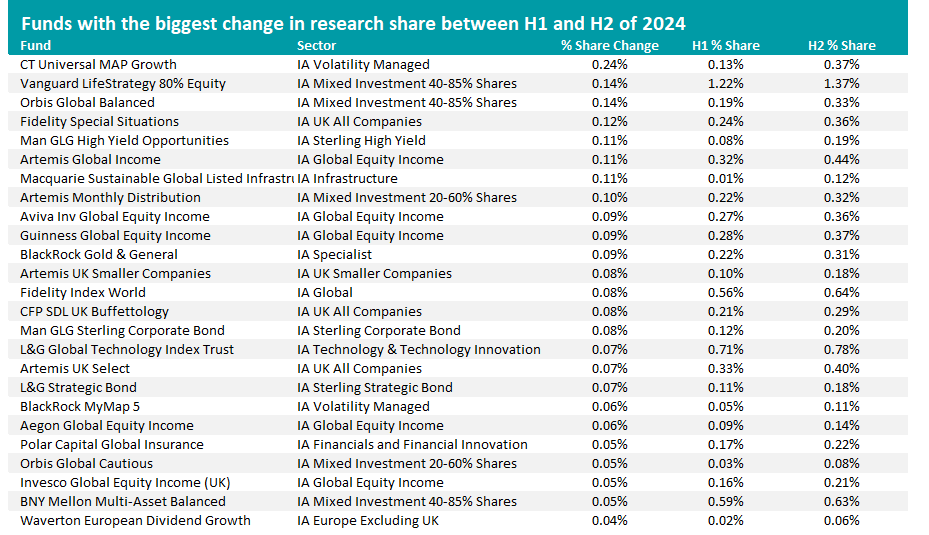

Indeed, one of the sector’s members - CT Universal MAP Growth – was the fund with the largest increase in research share, moving from 0.13% in H1 to 0.37% in H2 (the research share of individual funds tends to be relatively low, given the sheer number in the Investment Association universe). Put another way, the fund was the 159th most researched in the first half but jumped into 25th place in the second half.

The £1bn fund is managed by Paul Niven, with the belief that strategic and tactical asset allocation should be the main driver of performance. Niven and his team are free from any constraints on a geographical, industry or sector level to invest where their process deems most optimal.

Analysts at Rayner Spencer Mills Research said CT Universal MAP Growth and the other funds in its range are “a strong option for advisers/investors looking for a range of risk-managed solutions”, pointing to the experience within its management team and its “structured but pragmatic” investment process.

Other IA Volatility Managed funds that have been getting researched more in the second half of 2024 include BlackRock MyMap 5, HSBC Global Strategy Balanced Portfolio, HL Multi-Index Moderately Adventurous and CT Universal MAP Balanced.

This isn’t the only mixed-asset peer group that investors are spending more time looking at however, as both the IA Mixed Investment 40-85% Shares and IA Mixed Investment 20-60% Shares sectors also saw an increase in research share.

This could suggest that investors are seeking to diversify portfolios away from the narrow band of stocks that have dominated market leadership for some time, such as the Magnificent Seven, but have started to slip in recent months.

Vanguard LifeStrategy 80% Equity, Orbis Global Balanced, BNY Mellon Multi-Asset Balanced, Vanguard LifeStrategy 60% Equity and Janus Henderson Global Responsible Managed are the IA Mixed Investment 40-85% Shares funds with the biggest increase in research share.

Meanwhile, the top beneficiaries in the IA Mixed Investment 40-85% Shares sector were Artemis Monthly Distribution, Orbis Global Cautious, BNY Mellon Multi-Asset Moderate, L&G Future World Global Opportunities and Close Diversified Income Portfolio.

Source: Trustnet, Google Analytics

An increase in research for IA Global Equity Income funds is another trend over the past few months. Some 3.9% of Trustnet factsheet views went to global equity income funds in 2024’s opening half but this grew to 4.2% in the second half.

The IA Global Equity Income sector has had a decent year-to-date, with the average fund making an 11.7% total return. With interest rates starting to fall, investors might be considering moving up the risk scale in order to find higher yields.

Artemis Global Income, Aviva Investors Global Equity Income, Guinness Global Equity Income, Aegon Global Equity Income and Invesco Global Equity Income are some of the funds here that are being researched more by Trustnet users.

Another research trend seems to be investors looking into likely beneficiaries of the ‘Trump trade’ ahead of US presidential election. The IA North American Smaller Companies and IA Financials and Financial Innovation sectors were being researched more in the second half of the year.

Both US small-caps and financials have been identified by commentators as sectors to watch when Donald Trump moves back into the White House, owing to his America First agenda, deregulation promises and the prospect of higher for longer interest rates if his policies prove to be inflationary.

Federated Hermes US SMID Equity, CT US Smaller Companies, GS Goldman Sachs US Small Cap CORE Equity Portfolio, Artemis US Smaller Companies and New Capital US Small Cap Growth are the IA North American Smaller Companies funds getting researched more.

In the IA Financials and Financial Innovation sector, Polar Capital Global Insurance and Janus Henderson Global Financials were the main beneficiaries of higher investor interest.