Artemis is increasingly finding its best ideas in emerging markets. Its quantitative SmartGARP process calculates that 44% of the world’s most attractive stocks are in emerging markets, which is remarkable given they only account for 9.1% of the MSCI All Country World Index.

The SmartGARP system, which stands for growth at a reasonable price, scans the equity universe for companies on a low valuation whose profit forecasts are being upgraded – in other words, where sentiment is improving.

Companies with improving fundamental prospects, but where their share prices do not yet reflect those improvements, can be found in abundance in emerging markets, said Raheel Altaf, manager of Artemis SmartGARP Global Emerging Markets Equity.

Outside of India and Taiwan, emerging markets have been overlooked by investors and face a cluster of economic headwinds and geopolitical issues. Even so, “we're seeing a number of positive catalysts coming through in terms of what businesses are actually doing and the catch-up opportunity in shares is quite significant”, he explained.

Artemis looks at how sustainable profits are through time. One way to measure that is by the return on capital that businesses are generating, in excess of the cost of capital. In other words, is a business using its assets to grow?

Companies in emerging markets have survived through various crises and as a result, those that are thriving today have strong balance sheets and solid fundamentals. Management teams have taken a conservative approach to capital allocation decisions and have been deleveraging. “If you're going through hard times, the last thing you're going to do is go out and aggressively spend money,” he observed.

Emerging market companies are also generating cash and returning it to shareholders through dividends.

“People typically look at emerging markets and think of risky companies or early stage companies or immature businesses. What we're seeing today is a maturity in the asset class, a stability in terms of the underlying fundamentals of businesses, and a starting valuation that is really very attractive,” Altaf observed.

In Korea, which is currently the fund’s largest active overweight, it is not uncommon to see strong businesses priced at well below book value, with a price-to-earnings ratio of 5-6x and dividends of 6-7%.

At the other end of the spectrum, India is the most richly valued equity market in the world, even more expensive than the US. “Valuations are priced for being perfection and as we know, it's very rare that you get perfection in markets. You get disappointments,” he said.

A valuation discipline protects portfolios by having a margin of safety, he argued. “You can ride the turbulence and the volatility of markets and do well, because your starting point is one where you've actually captured a lot of the downside already.”

Altaf has been able to find reasonably valued companies in India that should benefit from the country’s robust economic growth, such as infrastructure plays, telecoms and electricity producers.

Meanwhile, China has been the worst performing equity market in the past few years – its recent rally notwithstanding – but there are signs of a nascent recovery.

The average Chinese citizen has more savings today than ever before, although a lot and of people’s wealth is tied up in the troubled property market. In the past few months, the government has made “an open ended commitment to boosting growth” and over time, he expects the substantial, coordinated, economic stimulus measures to unleash people’s spending power.

“The reason we've moved quite overweight China is partly driven by that very positive catalyst, but also because there are great businesses in China. They're growing and they're world leaders, and those are businesses you can buy today on very low valuations. The divergence between share prices and fundamentals has become extreme in China,” he said.

Until recently, he mostly held Chinese companies with extremely strong balance sheets, a high dividend yield and a huge margin of safety in the valuation, such as Sinotrans, a transportation logistics business paying an 8% dividend yield. Its share price has almost doubled in the past few years, whilst the Chinese stock market has been falling.

Altaf has been rotating his portfolio since March to capitalise on improving earnings sentiment and signs of a consumption-led recovery. He has been moving out of defensive stocks and into consumer-oriented businesses such as Alibaba, car manufacturer Geely group and appliance maker Midea.

Alibaba, the ecommerce and technology multinational, used to be a stock market darling trading on 30x earnings, but then it fell out of favour and plummeted to about 7x earnings, he said. It has recovered to 10-11x earnings today.

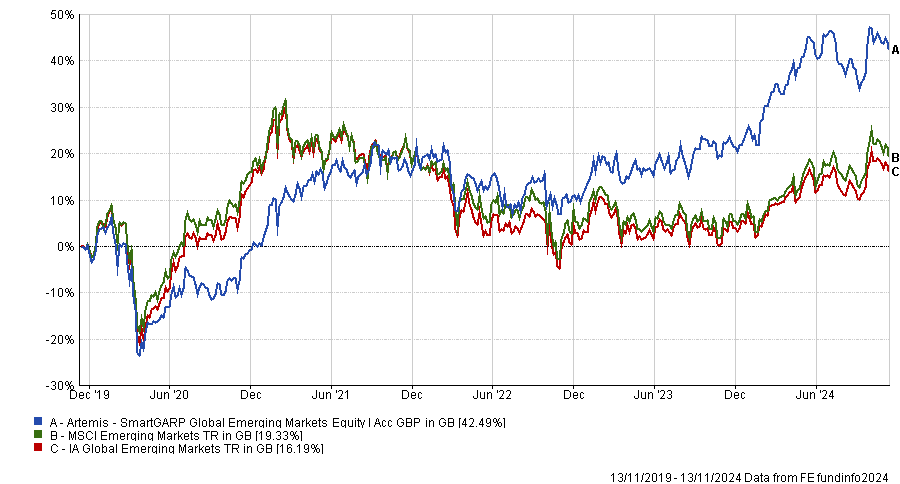

The China overweight has not been a headwind to performance. Artemis SmartGARP Global Emerging Markets Equity is the second-best performing fund in its sector over three years and 11th over five years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics