Investors with £15,000 to spare would probably be inclined to stick the sum into the stock market, but let’s imagine they decided to buy a Hermes Birkin bag instead.

Usually, that privilege is reserved for recurring customers who have already spent at least the same amount on other Hermes products and made it onto the waiting list.

Assuming this is the case, let’s say the visit to the shop establishes that instead of £15,000, the much-dreamed bag now costs £16,000.

“Do you walk out of the shop?” asked Marcel Stotzel, deputy manager of the £4.3bn Fidelity European fund. Probably not – and this speaks volumes about the unsurmountable pricing power that the top European companies have, he said. “It’s incomparable to any other market in the world”.

The same goes for Nespresso coffee drinkers, who are unlikely to give up on their caffeine intake just because their cup has become 10p more expensive.

But for each of these Dr Jekyll companies, a Mr Hyde is lurking somewhere in the market – “crap, quasi-government-owned companies with really bad governance at the low end”, as Stotzel described them.

“The spread between the good and the bad in Europe is higher than any other market in the world,” he said. This means Europe is “a much more fertile stock-picking ground than for example the US”.

Even within luxury goods, it’s worth choosing your horses wisely. Western consumers are done spending their post-pandemic furlough money and stimulus cheques and sales in China – a key market for European brands – have slowed, as the Chinese wealth creation engine is not growing as strongly as it was.

For all these reasons, Stotzel likes to focus more on “safer luxury” – not the likes of Burberry, whose share price plummeted 39% over the year to date, but more the likes of Hermes, which has two-year backlogs that it can eat into.

Performance of stock over the year to date Source: Google Finance

Source: Google Finance

“We like the ultra-high-net-worth space, where the Chinese consumer still has the ability and the willingness to purchase,” the manager said.

Europe also looks particularly attractive in those areas where companies “just happen to be at a big discount for the only reason they are trading in Europe”.

An example of that from the Fidelity European portfolio would be Swedish mining equipment company Epiroc. Together with Sandvik, they are the only two players in the world whose machines can go deep into the ground to find gold ores, which are becoming more and more elusive and difficult to extract.

“They have no US competitors, no Chinese knockoffs, nothing,” the manager said. “Epiroc sells into Chinese mines, for example, which makes me pretty confident that its business model is sustainable.”

Fidelity European is a 45-strong portfolio, whose top-10 companies include the usual European suspects Novo Nordisk (6.3%), SAP (5.1%) and ASML (5%), among others.

The fund has been struggling in the past year, when it only achieved fourth-quartile returns, but it maintained a maximum FE fundinfo Crown Rating of five given its strong long-term performance, reaching first quartile over the past 10 and five years and second quartile over three.

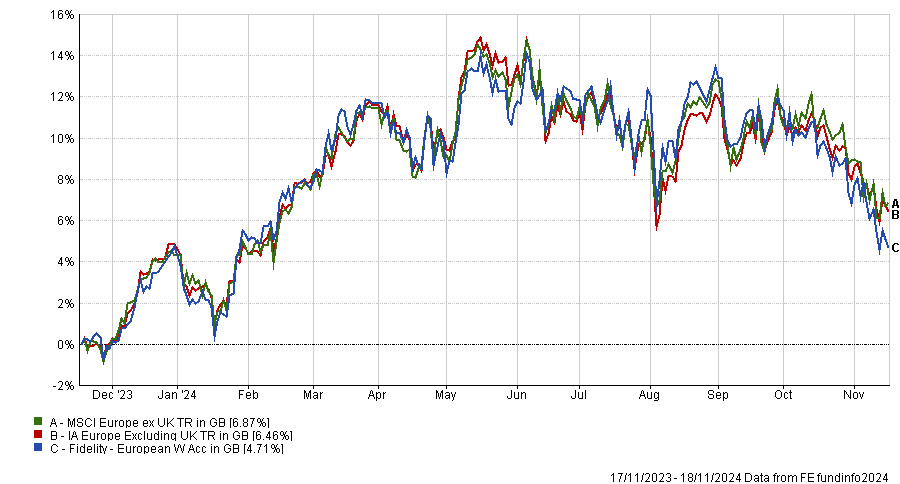

Performance of fund against index and sector over 1yr

Source: FE Analytics

Stotzel isn’t blind to the challenges Europe faces, especially economically. But his main lesson was that “the economy isn’t a proxy for the stock market”.

Benjamin Melman, global chief investment officer at Edmond de Rothschild, agreed that European pessimism might be overdone.

While there is no doubt that Donald Trump’s election and the threat of tariffs have exacerbated investor scepticism towards Europe, Melman said investors should not forget that European companies with a cost base in the US will benefit from the lower corporate tax rate.

According to Morgan Stanley’s estimates, while 26% of the sales generated by MSCI Europe companies are exposed to the US, the percentage of exports – threatened by the tariffs – is only 6.2%.

“European equities are now trading at a record discount relative to their US counterparts, yet Europe is not in crisis. We have also observed that the economic surprise index has tended to recover a little over the past few weeks,” he said.

“In Germany, the likely change of government could bring more favourable news on the fiscal front. Germany has all the fiscal levers it needs to rebound and while the political will has not been clearly expressed so far, the lines are shifting.”