Fund management is home to several big names, such as BlackRock or Fundsmith, with well-earned reputations for quality. However, there are strategies that despite enjoying good performance, have remained relatively underappreciated.

While these ‘hidden gems’ may pass under the radar for many investors, they are well-liked among professional fund pickers, who are always keen to find undervalued strategies that can keep up with the industry’s giants.

Below, fund selectors reveal their best-kept secrets, covering everything from US and global equities to European small-caps.

GQG Partners US Equity

For Jason Hollands, managing director at Bestinvest, the £1.5bn GQG Partners US Equity fund is a standout example of a hidden gem.

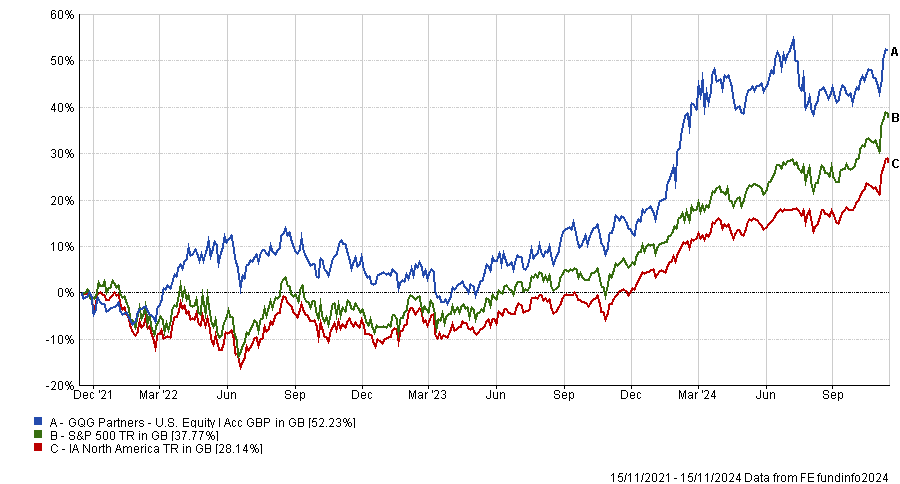

Despite only being launched in March 2021, the fund has enjoyed the third-best three-year performance in the sector at 52.2%. This result surpassed both the wider S&P 500 index and the highly competitive IA North America peer group.

Performance of the fund vs the sector and benchmark

Source: FE Analytics

Despite these strong results, Hollands noted that the portfolio has yet to make a splash with UK retail investors, as it lacks the large sales and marketing teams that larger fund houses take for granted.

Nevertheless, Hollands was a fan of the strategy’s high conviction, concentrated approach with just 33 stocks. “While this may seem risky, there is a very stringent focus on downside protection and historically, the fund has proven defensive during difficult periods,” he said.

Moreover, investigative analysis plays a crucial role in the team’s approach. Each stock is monitored by two team members, allowing them to make changes quickly to keep up with market developments.

Analysts at FE Investments are similarly positive about the fund, awarding it with an FE Fundinfo Crown Rating of five. “The macro ‘switch off’, whereby entire sectors can be exited quickly in the event of new risks emerging, has been highly successful at limiting damage in falling markets,” they said.

Palm Harbour Global Value

Alex Paget at VT Downing Fox suggested an underappreciated global fund, the £10.5m Palm Harbour Global Value fund, led by senior manager Peter Smith.

“It sits in the global sector but looks nothing like the ‘average’ global fund. It’s value, it’s small-cap, and (thanks to Peter’s experience) will likely be biased towards European stocks,” he explained.

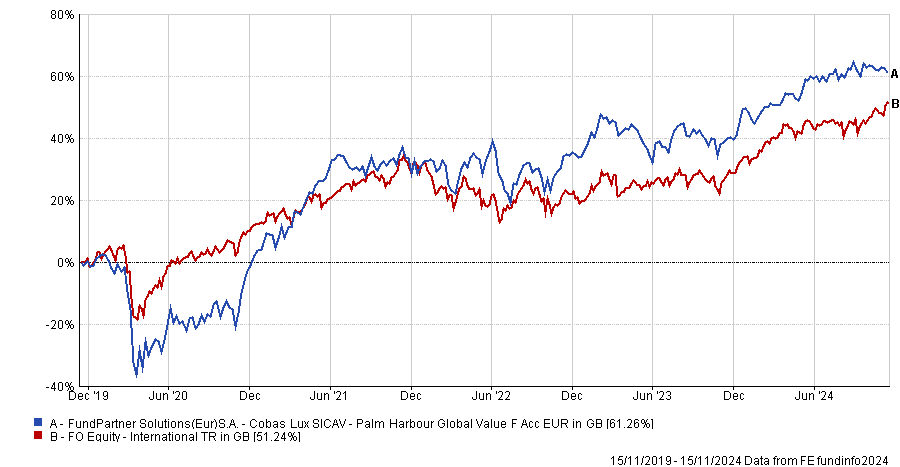

This offshore “minnow” has risen by 61.3% in five years compared to a sector average of 51.2%, a second-quartile performance. This track record is particularly impressive given the fund’s bias towards Europe and away from the US, Paget argued.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

“This is a real hidden gem that will deliver strong long-term returns, especially when the current era of mega-cap domination eventually subsides,” he added.

Moreover, he explained that the strategy benefits from an emphasis on stock picking, with the team constantly searching for discounted opportunities. This has positioned the fund well to endure market downturns and shifts in sentiment.

As a result, the fund has enjoyed strong downside protection, with a first-quartile downside risk of 12.4% over the past three years.

Paget said: “We want to invest in the next GOATs (greatest of all time) and we think this fund has very GOAT-y credentials.”

Polar Global Insurance

Finally, Ben Yearsley, director at Fairview investing, identified the £2.5bn Polar Global Insurance fund as a favourite.

“It feels odd suggesting a fund that has a 20-year track record and is more than £2bn in size, but that is precisely what I’m going to do. There isn’t a find like it available to UK investors,” he said.

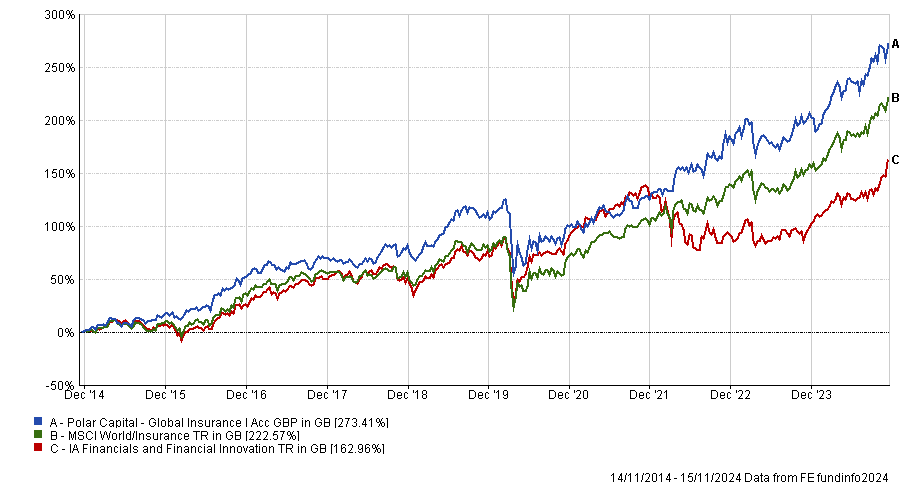

With a sector-leading 10-year performance of 273.4%, this strategy has outpaced the IA Financials and Financial Innovation peer group and the MSCI World/Insurance benchmark. While the fund slid into the second quartile over half a decade, it was the best-performing strategy in the past three years.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

Yearsley rates the fund highly due to its stock composition. It is an insurance-focused fund which forgoes well-known names such as Aviva and instead targets smaller reinsurance businesses such as Arch Capital Group.

“These companies benefit from good insurance underwriting, basically setting the correct levels of premium as well as earning a return on premiums as they are invested,” he explained.

“This latter return is linked to treasury yields and the fund is a beneficiary of the higher rate environment we are now in.”

Analysts at Square Mile Investment Consulting & Research also favoured this fund, crediting it for its sensible and proven management style, which allowed it to navigate this “sleepy sub-sector of markets” that many investors often deem too complex.