Nvidia, Taiwan Semiconductor Manufacturing, Novo Nordisk and Berkshire Hathaway are some of the stocks that this year’s best IA Global funds hold in common, FE fundinfo data reveals.

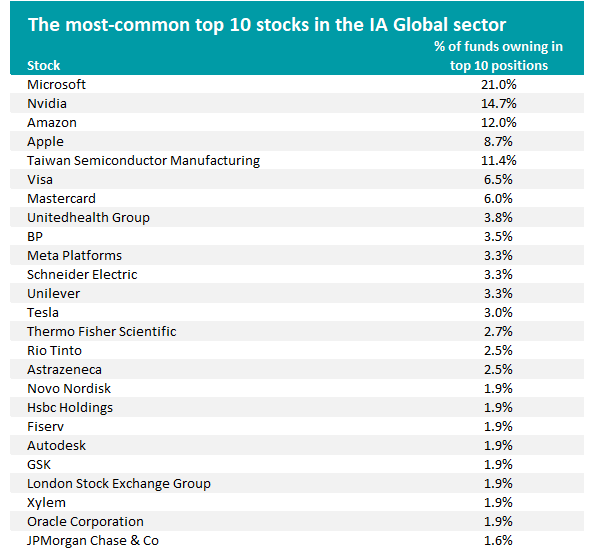

Across the entire IA Global sector, the most-common top 10 holding is tech giant Microsoft, which is among the biggest positions of 21% of the peer group’s members.

It is followed by Nvidia (owned by 14.7% of global equity funds), Amazon (12%), Taiwan Semiconductor Manufacturing (11.4%) and Apple (8.7%).

Source: FE Analytics

However, in this article Trustnet is focusing on the funds in the first decile of the IA Global sector over 2024 to date, to discover which companies they hold in common. We found that there are some stark differences in how 2024’s best performing IA Global funds are positioned versus their average peer.

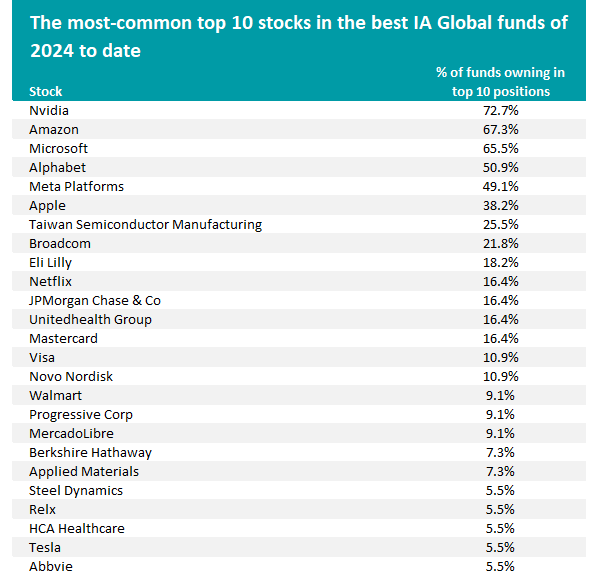

The most obvious is Nvidia, the US technology company specialising in graphics processing units (GPUs), software and systems for gaming, artificial intelligence (AI) and data centres.

While fewer than 15% of the sector have the stock in their top 10 holdings, it is found in 40 of the 55 funds in the sector’s top decile for 2024 total returns – or 72.7% of the year’s very best performers.

The company is among the biggest holdings of specialist global funds, such as Sanlam Global Artificial Intelligence, Polar Capital Artificial Intelligence and M&G Global AI Themes, as well as generalist strategies like Royal London Global Equity Select, Baillie Gifford Long Term Global Growth Investment, CT Global Focus and GQG Partners Global Equity.

Nvidia’s shares have rocketed since AI broke into the mainstream at the end of 2022 with the launch of ChatGPT and similar tools. FE Analytics shows the stock is up 872% (in US dollars) since the start of 2023, compared with 60% from the S&P 500 and 47% from the MSCI AC World.

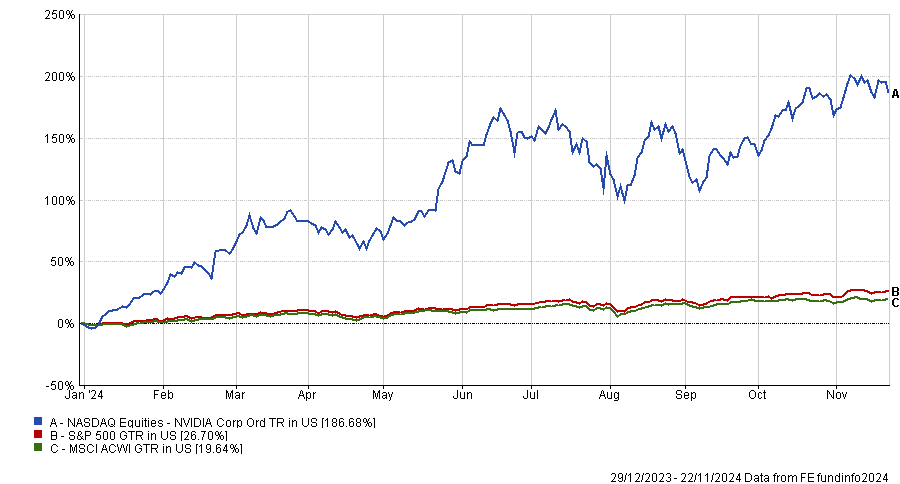

Performance of Nvidia vs US and global equities in 2024

Source: FE Analytics. Total return in US dollars between 1 Jan 2023 and 22 Nov 2024

As the chart above shows, this strong run has continued in 2024 so any funds with Nvidia in their top holdings have had a solid tailwind to their performance.

Dan Coatsworth, investment analyst at AJ Bell, said: “Nvidia is the poster child for the AI revolution. It is at the epicentre for the explosive growth in machine learning and automation, with AI being embraced by every industry imaginable on a global basis. Its chips are at the top of every company’s shopping list because it has become the hallmark for all things AI.”

However, he pointed out that Nvidia’s shares fell after its latest results, despite earnings being 8% ahead of expectations. This was better than the 6.25% beat achieved in the previous quarter, but below the double-digit beats seen across four sets of quarterly results between May 2023 and February 2024.

“The negative market reaction to Nvidia’s results suggests investors are now focusing on the minutiae rather than the big picture. That’s a natural evolution as the more people zoom in on a company, the more they learn about it and the more granular detail they want,” Coatsworth explained.

“Investors have enjoyed stellar share price gains from Nvidia over the past two years and that’s made them think it is invincible. In reality, a small decline in margins is not a reason to panic, particularly when they are still over 70% which many companies could only dream of. Nvidia is confident margins will rebound as production volumes ramp up for its Blackwell chips.”

Source: FinXL

Nvidia is part of the so-called Magnificent Seven, the group of US tech giants that led the market in 2023 and the opening months of 2024. The other members of this cohort are Apple, Microsoft, Alphabet, Amazon, Meta Platforms and Tesla – all commonly found in the top 10 holdings of 2024’s strongest global equity funds.

Around two-thirds of the IA Global sector’s top decile hold Amazon and Microsoft in their biggest positions, while half own Alphabet and Meta. This is far higher than the level of ownership across the whole sector.

Tesla is the least common Magnificent Seven name in this year’s best performers, owned by 5.5%. But this compares with only 3% of the wider sector having the electric vehicle maker in their top 10s.

There are, however, signs that the Magnificent Seven’s market dominance is easing as Apple, Alphabet and Microsoft are trailing the S&P 500 over 2024 so far, while Amazon is only just above the index. Tesla was also underperforming but rallied sharply after Donald Trump won the US election.

Outside of the Magnificent Seven, there are other clear differences between the biggest holdings of the average IA Global fund and those in the top decile this year.

One-quarter of 2024’s best performers hold Taiwan Semiconductor Manufacturing in their top 10, just over double the ownership of the wider sector.

About 90% of the world’s most advanced semiconductors are produced in Taiwan, most through Taiwan Semiconductor Manufacturing. The company is the world's largest producer of semiconductors and is a major supplier of Nvidia and Apple, which has attracted investors and buoyed its shares.

Semiconductors are a recurring theme among this year’s best global equity funds, as both Broadcom and Applied Materials operate in this area. Neither company is among the most common holdings of the whole sector, but they are for the top performers.

Payment technology companies are popular holdings of global funds, with 6.5% holding Visa in their top 10 and 6% owning Mastercard. This rises to 16.4% holding Mastercard and 10.9% Visa among the best performers.

Novo Nordisk is one of the biggest holdings of 10.9% of this year’s top global funds, compared with just 1.9% of the entire sector. The Danish pharmaceutical company specialises in diabetes care medications and devices.

It has had great success with its drug semaglutide, which used to treat diabetes under the brand names Ozempic and Rybelsus and obesity under the Wegovy brand name. These have proved to be popular, boosting the company’s earnings and shares.

Other stocks among those most held by this year’s top IA Global funds but not the wider sector include Warren Buffett’s Berkshire Hathaway, US pharmaceutical company Eli Lilly, streaming giant Netflix and retail corporation Walmart.