Venture capital trusts (VCTs) turned 30 last Friday, as November 29 marked the anniversary of the 1995 Budget that introduced the VCT scheme.

Since then, VCTs have helped create several household name companies, according to Richard Stone, Chief Executive of the Association of Investment Companies (AIC), “generated thousands of jobs and boosted economic growth”.

“They made major contributions across industries, from tech to healthcare, retail to manufacturing.”

Among investors, they are mostly known for offering tax relief to those who take the plunge – a £10,000 investment in VCTs can save an investor £3,000 in income tax, as well as providing tax-free income and capital growth.

Below, Trustnet asked VCT specialist the Wealth Club which vehicles are worth considering.

British Smaller Companies

Investment manager Isaac Stell chose British Smaller Companies VCTs, which are among the longest-standing in the market.

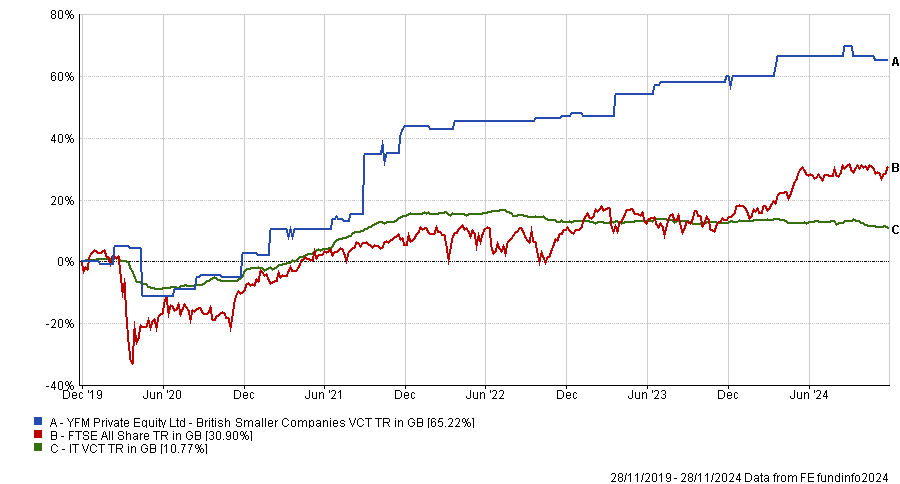

Performance of fund against sector and index over 5yrs

Source: FE Analytics

They are managed by YFM Equity Partners, who have been investing in young, fast-growing companies for more than 40 years.

Companies in the portfolio include Matillion, one of the world’s leading cloud integration platforms, Unbiased, the financial adviser review site and Outpost FX, a digital effects studio working on Hollywood and streaming blockbusters such as The Rings of Power and Napoleon.

“The VCTs look to invest in technology companies, with a bias towards data, tech-enabled services and new media,” Stell said.

“The VCTs have built an enviable track record within their favoured sectors as well as a strong performance history, producing total returns of 66.4% and 55.2% across British Smaller Companies and British Smaller Companies 2 in the five years to 30 September 2024 – though investors should remember these remain higher risk investments.”

Molten Ventures

Head of investment research Jonathan Moyes picked Molten Ventures.

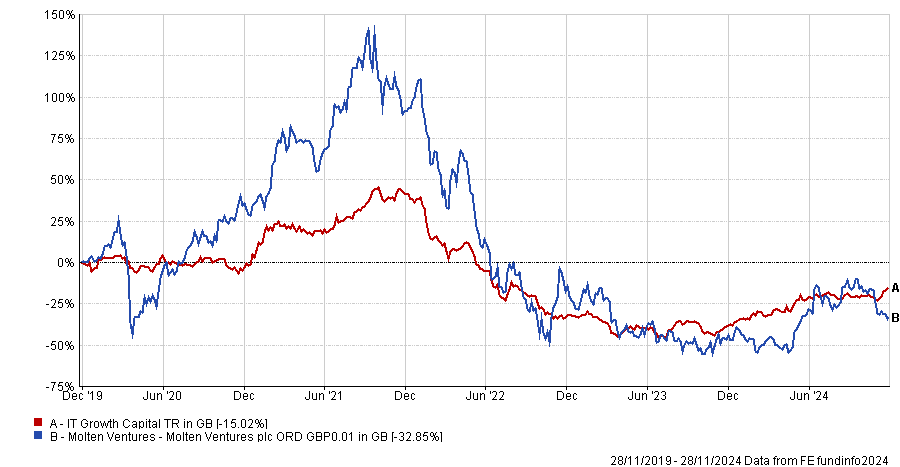

Performance of fund against sector over 5yrs

Source: FE Analytics

“It appears to have weathered the storm in the venture capital world well over the past two years and has a portfolio that is showing promise,” he said.

Its largest holding, core banking software provider Thought Machine, has seen strong demand for its banking-as-a-service product, attracting investment from JPMorgan, Lloyds and Morgan Stanley.

Other notable holdings include account-to-account payments platform Form3 and Riverlane, which is developing an operating system for quantum computing.

“Its high growth style may sit well within a wider VCT portfolio,” Moyes concluded.

Octopus Apollo

Investment manager Nicholas Hyett selected Octopus Apollo, which focusses on relatively mature B2B software businesses that tend to be capital light, meaning they can survive and even thrive without the regular cash infusions other start-ups often need.

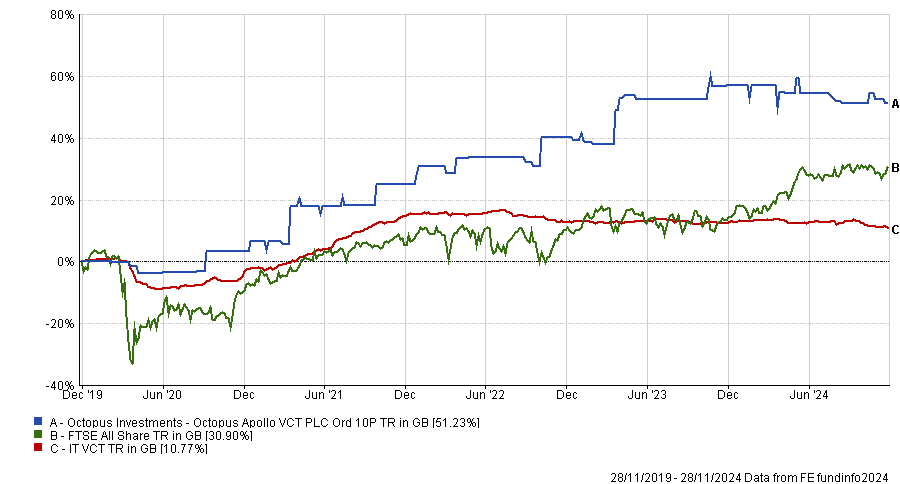

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Their corporate customers are also more reliable than consumers, and once software is integrated into a business’ day-to-day processes, it doesn’t get ripped out on a whim, Hyett explained.

“That focus has served Apollo well in recent years, when rising interest rates have been brutal for companies that relied on regular investments to fund rapid growth – sapping capital out of venture investing as it found more reliable returns elsewhere.”

Admittedly, the downside is that in boom years, these steady-Eddie businesses can look “rather boring”.

“But when boom turns to bust, boring turns to beautiful – making Apollo a good diversifier in a portfolio of generally higher octane VCTs.”

Octopus AIM

Investment analyst Ellie Sawkins went for the Octopus AIM VCTs, which are two of the more diversified VCTs investing in the Alternative Investment Market (AIM) of the London Stock Exchange.

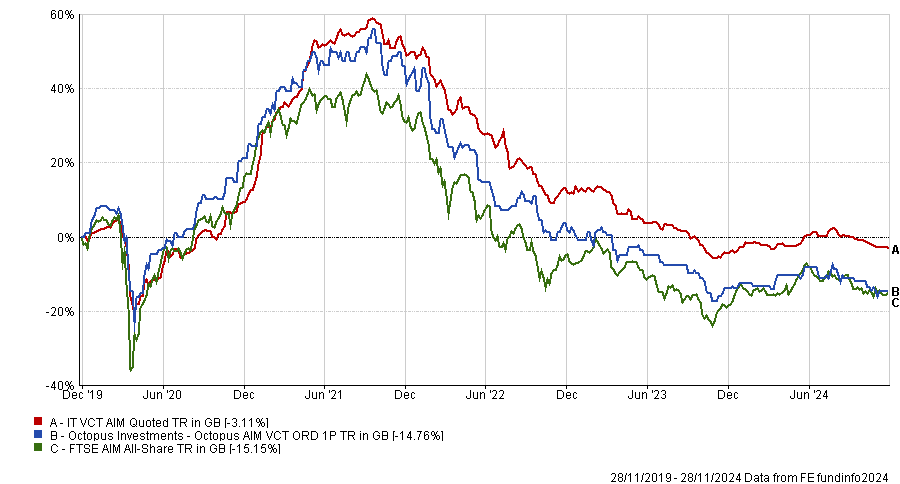

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Managed by the “highly experienced” Octopus Quoted Companies team, the portfolios have been resilient, with 67% of companies profitable and 50% paying dividends, despite the troubled waters in which the AIM market has found itself in recent years.

They include companies such as laboratory equipment suppliers Judges Scientific and identity verification business GB Group, but also have the freedom to invest in private companies, such as photobook creator Popsa.

“With uncertainty around the future of inheritance tax relief on AIM now firmly in the rearview mirror, there are reasons to think AIM could be on for a renaissance – in which case Octopus AIM could be set for better times ahead,” Sawkins concluded.

Pembroke

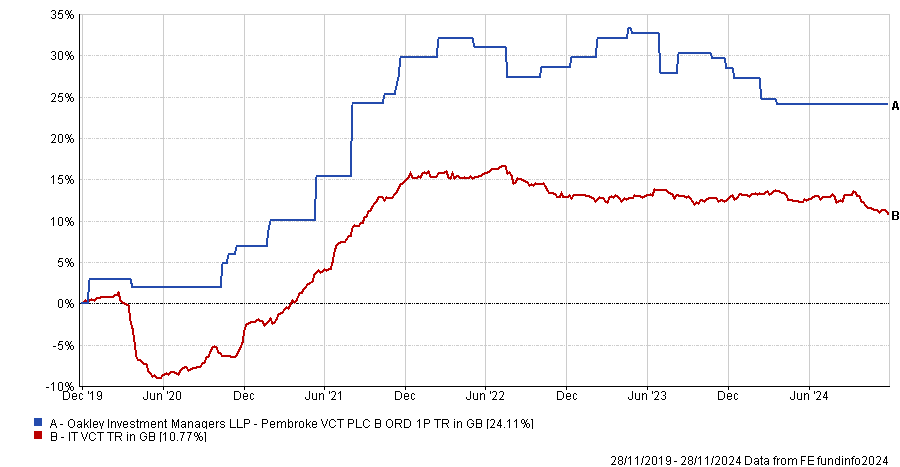

Finally, head of investment research Jonathan Moyes highlighted Pembroke VCT, one of the breakout VCTs of the last five years, having grown its assets to over £200 million.

Performance of fund against sector over 5yrs

Source: FE Analytics

The VCT has developed an excellent reputation for backing entrepreneurs building premium consumer brands, with early exits from Pasta Evangelists, the premium pasta brand, and Plenish, the premium oak milk brand.

“Promising” portfolio companies include largest holding LYMA Life, the medical grade home beauty laser, and Secret Food Tours, recently ranked the seventh fastest growing technology business in the UK by Deloitte.

According to Moyes, “the distinctive sector focus may provide valuable diversification to a wider VCT portfolio”.