The private equity market now holds more than $10trn in assets, according to JP Morgan Asset Management, but for many investors it remains an obscure and complex market, difficult to break into and even more difficult to understand.

Alan Gauld, manager of the £812m Patria Private Equity Trust, admitted: “My take is that private equity has a bit of a PR problem.”

Despite being a market with a significant runway for growth, Gauld criticised his fellow managers for not doing enough to demystify the sector and encourage investors to take a chance on the asset class.

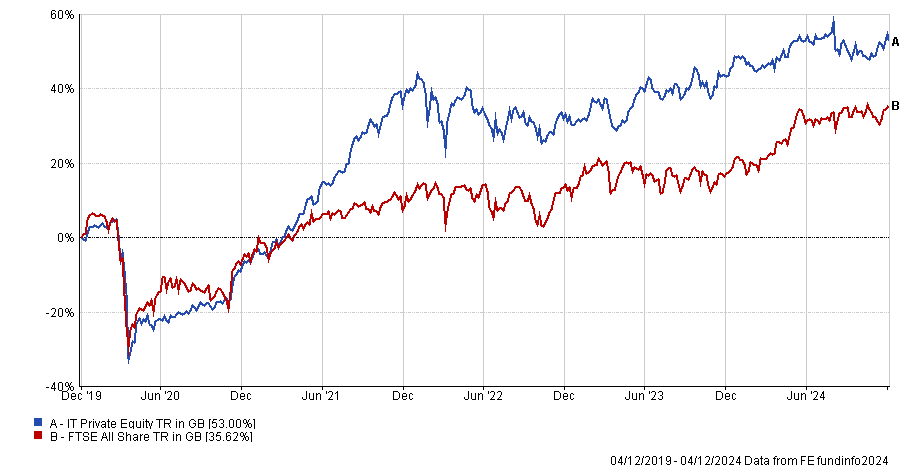

Performance of Patria Private Equity Trust vs sector and benchmark

Source: FE Analytics

His strategy has delivered top-quartile performance in the IT Private Equity sector over one and five years, making an 83% return over the past half a decade.

The challenge of private equity

For Gauld, despite the market having a significant runway for growth, one of the biggest challenges facing private equity is its own poor reputation.

He said: “There is still this old perception about private equity that unfortunately persists: that it is about asset stripping, that it takes strong companies, slashes costs and puts a bunch of debt on.”

“I can’t even describe how out of date that is,” he added.

As a result, the manager argued, investors have concluded that the most effective investment is by putting their money into a global index tracker, rather than being more adventurous and diversifying away from traditional assets. Such a trend presents a real challenge for private equity.

For Gauld, some of the responsibility for this poor reputation enduring must be laid at “the doorstep of private equity itself”.

He suggested that private equity managers have a general aversion to sharing in depth information about portfolio construction, because it allows competitors to see why you are valuing certain assets and use that against you, putting you at a competitive disadvantage.

“I think that puts some investors off, as they might like to touch, feel and understand information about the companies,” he added. “The reality of private equity is that we cannot always provide that.”

As a result, the barrier to entry in private equity remains high and these impressions of the asset class have limited further growth.

Gauld said: “There is no real incentive for people to try and put their head above the parapet, to try to dispel some of these myths frankly, because the institutional money just keeps rolling in.

“Certainly, I think the industry has a communication issue.”

Why invest in private equity?

As a result, some might question why they should invest in private equity over public equities or trackers.

For Gauld, part of it comes down to performance. In the medium to long term, the asset class has posted strong returns, with the IT Private Equity Sector up by 53% over the past five years, outperforming the FTSE All Share.

Performance of sector and index over 5yrs

Source: FE Analytics

Looking to the future, he believes private equity is set to benefit from global trends, such as the slow cutting of interest rates. He argues that this will make investment and sales in the market more attractive, which benefits NAV growth across the sector.

Moreover, he explained that private equity investors are sector-specialised and take majority control of a business, they are generally far more proactive than their public counterparts, willing to step in to help drive growth.

He said: “I'm convinced that it [private equity] lets businesses develop much more quickly than they would in the public markets.”

The core example of this is Amazon. When Amazon was listed in the public markets for the first time 20 years ago, it was valued at about $500m. By contrast, companies such as Uber, which listed publicly for the first time in 2019, were valued at about $80bn upon debut, which Gauld attributed to spending more time in the private market.

Gauld said: “I think if Amazon went through that journey that it did 20 years ago today, it would have stayed in the private market for much longer.”

Consequently, he argued that private equity adds genuine diversity to investor portfolios and gives exposure to what could be the next disruptive tech business.

He concluded: “There are 28,000 businesses backed by private equity these days, and if you only invest in listed stocks, you are missing out.

“I think it is a shame that not everyone recognises that.”