Star UK equity managers are going into 2025 with strong optimism towards domestic stocks, arguing that cheap valuations and a turnaround in performance should help attract investors back to the unloved home market.

Keith Ashworth-Lord, manager of the CFP SDL UK Buffettology fund, said: “Whisper it gently, but the macro is improving and there is a gradual increase in positive sentiment towards the UK. This has been one of the key investment themes of 2024.

“Whilst not universally welcomed, the Labour government and the Republican trifecta mean we have political certainty for several years ahead. October’s Budget, whilst damaging to economic confidence, is now helpfully in the rear-view mirror.

“Overlaid with this is a chronic degree of undervaluation of UK equities versus their overseas peers, especially the US, something that is behind the current wave of takeover approaches.”

Going into 2025, Ashworth-Lord will be maintaining CFP SDL UK Buffettology’s preference for quality-growth compounders and tilt towards small- and mid-cap companies to benefit from any renewed interest in the UK.

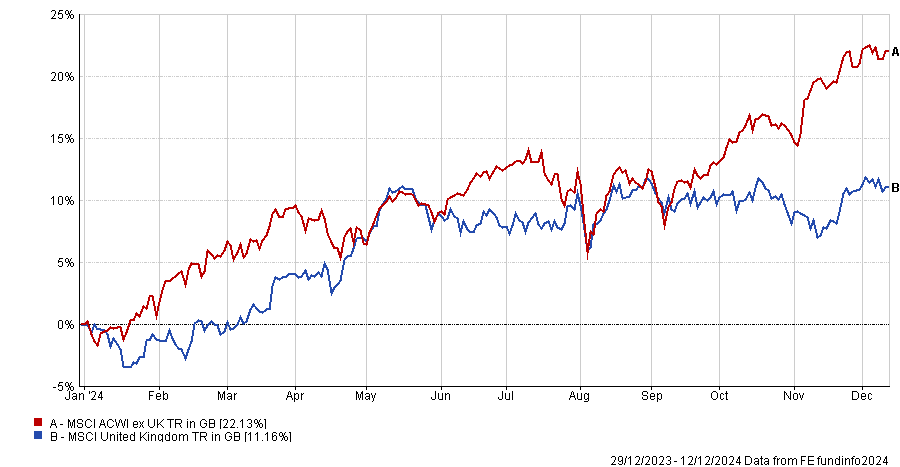

Performance of UK stocks vs global equities over 2024

Source: FE Analytics

Alex Wright, manager of Fidelity Special Situations fund and Fidelity Special Values trust, is another UK equity investor arguing that domestic stocks still look cheap when compared with other markets despite recent improved performance.

Other supportive factors include a more stable political situation thanks to the Labour government’s large majority, attractive dividends in a global context and a record number of UK companies buying back their own shares, the manager said.

On positioning going into 2025, Wright said: “We have been finding new ideas in cyclical areas such as industrials, advertising and staffing and also added back into select real estate and housing related names, where demand appears to be stabilising and valuations remain low.

“Another area where we continue to find opportunities is defensives, where having taken some profits from our support services holdings, we have added to a number of consumer staples businesses and utilities on weakness.”

While the UK market is relatively unloved by domestic investors, Adrian Frost, Nick Shenton and Andy Marsh, co-managers of the Artemis Income fund, expect its attractive valuations and international nature to continue drawing in foreign investors.

One area where they see some of the “most interesting opportunities” are in tech stocks.

“People think the UK doesn’t have any tech companies, but that’s not true. It has some exciting companies using data and technology to provide valuable services. Think companies like RELX or LSEG,” they said.

“These have grown materially over the past five years and improved their growth prospects for the coming decade. These companies are starting to be appreciated by global investors.”

Martin Walker, head of UK equities at Invesco, pointed to the fact that the UK market is home to many high-quality companies that are trading at a discount and offers international investors a different opportunity set to the likes of the US.

“Sector exposures in the UK are very different to other global equity markets – bringing important additional benefits to international asset allocation decisions, in terms of diversification. The UK has minimal direct exposure to technology, but greater exposure to cash generative financials, energy and basic materials,” the Invesco UK Opportunities manager said.

“We are particularly excited about the opportunities in growth utilities and in internationally orientated consumer staples.”

Taking more a macro view, Liontrust Special Situations co-manager Anthony Cross expects to see proactive government to stimulate UK economic growth in 2025 and beyond. Policies aimed at encouraging greater investment, particularly through pension funds, are essential and called on the government to encourage pension funds to invest more in the home market.

"We believe that a vibrant domestic stock market is the linchpin of a dynamic economy," Cross explained. “Improved investment flows will have a positive impact upon the valuations of UK-listed companies, which are cheap when compared with overseas markets.”

Cross suggested there could be a ripple effect from improved valuations, attracting benchmark-aware investors, encouraging more companies to list on the London market and boosting merger and acquisition activity. He suggested this would create a virtuous cycle, strengthening the UK economy and solidifying its competitiveness on the global stage.

Finally, Paul Marriage, manager of the TM Tellworth UK Smaller Companies fund, said he is going into 2025 with the same “cautious optimism” for UK smaller companies that he ended 2022 and 2023 with.

“The reasons to be cheerful are that the sector generally trades well in a rate-cutting, pro domestic environment. Our portfolio is not especially rate sensitive and we are not over-reliant on UK revenues in most of our investments,” he said.

“The Budget has not dealt a fatal blow to the AIM market as feared a few weeks ago. Moreover, our stocks have not rerated upwards in many material ways this year - valuations remain resolutely modest and, in some cases, derisory.”