Corporate bond valuations are expensive, spreads are tight and some very poor-quality companies have been able to issue debt of late. Jonathan Golan, manager of the Man Sterling Corporate Bond fund, warns that other bond managers have been relaxing their underwriting criteria to chase yield, a dangerous practice at the top of the cycle.

Instead, he has been hunting for out-of-favour and idiosyncratic opportunities, such as bonds issued by UK challenger banks.

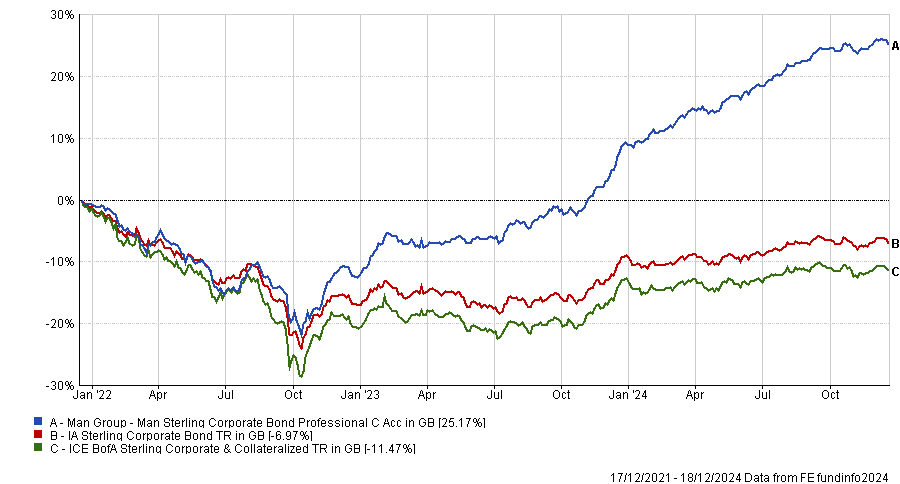

His counter-cyclical approach has enabled Golan to achieve strong performance and recognition. He won the 2024 FE fundinfo Alpha Manager of the Year award for the IA Sterling Corporate Bond sector, where his fund was the best performer over one and three years to 18 December 2024.

Performance of fund vs benchmark & sector over 3yrs

Source: FE Analytics

Below, Golan explains why having a margin of safety is crucial and why the current environment looks like 2006 – the market’s previous peak.

How is your investment strategy different from your peers’?

At the heart of our investment process is the margin of safety. Any investment we make must provide us with a spread over government bonds that greatly overstates the credit risk we're taking by lending money to that company.

This means we're naturally counter-cyclical. At the bottom of the market cycle, many securities will trade below their intrinsic value and therefore we'll invest aggressively; at the top of the market there are going to be fewer opportunities below fair value. The strategy’s risk profile now is considerably lower than in 2022 and 2023.

Mr. Market is capricious. Some days, he wakes up and is very pessimistic, which is when we're happy to buy the opportunities he's sending our way. But sometimes, Mr. Market is optimistic and aggressive, and we step back.

We don't focus on the largest issuers in the benchmark because we want as close as we can get to a free lunch. Getting greatly overcompensated for risks tends to happen with medium and smaller issuers, which fewer people are analysing.

Spreads are tight, so is it hard to find opportunities that overcompensate you?

In most investment-grade markets, we’re getting close to all-time tights, exceeding the previous peak in 2006. Valuations are expensive, particularly in the US, so in some of our global strategies, we've completely collapsed our exposure to US investment-grade credit.

We try to skate to where the puck is going, so we've been focusing on the financial sector since the lows of March 2023, when we saw the best valuations relative to non-financials since the European debt crisis.

European banks did well in 2023 and 2024, given the higher interest rate environment. The outlook for 2025 is of moderating but solid profitability. Investment-grade financial still have better valuations and fundamentals than non-financials.

By contrast, industrials, auto makers, capital goods and chemicals are facing a difficult backdrop in Europe and many companies are reporting poor results. It's an unusual situation where the fundamentals are not strong but the valuations are very unattractive, so that gives you no margin of safety at all.

What have been your best and worst performing investments this year?

Real estate has been one of the best-performing parts of the portfolio, a gift that kept on giving. In 2022 at the bottom of the cycle, real estate was a once-in-a-multiple-cycle opportunity because spreads were higher than during the European debt crisis.

We're still maintaining some loans where there's a good margin of safety, but after being a key focus for two and a half years, real estate is now becoming a normal overweight rather than a very outsized overweight.

The second area which created a lot of value is financial services, not only banks but asset managers, investment platforms and inter-dealer brokers.

Within the UK, we’ve found value in challenger banks, which focus on niche markets where larger banks don't compete. They tend to have a good cost/income ratio because they are online only and don't have the legacy cost of a branch network. Challenger banks have better profitability than high street banks, but their spreads are much higher because they don't have the same household name recognition.

On the negative side, our strict underwriting criteria means that no single issuers have detracted significantly from performance. Over the past two years, even in our Dynamic Income strategy, which has around 70% in high-yield, not a single position has detracted more than 20 basis points at the fund level.

What is the biggest mistake bond managers make?

When the market is expensive, a lot of bond managers loosen their underwriting criteria to get a little bit more yield. They’re picking up pennies in front of a steamroller. Some of the worst vintages I've seen in my career are coming out. Some terrible, bad-quality companies have been able to issue debt.

The biggest mistake I've seen people make is having a relative value approach, thinking the market is expensive so they buy something cheaper than the market. But is it cheap in the absolute sense?

Our spread targets are constant throughout the cycle for a certain level of credit risk, and even if the market is expensive, we can't compromise on a lower spread target. The implication is, if we can't find enough investment opportunities, we will be in cash, government bonds and AAA securities, so there could be points in the cycle where we're not fully invested.

At the moment, we're close to fully invested, but there is a substantial component in very short-dated, high-quality securities that we wouldn't run mid-cycle.

What's the duration of your fund?

Bond managers have two decisions to make. One is the interest rate exposure and the second is which companies to lend money to (credit risk).

At the moment, we don’t want to be underweight interest rate exposure because real yields (the nominal yield minus inflation expectations) are elevated and we want to capture that high nominal yield component.

But the excess yield you get for owning corporate bonds relative to government bonds is slim for the broad market, so we are focusing on idiosyncratic corporate bond opportunities that are shorter-dated.

We have a lending spread of around 300 basis points, which is considerably higher than the benchmark and is attractive in the absolute sense.

We don’t want the interest rate decision to pollute the corporate bond underwriting, but this means we have a wedge between the duration of our corporate bonds and the total duration of the fund. We are filling that wedge with government bonds and government bond futures, seeking to capture high nominal yields offered longer in the curve while controlling for spread-widening risk.

When you're not wrestling with Mr. Market, what do you do for fun?

Music is a focus and then hiking and swimming. Playing guitar is a passion. I started out on electric and moved to acoustic.