It is hard to find consensus when it comes to choosing the best investments, but if any fund ever came close to it, it is the BlackRock Continental European Income.

Among the 229 funds and trusts included in the five main best-buy lists in the industry (published by Hargreaves Lansdown, AJ Bell, interactive investor, Barclays and Fidelity), it was the only one to appear in as many as four – an achievement it has been repeating for at least the past three years. Fidelity was the only provider to remain unconvinced.

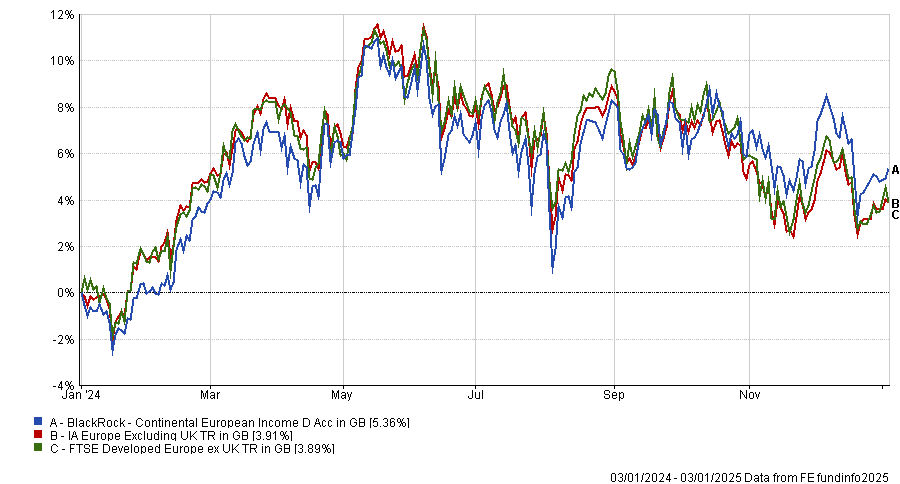

Performance of fund against sector and index over 1yr

Source: FE Analytics

Managed by Andreas Zoellinger and Brian Hall, this £1.2bn vehicle was also highlighted by analysts at Square Mile, Rayner Spencer Mills Research (RSMR) and FE Investments, who see it as a core European ex-UK equity holding.

They were particularly pleased with the flexibility of the fund and the way it “managed interest-rate exposure efficiently, ensuring protection from rising rates in 2022, but then pivoting and capturing the capital gain available from falling yields more recently.”

It maintained a second-quartile performance over the past 10, five and one year, but the China real-estate stress in 2021 impacted its three-year performance, which was only worthy of a third-quartile place in its sector.

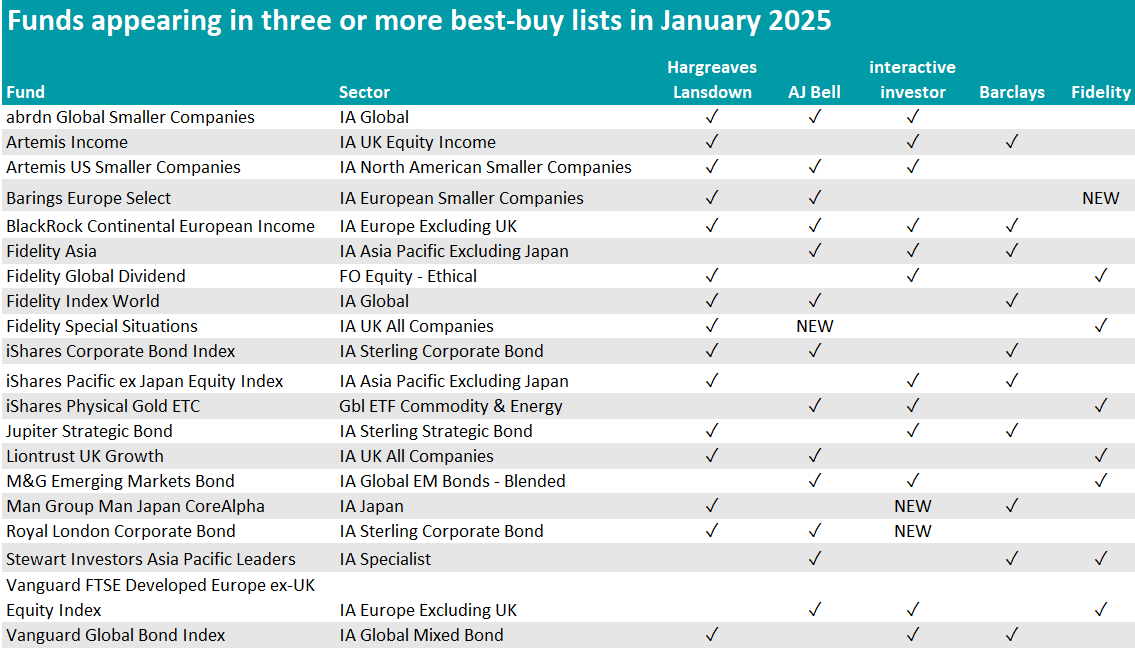

Much of the list has remained unchanged since last year, except for four funds that swayed one more analyst team and gained a place among the top crop this year.

Among them, the £474.6m Barings Europe Select fund gained Fidelity’s seal of approval on top of Hargreaves’ and AJ Bell’s despite being flagged by the latest Bestinvest ‘Spot the Dog’ analysis, which highlights funds that lagged behind a relevant benchmark by more than 5% for the past three years as well as in each individual year.

Source: FE Analytics

Fidelity analysts were persuaded by the “experienced” management team (made up of Colin Riddles, Nicholas Williams, Rosemary Simmonds and William Cuss) and the “detailed” company research carried out.

“This fund is likely to require a long investment horizon of 10 years or more,” they said. “This should allow investors to benefit from the rewards that should come from an above-average-risk investment.”

AJ Bell’s newly-found conviction in Jonathan Winton and FE fundinfo Alpha Manager Alex Wright granted their fund, Fidelity Special Situations, a place in this review.

It became an AJ Bell favourite fund in August 2024, when it was added “to offer variety” to its UK equity selections, and after its global variant was removed from the list in March 2024 due to the departure of the lead manager, Jeremy Podger.

They said: “Investors are well served by this contrarian investment approach, which looks for overlooked or unloved companies with a catalyst for change that hasn’t been factored in by the market. The experienced Wright, who has a long tenure at Fidelity investing in this style, is supported by a large analyst team at Fidelity.”

The five FE fundinfo Crown-rated Man Japan CoreAlpha also gained a place in the spotlight, thanks to its inclusion in interactive investor’s Super 60 list this January.

Jeff Atherton took over as lead manager in January 2021 following the retirement of the fund’s long-standing manager Stephen Harker.

He adopts a “distinct” value and contrarian bottom-up approach, driven by the belief that periods of underperformance are often followed by periods of outperformance; this means that he tends to buy stocks when they are unloved and increase the weighting as the stock price falls further, remaining patient until the value is realised.

There have been some refinements to the investment process under Atherton, interactive investor analysts noted, including giving more prominence to catalysts and to some quality metrics such as return-on-equity and quality of earnings, which “are essentially risk controls”.

“The fund’s value bias will clearly influence returns over the shorter term, but the strategy has shown longer-term success,” they said. “We view the process enhancements positively and feel the fund is a compelling choice for investors seeking exposure to value stocks in Japan.”

Finally, Royal London Corporate Bond was added to interactive investor’s favourites in March 2024 on the back of its “time-tested, team-based approach”.

Managers Matt Franklin and Alpha Manager Shalin Shah have been “working together successfully” for many years and over different stages of the cycle, identifying the most-attractive credit markets through a review of the macro environment as well as through bottom-up credit research.

This process has led to a bias towards secured bonds historically in sectors such as social housing, investment trusts and asset-backed securities.

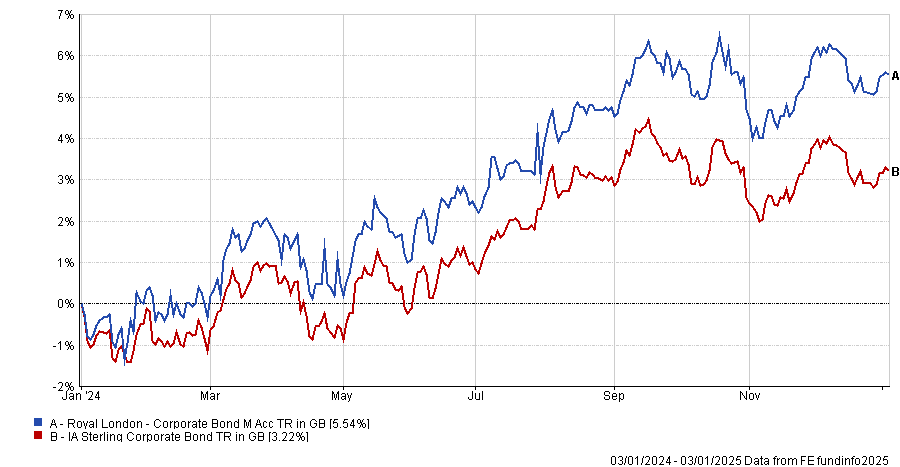

Performance of fund against sector and index over 1yr

Source: FE Analytics

According to interactive investor analysts, the fund’s top-quartile performance over the past 10, five and one year, as illustrated in the chart above, “reflects a focus on under-researched bonds and a long-term approach”.

Since last year, two funds left the party – WS Amati UK Listed Smaller Companies, removed by AJ Bell in October 2024 “to accommodate a higher conviction option”, and M&G Global Macro Bond, which lost the support of all the platforms as bond guru Jim Leaviss retired in August last year.

The Fidelity Asia fund maintained its ranking with AJ Bell, interactive investor and Barclays despite its appearance in Spot the Dog last August.