Almost half of the funds in the Investment Association’s bond sectors have lost money since the fixed income sell-off started in late 2024, FE fundinfo data shows, with over 21 racking up double-digit losses.

Gilt yields have climbed in recent weeks, with the 10-year at its highest since the 2008 global financial crisis and the 30-year at levels not seen since 1998, on the back of worries around inflation and high government borrowing. Government bonds in other developed markets such as the US have also been hit by the same concerns.

Laith Khalaf, head of investment analysis at AJ Bell, said: “There are no easy answers to the question of why markets move, especially over a short time frame, and sometimes it’s simply a matter of momentum. However, the fact yields are rising on both sides of the Atlantic does suggest the new year has brought with it a focus on the incoming US president, and the potential for his trade and immigration policies to be inflationary, which has implications for both economies.

“Bond investors might also be looking at the giant stacks of government debt already on the books on both sides of the pond and saying thanks, but no thanks.”

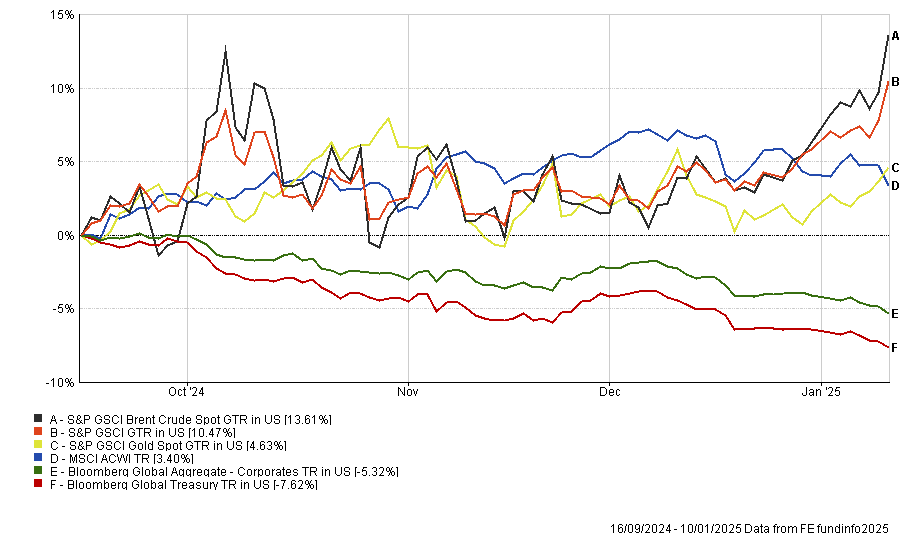

Performance of asset classes in fixed income sell-off (in local currency terms)

Source: FE Analytics. Total return in local currency between 16 Sep 2024 and 13 Jan 2025

The chart above shows the performance of various asset classes, in local currency terms, since bond prices started to fall on 16 September 2024. The global government bond index has fallen 7.6% over this period, with the global corporate bond index down 5.3%.

At the same time, commodity prices have risen and added to concerns that inflation is proving harder to beat than central banks hoped. The S&P GSCI – a broad index of 24 commodities from all commodity sectors (energy products, industrial metals, agricultural products, livestock products and precious metals) is up 10.5% with oil going even higher.

Of course, the fixed income market is huge with many sub-asset classes, such as government debt, investment grade and high yield, not to mention its geographical diversity. So how have the funds in the Investment Association’s bond sectors performed since mid-September?

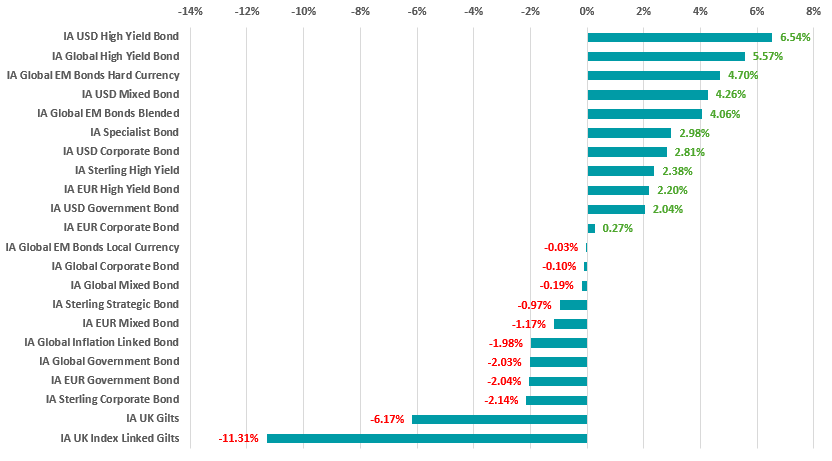

Source: FE Analytics. Total return in sterling between 16 Sep 2024 and 13 Jan 2025

The table above – in which returns are shown in sterling to better reflect the experience of UK investors – highlights just how badly UK fixed income is performing in the sell-off.

The average fund in the IA UK Index Linked Gilts sector is down 11.3% over the four-month period while the average IA UK Gilts funds has lost 6.2%. This contrasts with strong returns from the likes of IA USD High Yield Bond and IA Global High Yield Bond funds.

Bond investors are more bearish on the UK than other markets because of concerns around chancellor Rachel Reeves’ spending plans and borrowing requirements.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, added: “In the UK, there is also particular concern brewing about stagflation taking hold, given that inflation has been creeping up and pay growth is still hot, while the economy has been stagnating. There are concerns this may limit the interest rate reductions by the Bank of England this year.

“It seems appetite to buy long-dated UK government debt has fallen amid the increased uncertainty gripping global bond markets.”

UK bonds are also being hit harder because of a weakening pound – sterling has fallen to a 14-month low against the US dollar.

Nigel Green, chief executive of deVere Group, argued that “bond market turbulence, fears over unsustainable debt and a lack of investor confidence in Britain’s long-term prospects” have combined to push the pound lower.

This has come as the dollar has strengthened, thanks to its status as a safe haven currency and a hawkish tone from the Federal Reserve.

“The combination of a robust dollar and a weakening pound is accelerating the capital flight from sterling. Investors are turning to safer currencies and assets, as the UK appears increasingly fragile in this turbulent environment,” Green said.

“The trajectory of the pound is a reflection of broader uncertainties. Markets are sending a clear message: the UK needs to take bold, effective steps to restore confidence or risk further economic fallout. Investors are losing patience.”

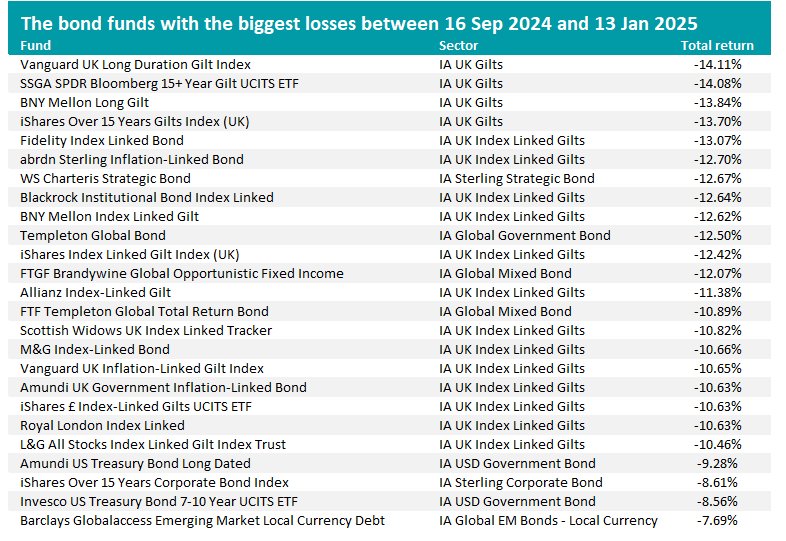

Given all this, it should be no surprise that when it comes to individual bond funds, those with the heftiest losses since 16 September tend to be in the UK gilts sectors and focus on long-dated bonds, which are more sensitive to interest rate changes.

Source: FE Analytics. Total return in sterling between 16 Sep 2024 and 13 Jan 2025

Vanguard UK Long Duration Gilt Index, SSGA SPDR Bloomberg 15+ Year Gilt UCITS ETF, BNY Mellon Long Gilt and iShares Over 15 Years Gilts Index (UK) – all of which reside in the IA UK Gilts sector – are down the most since 16 September 2024.

Of the 871 funds within the Investment Association’s 22 fixed income sectors, 423 have made a negative return over the period looked at in this research, with 21 losing more than 10%.

But as we saw above, some fixed income sectors have made high returns over the past four months and there are 10 funds that have made double-digit returns.

Polar Capital Global Convertible sits at the top of the list with a 14.3% total return, followed by PGIM Emerging Market Total Return Bond (13.7%), Nomura Asia High Yield Bond (12.4%), Allianz US Short Duration High Income Bond (11.3%) and GS Asia High Yield Bond Portfolio (11.2%).