Less market-friendly policies from president-elect Donald Trump, souring investor risk appetite for artificial intelligence (AI) stocks and sudden jumps in bond yields are three triggers that could push BlackRock to think again about where it is taking risk.

The world's largest fund management house, with assets under management of $11.5trn, currently has a pro-risk stance with its biggest overweight to US equities.

A note from Jean Boivin, head of the BlackRock Investment Institute, and his team said: “We upped our US equities overweight in December as we expected AI beneficiaries to broaden beyond tech given resilient growth and Fed rate cuts. We think US equity gains could roll on.

“Yet an economic transformation and global policy shifts could push markets and economies into a new scenario. We look through near-term noise but outline triggers for adjusting our views, by either dialling down risk or shifting our preferences.”

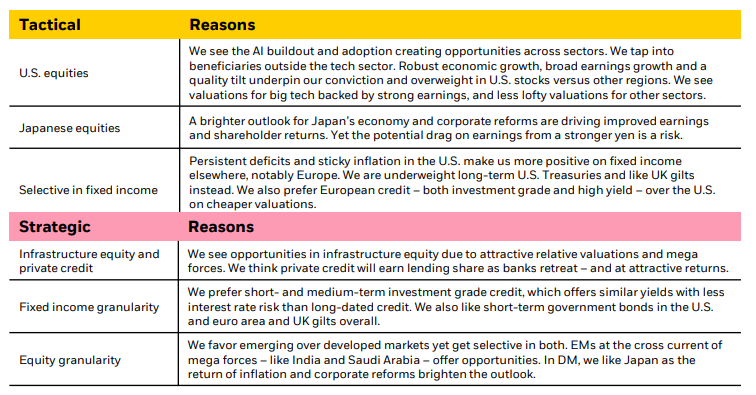

BlackRock’s highest conviction tactical and strategic views

Source: BlackRock Investment Institute, Jan 2025

Boivin highlighted the three triggers that could cause the firm to re-assess its pro-risk stance, with the first being the impacts of global policy especially US trade, as well as fiscal and regulatory decisions.

The trigger revolves around whether or not Trump adopts a market-friendly approach to goals such as improving growth and reducing budget deficits when he returns to the White House.

“In a market-friendly approach, rolling back financial regulation and cutting government spending could boost economic growth and risk assets. That, plus efforts to rebalance global trade and expand fiscal stimulus in countries where investment and consumer spending have lagged the US may help address trade deficit worries,” the strategist explained.

“In a less market-friendly approach, plans to extend tax cuts alongside large-scale tariffs could deepen deficits and stoke inflation. More broad-based tariffs could strengthen the US dollar, fuel inflation and call for high-for-longer interest rates. This plan would clash with Trump’s calls for a weaker dollar to boost US manufacturing and his push for rate cuts.”

The second trigger is whether risk appetite will stay upbeat as earnings results for richly valued AI beneficiaries, which have led the market in recent years with some spectacular gains, come in.

The so-called Magnificent Seven – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla – are expected to drive earnings this year as they are at the heart of the AI buildout.

While BlackRock expects their leadership to narrow as resilient consumer spending and potential deregulation support earnings beyond tech, any misses to their earnings expectations would be taken badly by the market and cause investors to question if tech stocks’ high valuations are still justified.

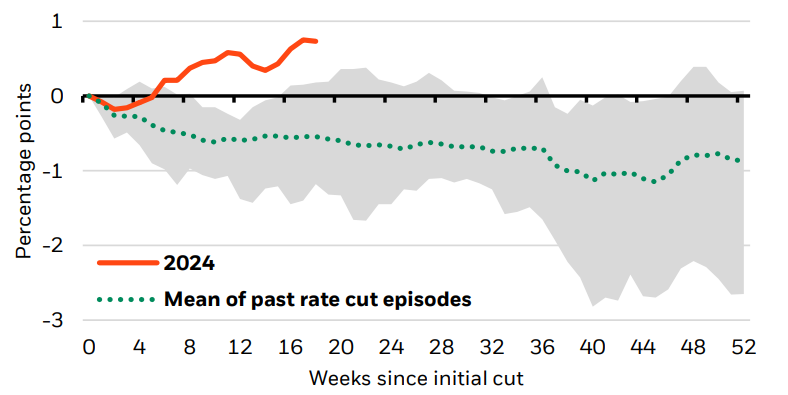

The third and final trigger the BlackRock Investment Institute is watching for is financial market vulnerabilities such as a sudden jump in bond yields. It pointed to the “unusual” yield jump since the Federal Reserve started cutting rates, shown below, as evidence that the current environment is very different to those of the past.

Change in US 10-year Treasury yields through rate cutting episodes, 1984-2024

Source: BlackRock Investment Institute, with data from Haver Analytics, January 2025. Note: The chart shows the change in 10-year Treasury yields through periods when the Federal Reserve cut interest rates. The shaded area shows the range of those changes since 1984 and the dotted green line shows the average. The orange line shows the change in yields since the Fed’s cut in September 2024.

BlackRock expects bond yields to climb further as investors demand more term premium for the risk of holding bonds. LSEG Datastream data shows term premium – or the compensation that investors require for bearing the risk that interest rates may change over the life of the bond – is rising from negative levels and is at its highest in a decade.

“The surge in UK gilt yields shows how concerns about fiscal policy can drive term premium – and bond yields – higher,” Boivin said. “The refinancing of corporate debt at higher interest rates is another risk. It could challenge the business models of companies that assumed interest rates would remain low.”