One of the biggest mistakes investors can make is to blindly fill their boots with funds recommended by best-buy lists and never reassess them in the following years, as these funds can fall out of favour as quickly as they are placed on these lists.

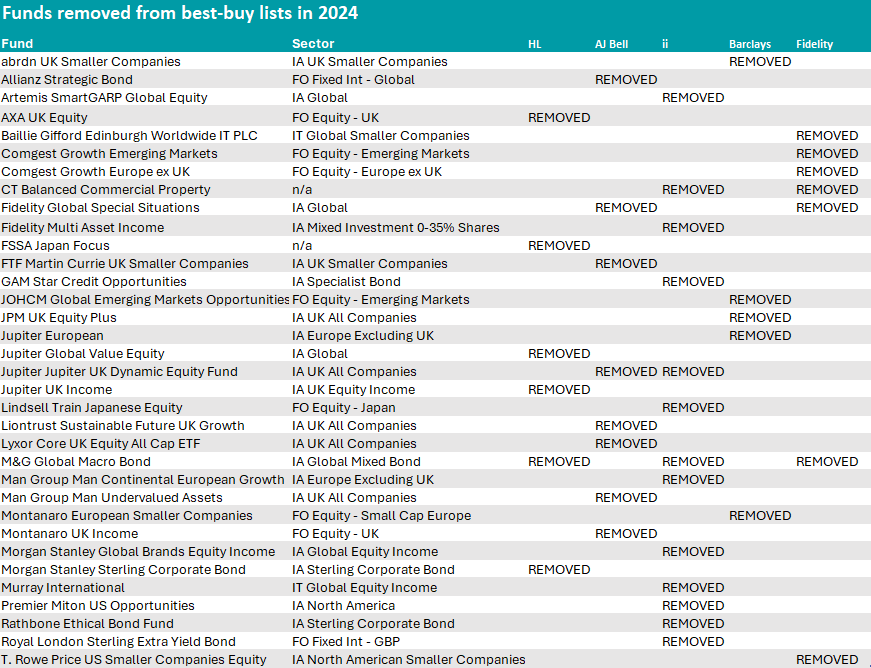

Having revealed the 20 funds recommended by most best-buy lists last week, today Trustnet looks at the funds that were removed from best-buy lists in 2024 and the management houses that lost their last-ranked fund.

A total of 36 strategies lost their recommended status across the five biggest platforms in the UK – Hargreaves Lansdown, AJ Bell, interactive investor, Barclays Smart Investor and Fidelity Personal Wealth.

Last year was a momentous year for manager moves, with the high number of leavers and joiners a key reason why authors of best-buy lists had to review their rankings.

Source: Trustnet

A prominent example was M&G Global Macro Bond, dropped by all platforms that had recommended it (Hargreaves Lansdown, interactive investor and Fidelity) when manager Jim Leaviss retired in July, leaving investors with “no obvious replacement”, according to director of Fairview Investing Ben Yearsley.

A similar fate befell Jupiter UK Special Situations, known as Jupiter UK Dynamic Equity since Alex Savvides has replaced the outgoing Ben Whitmore, which lost interactive investor and AJ Bell’s seals of approval. Likewise, Fidelity Global Special Situations was dropped by interactive investor and Fidelity following the retirement of Jeremy Podger.

Some fund groups lost their last rating as a result. When Julian LeBeron overhauled the Allianz Strategic Bond portfolio he inherited from Mike Riddell, who left the firm in August, he failed to convince AJ Bell. The platform dropped the fund as soon as the move was announced back in May. It was the only Allianz strategy with a ‘best buy’ status.

Since then, the fund has made a 0.5% return against the 4.6% of its average IA Sterling Strategic bond peer.

T. Rowe Price suffered a similar fate with the removal of its US Smaller Companies Equity fund by Fidelity after Curt Organt’s retirement in September. Fidelity partners with Fundhouse for the selection of its Select 50 funds and the firm “did not have sufficient conviction in the new, more inexperienced manager to keep the fund on the list.”

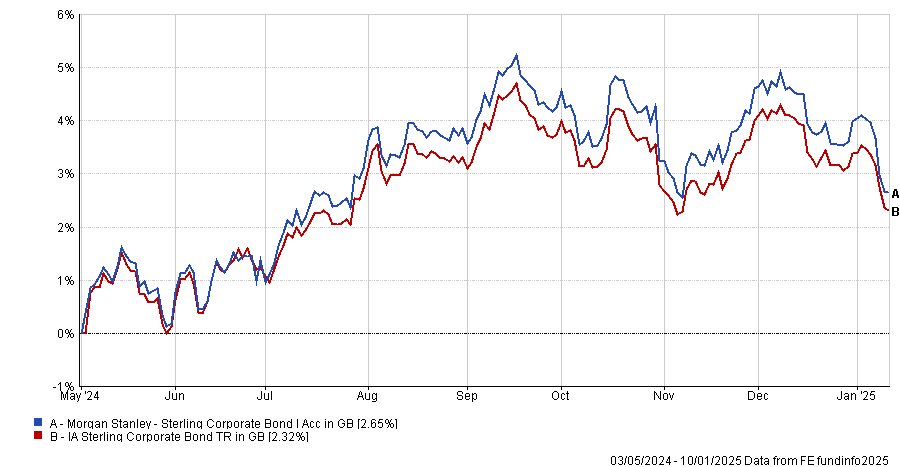

Finally, Hargreaves dropped the Morgan Stanley Sterling Corporate Bond fund on 3 May on the news that its manager, Richard Ford, would retire at the end of August. Its only other ranked fund, the Global Brands Equity Income portfolio, left interactive investor’s list on 24 January 2024.

Performance of fund against sector since May 2024

Source: FE Analytics

“This fund is managed with a derivative overlay which effectively exchanges some potential upside on individual stocks for an income stream. In a low-yield environment this approach provides a useful way of generating income, however, it can result in lower total returns over time,” analysts explained.

“With yields having increased, our view is that most investors are better served by looking for natural income streams from equities, bonds or cash. We therefore no longer view this fund as one of our highest conviction ideas.”

Since then, the fund returned 9%, 4.4 percentage points behind its IA Global Equity Income sector and 12.4 percentage points behind its benchmark, the MSCI World index.

But it wasn’t just managers leaving that sank their ships, as three more management firms lost their last-standing funds on other grounds.

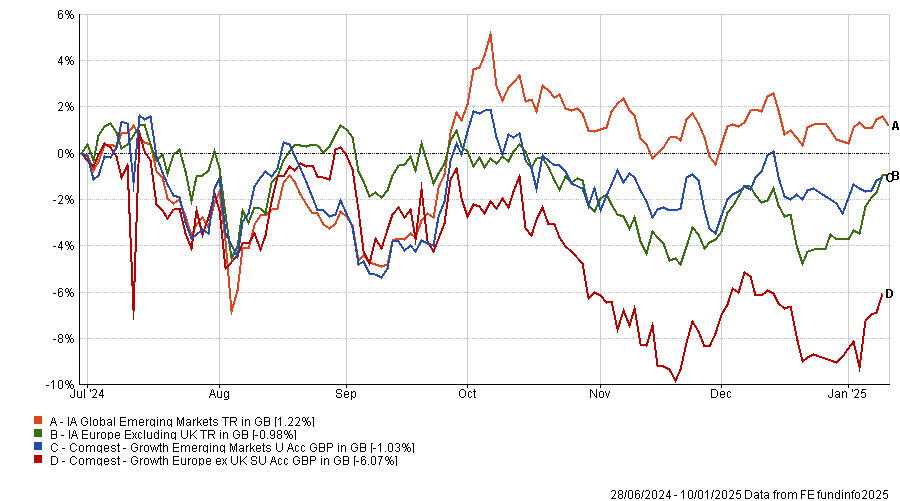

One was Comgest, as Fidelity lost conviction in both the Comgest Growth Emerging Markets and Comgest Growth Europe ex UK funds.

A Fidelity spokesperson said: “Both of the Comgest funds experienced significant changes to the portfolio management teams creating uncertainty about how the funds would be run going forward. In addition, the previous 18 months had also seen changes to senior management at the firm. This created uncertainty about the allocation of responsibilities across the organisation.”

Since their removal, the funds lost 1% and 6%, respectively, as the chart below shows.

Performance of funds against sector since July 2024

Source: FE Analytics

Montanaro is another name to suffer a double whammy, as its UK Income fund lost its place in AJ Bell’s Favourite Funds list last October “as part of a consolidation of UK equity funds into higher conviction alternatives”, and the European Smaller Companies fund was removed by Barclays too “as part of ongoing product monitoring” back in April.

Since their respective exclusions, the UK portfolio has lost 9.7% versus 2% of the IA UK All Companies sector, while the European strategy returned 6% against the 1% of its benchmark, the MSCI Europe Small Cap index.

Finally, GAM Star Credit Opportunities was placed under review by interactive investor on 11 October 2023 due to uncertainty surrounding the future of GAM.

The fund is sub-advised by third-party manager Atlanti and distributed by GAM and its management has therefore been insulated from the GAM-level turmoil to some degree.

But the uncertainty at GAM continues and was too big a concern for interactive investor, which no longer viewed the fund as one of its highest conviction ideas and removed it in January 2024.

Others to lose their ratings include CT Balanced Commercial Property, which was acquired by Guernsey firm Starlight Bidco in September. Fidelity and ii removed it from both of their lists, meaning it was no longer included in any of the main five.

Elsewhere, Hargreaves Lansdown removed FSSA Japan Focus from its Wealth Shortlist in May 2024, as the fund had shrunk to just £82m in assets under management. By September it had closed, striking FSSA from any of the top-five best-buy lists.

Abrdn UK Smaller Companies was dropped by Barclays Smart Invest, the only fund group recommending the portfolio, having only been added in 2023. FTF Martin Currie UK Smaller Companies also lost AJ Bell’s confidence after just one year.

AXA UK Equity and Baillie Gifford’s Edinburgh Worldwide were axed by Fidelity, the only list they appeared on.

Meanwhile, interactive investor ended its lone stance on Fidelity Multi Asset Income, Lindsell Train Japanese Equity, Man GLG Continental European Growth, Premier Miton US Opportunities, Rathbone Ethical Bond and Royal London Sterling Extra Yield Bond.

JOHCM Global Emerging Markets Opportunities, Jupiter European and JPM UK Equity Plus were axed by Barclays while Jupiter Global Value Equity and Jupiter UK Income were removed by Hargreaves Lansdown. They are now without a recommendation from the five studied.

Lastly, AJ Bell got rid of its lone backing of Liontrust Sustainable Future Global Growth, Man GLG Undervalued Assets and Lyxor Core UK Equity All Cap ETF.