Best-buy lists are ever-changing. While removals often make headlines, additions are just as important to keep them – and investors’ portfolios – fresh and up to date.

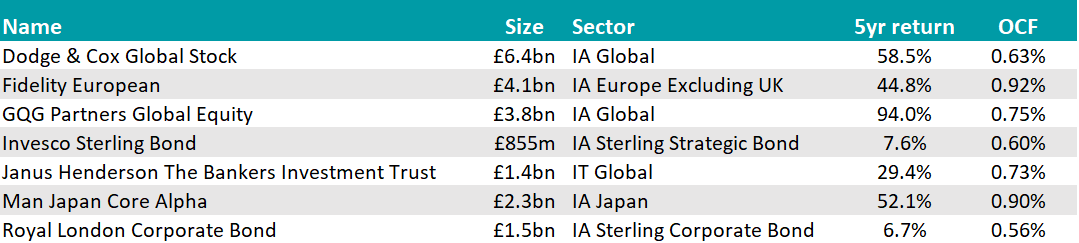

Six new funds and one investment trust caught interactive investor (ii)’s eye in 2024, gaining an inclusion in its Super 60 list. Half of the newcomers invest globally: Dodge & Cox Global Stock; GQG Partners Global Equity; and Bankers Investment Trust.

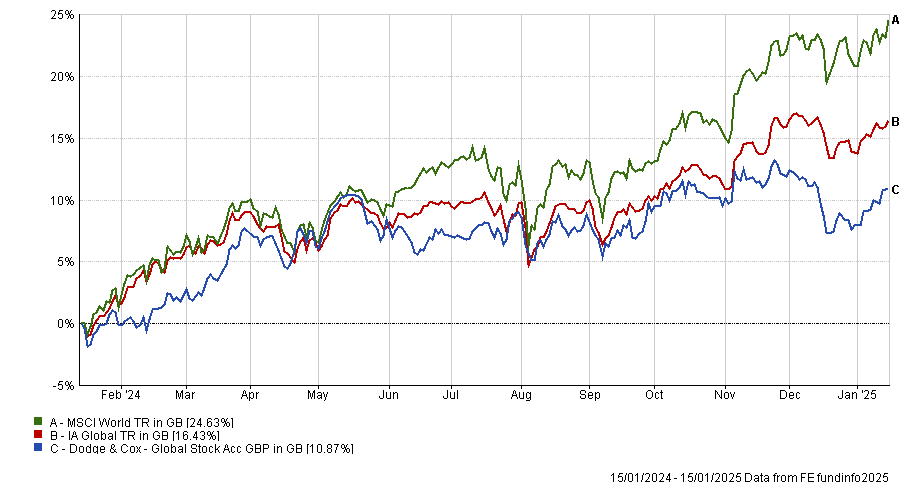

Already ranked in Fidelity’s Select 50, the Dodge & Cox strategy collected its second seal of approval from the main five investment platforms. Analysts at ii were convinced by the “considerable depth of management experience and continuity of management”, with most of the investment professionals becoming partners in the firm.

They also liked the fund’s return profile, which shows a large divergence from the MSCI World Index on a calendar year basis.

Performance of fund against sector and index over 1yr

Source: FE Analytics

This is achieved by investing in large-cap stocks that look cheap on a range of valuation measures, relying on bottom-up, fundamental research of companies and industries. Stocks are also chosen independently of any index.

They said: “This is a genuine team-based approach with members of the portfolio committee having long tenures but not close to retirement. The quality of the supporting analysts is high and team risks are low. A collaborative approach minimises key-person risk yet has produced thoughtful, original research.”

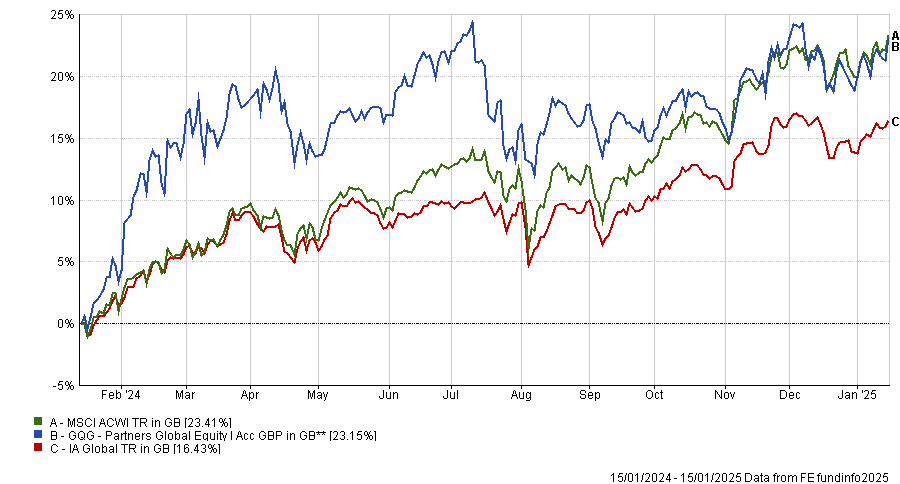

The GQG fund, meanwhile, is a $3.8bn strategy managed by a trio of FE fundinfo Alpha Managers – Rajiv Jain, Brian Kersmanc and Sudarshan Murthy – with Siddarth Jain serving as deputy manager.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The team has a growth-oriented outlook but also is cognisant on the medium-term, here placing a priority on limiting losses. The resulting portfolio contains 40-50 companies that have weathered tough economic climates, are on a solid financial footing and are in growing industries.

“The managers’ flexible investment approach and quality bias have typically led to strong performance through the market cycle, with good downside protection during periods of market weakness,” the analysts noted.

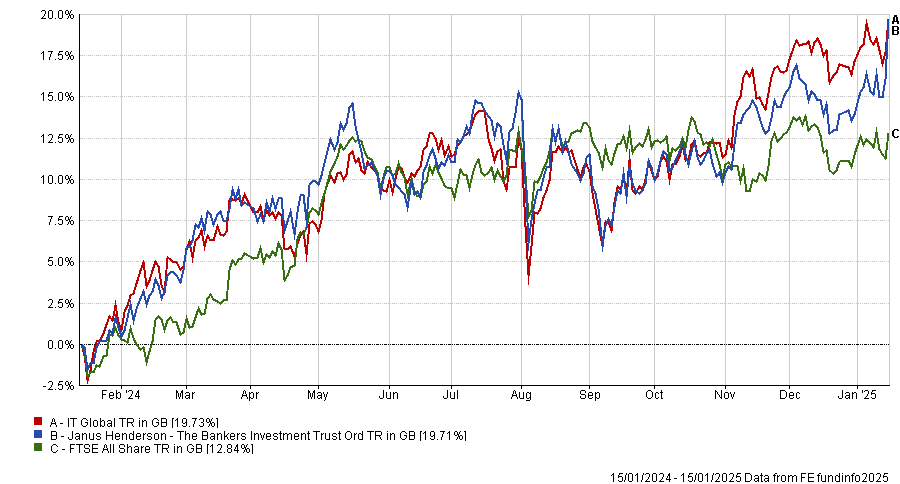

For income investors and fans of investment trusts, Janus Henderson’s Bankers could be worth considering. This best-ideas portfolio gathers more than 150 stocks from different submanagers at Janus Henderson, with asset allocation being determined by the board and by manager Alex Crooke, who has been at the helm since 2003.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The submanagers have their own investment processes, which “unavoidably leads to slight style biases in their respective allocations”, as ii analysts noted. However, the core mandate of capital appreciation and income growth “transcends the submanagers”, who are each assigned an income target by Crooke.

“This focus on income growth has in part informed the long-running home bias to UK stocks, whose attractive dividend yields, undemanding valuations and global revenue streams satisfy the mandate,” they said.

“On the flip side, the long-running underweighting to the United States reflects the share buyback culture in that market and relatively high valuations. These biases will impact returns at times.”

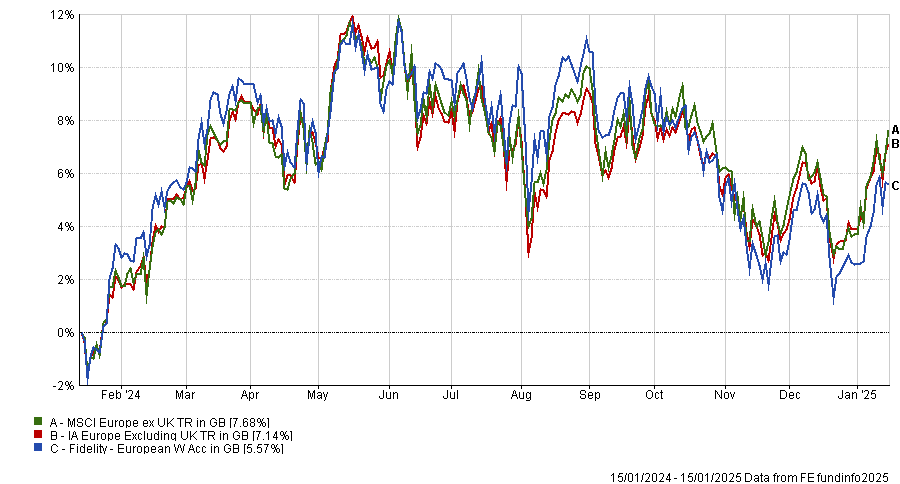

In Europe, interactive investor appreciated Fidelity European, which has an FE fundinfo Crown Rating of five. Managed by Alpha Manager Samuel Morse and Marcel Stotzel, it was added to the Super 60 at the beginning of 2024, mostly on the back of Morse’s track record.

He has developed his own stock selection criteria focusing on a company’s ability to grow its dividends, viewed as an indicator of the potential to provide steady cash flow growth over the long term, ii analysts explained.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The managers use valuations to adjust position sizes, while sector weightings do not stray too far from the MSCI Europe ex-UK Index, being limited to over- or underweights of up to 5%.

“Returns have been strong over time, with downside protection often being a feature, but the fund is likely to struggle when value stocks lead the market,” the analysts said.

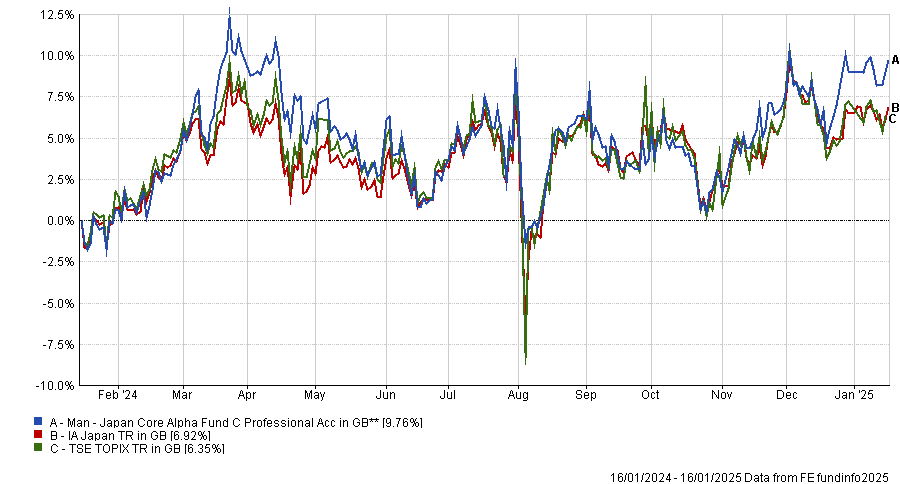

With Japanese equities possibly making a comeback, ii joined Hargreaves Lansdown and Barclays in their appreciation of Man Japan CoreAlpha, whose value bias “will clearly influence returns over the shorter term” but should reward investors in the long term.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Jeff Atherton, who took over as lead manager in January 2021 following the retirement of veteran stockpicker Stephen Harker, adopts a contrarian bottom-up approach, driven by the belief that cyclicality is a strong influence in virtually every sector of the market, and that periods of underperformance are often followed by periods of outperformance.

Stocks enter the portfolio when they are unloved and positions are increased as the stock price falls further, remaining patient until the value is realised.

Atherton has introduced some quality metrics and more risk controls to the process, now aiming for a slightly larger number of holdings. He has also reduced concentration in the top 10 holdings.

“The process enhancements should lead to a slightly higher-quality portfolio without sacrificing the contrarian-value nature of the guiding investment philosophy,” ii analysts said.

“We view the process enhancements positively and feel the fund is a compelling choice for investors seeking exposure to value stocks in Japan.”

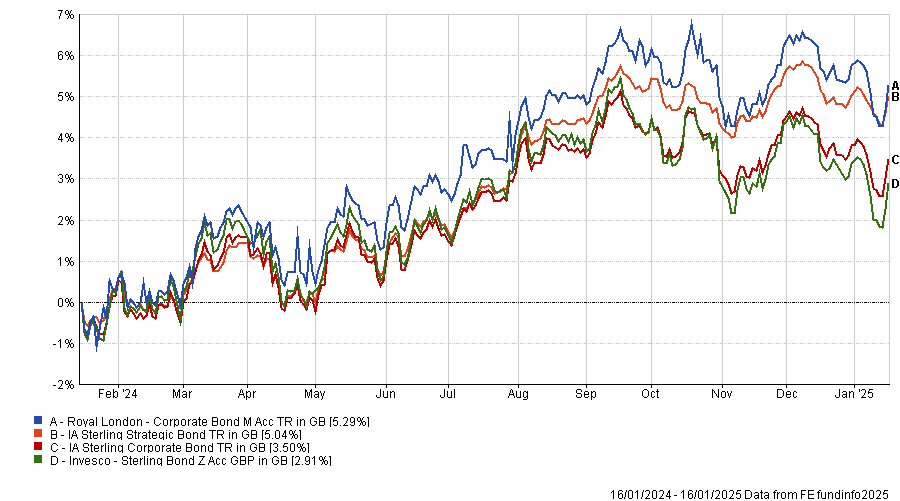

Finally, two sterling bond strategies were added – Royal London Corporate Bond and Invesco Sterling Bond.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The former was highlighted for its “strong performance reflecting a focus on under-researched bonds and a long-term approach”.

The latter convinced ii analysts for its “flexible mandate that can lead to significant performance deviations compared with peers, which the manager has used adeptly over the long term”.

Source: FE Analytics.