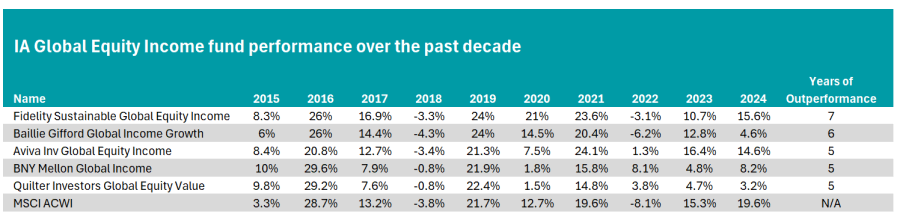

Of the 31 IA Global Equity Income funds with a 10-year track record, none were able to outperform a common market index the – MSCI ACWI – in 80% or more of the past 10 calendar years.

For Ben Yearsley, director at Fairview Investing, this was because the MSCI ACWI is “dominated by the US market”. He explained that this in turn is swamped by the Magnificent Seven and other low-dividend-paying tech names, meaning most global equity income funds do not hold them, limiting their ability to beat the benchmark.

“Until the current tech boom ends, global equity income funds will continue to struggle against the MSCI World. I do not see that as a problem, though, as they are doing something different”, Yearsley concluded.

Source: FE Analytics

However, while most global equity income funds failed to outperform the market as consistently as their cousins in the IA Global sector, some got close. The best of the list was the £150m Fidelity Sustainable Global Equity Income, which beat the MSCI ACWI in seven out of the past 10 calendar years.

Over this period, it faltered in 2016 and 2019-2020. Despite this, it delivered 269.7% for investors in the past 10 years, a best-in-sector result. Moreover, it delivered top-quartile results over the past one, three and five years.

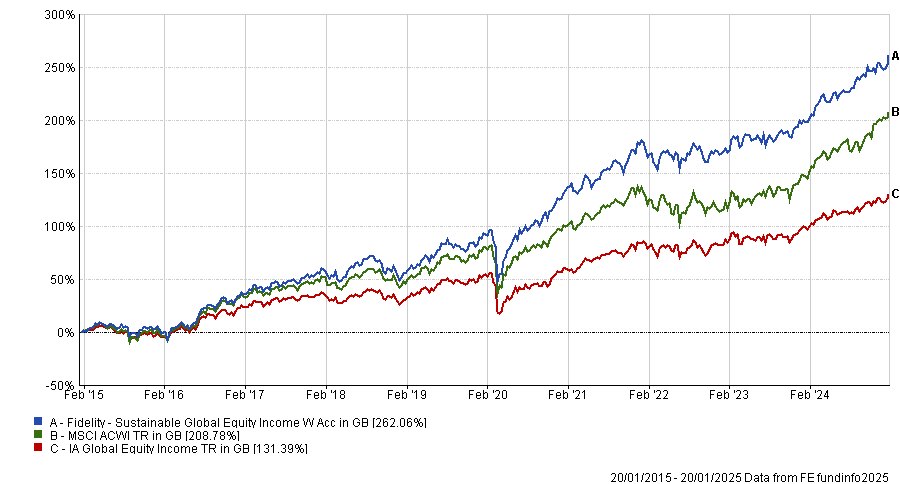

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

It also had an alpha score of 4.7% in this period, the best result in the sector by 1.7 percentage points, and ranked within the second quartile for maximum drawdown and downside risk.

However, it should be noted that the fund changed its strategy in 2022. Before this, it was formerly known as the Fidelity Institutional Global Focus and had utilised a core growth approach, which will have boosted returns as it lacked the income mandate of its peers.

If we broaden our scope to funds that outperformed the MSCI ACWI in six of the past 10 calendar years, another fund stands out. Baillie Gifford Global Income Growth, led by FE Fundinfo Alpha Manager James Dow, delivered a top-quartile 10-year return of 189.9%.

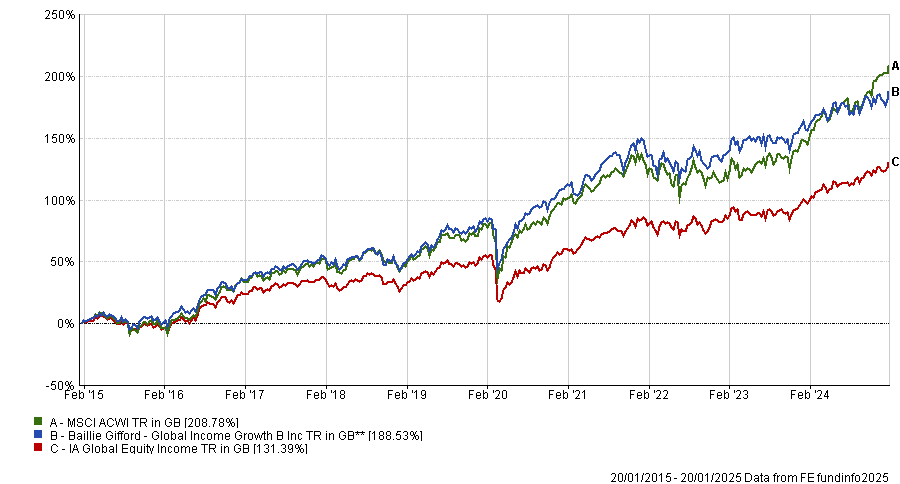

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

However, the portfolio fell into the third quartile over the past five years and the bottom quartile over the past three. Despite this decline, the fund ranked in the second quartile for 10-year volatility. Additionally, it had the fourth-lowest maximum drawdown of 18.8%, demonstrating that it was one of the best strategies for preventing major losses.

Its current dividend yield is 2.08%, one of the lowest in the sector.

Finally, two funds outperformed in five of the past 10 calendar years. The first is the £3.2bn BNY Mellon Global Income fund, managed by James Lydotes. With a dividend yield of 3.04%, it ranks within the second quartile of yields among its peers.

Over the past 10 years, the fund posted a second-quartile performance of 169.6%. In the near term, the portfolio has been up and down, with a fall into the third quartile over five years, followed by a surge back into the second quartile over three. However, the strategy has slid again into the third quartile over the past year.

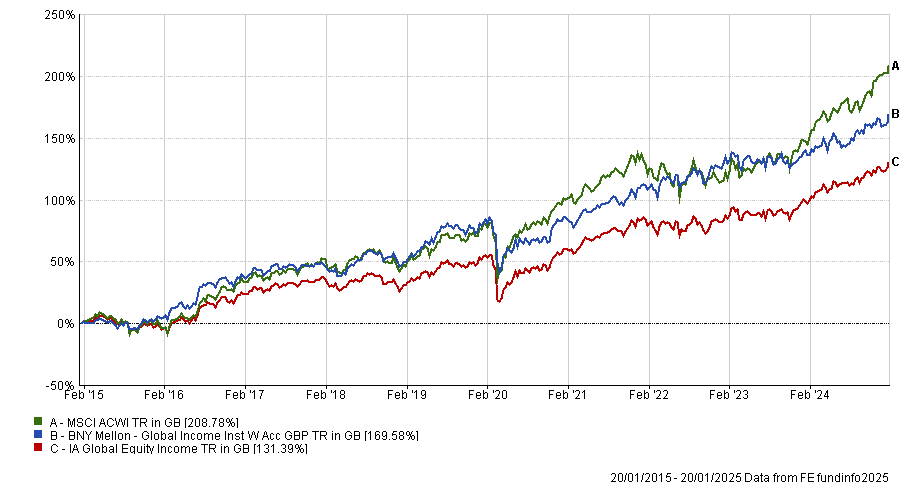

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

This was a consequence of underperformance in 2020, 2023 and 2024, when the fund was down by 10-12 percentage points compared to the MSCI ACWI.

Nevertheless, over the past 10 years, the strategy had 12.3% volatility and 13.1% downside risk, both of which were top-quartile results. As a result, it was a comparatively low-risk option.

However, Lydotes has only managed the fund since 2023 and so cannot be held responsible for the performance before that point. Before this it was run by veteran stockpicker Nick Clay, who left for RWC.

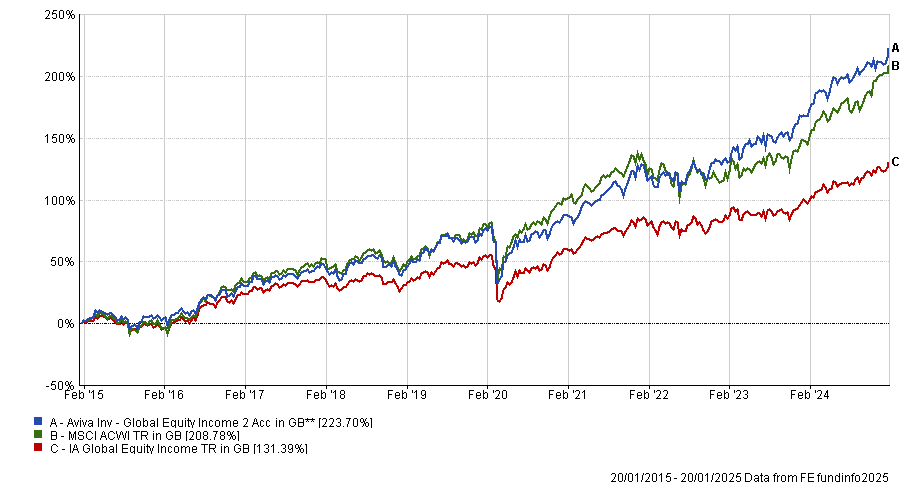

The five crown-rated Aviva Inv Global Equity Income Fund also qualified. Led by FE Fundinfo Alpha manager Richard Saldanha, who briefly left the firm for a month last year to join Royal London before returning to Aviva, the fund failed to beat the MSCI ACWI in half of the past decade.

Nevertheless, the fund surged by 223.7% in 10 years, which was the second-best performance in the sector. It proved extremely popular amongst investors last year, with a study in July finding that it had attracted more than £250m inflows in the first half of 2024.

Performance of fund vs sector and MSCI ACWI over 10yrs

Source: FE Analytics

This was followed with further first-quartile results over five and three years, where it was the second and third best-performing strategy in the sector. Over 10 years, the fund also had the fourth-best alpha score in the peer group of 2.95.

However, it fell into the second quartile over the past year, when it was up by 19.1%. Moreover, it was comparatively risky, with third-quartile volatility and downside risk. It also has a dividend yield of 2.04%, the sixth lowest in the sector.