Growth-focused investments are a favourite among investors as rising interest rates proved a short-lived hindrance and the rise of artificial intelligence has boosted valuations.

For some, this is a reason to look for opportunities elsewhere, including unloved areas such as income-paying strategies, while others still think growth has a lot to offer.

Last week, Peel Hunt published its ‘playbook’ for income seekers; below, researchers at the firm Anthony Leatham and Markuz Jaffe highlight 15 growth trusts to consider for 2025.

The main requirement was an attractive total return potential, primarily (but not necessarily) through capital growth. They chose companies irrespective of their investment style (value, growth or quality) and focused on those that benefit from the closed-end structure.

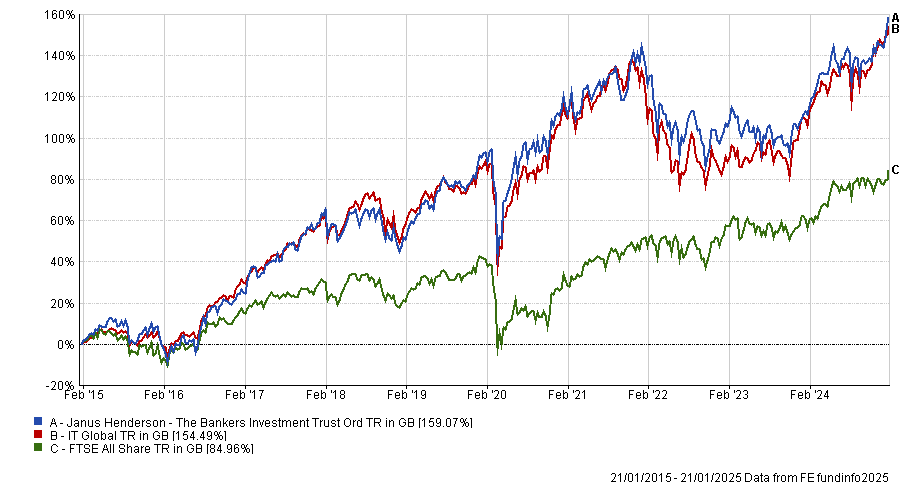

We begin with global equities and the Bankers Investment Trust, which also recently was noticed by interactive investor’s analysts, who included it in their Super 60 selection.

Janus Henderson’s Alex Crooke constructs this portfolio using the best ideas by other managers within the firm. He recently announced a strategic shift to concentrate the trust from six to four regional portfolios, reducing the number of holdings from over 150 to 100, trying to achieve better performance and maximise the alpha generation from the underlying managers.

Performance of fund against sector and index over 10yrs

Source: FE Analytics

Leatham is “positive on this strategic shift” and expects to see an improvement in relative outperformance as a result of the consolidation of regional portfolios, the reduction in the number of holdings, and the increased conviction.

“In a volatile environment, Banker’s flexible approach and Janus Henderson's manager skill provide a solid core global equity allocation,” he said.

“Our positive view on the manager skill across these regional portfolios and Alex Crooke’s oversight remains in place, and as net-asset-value (NAV) returns continue improving, we see value with the shares trading on a 10% discount.”

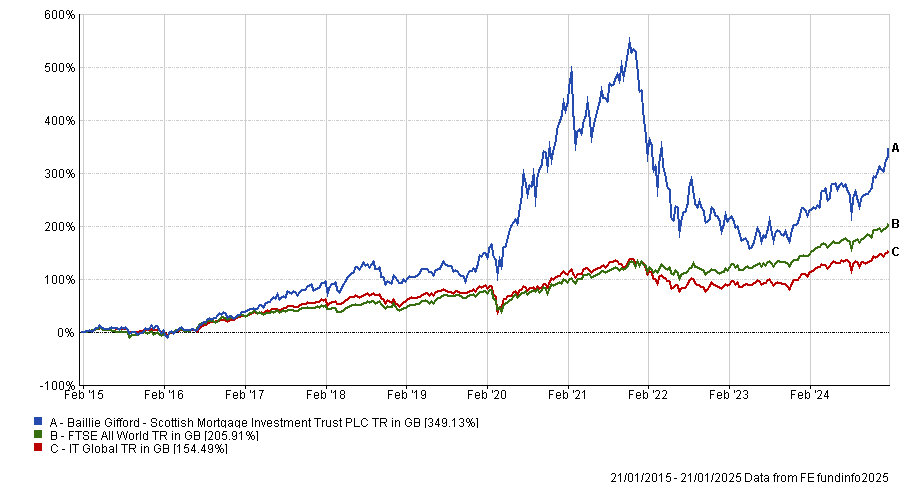

Scottish Mortgage, also made the list despite an underwhelming short-term performance and criticisms around its private holdings.

Leatham was “beyond this wall of worry”, having seen “significant improvement” in the transparency and reporting regarding private company valuations.

Performance of fund against sector and index over 10yrs

Source: FE Analytics

“In our conversations with investors, the attitude toward private company holdings turned from constructive to sceptical to risk-averse. The valuation data provided over the course of 2024 supports a more robust approach than risk-averse observers would credit,” he said.

“The next leg of sentiment improvement towards Scottish Mortgage, and the source of further discount narrowing, could well be a positive surprise in the private company portfolio.”

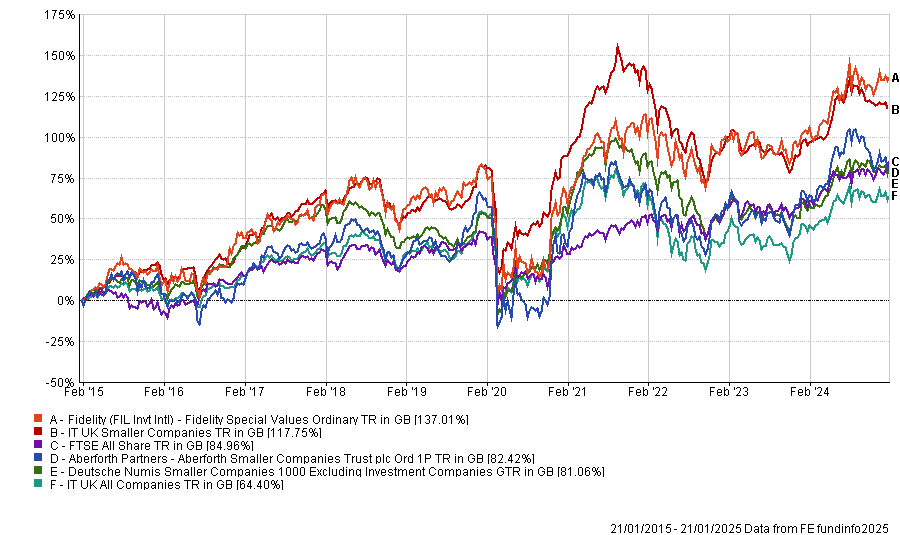

In the UK market, a deterioration in confidence opened up “a plethora of value opportunities”, according to Leatham, particularly at the smaller end of the market.

This attracted him towards the value and contrarian approaches of the Aberforth Smaller Companies and the Fidelity Special Values trusts, whose managers argue that the resilience of small UK-quoted companies is likely to be demonstrated again as they navigate imminent tax increases.

Performance of fund against sector and index over 10yrs

Source: FE Analytics

Aberforth’s value style ought to offer a further margin of safety in the current market, according to Leatham, with the current valuation opportunity enhanced by the 12% discount.

The Fidelity portfolio, managed by Alex Wrigt, provides “clear access” to the discount opportunity in the UK equity market, with “an abundance of value to exploit” and ongoing potential for further mergers and acquisitions.

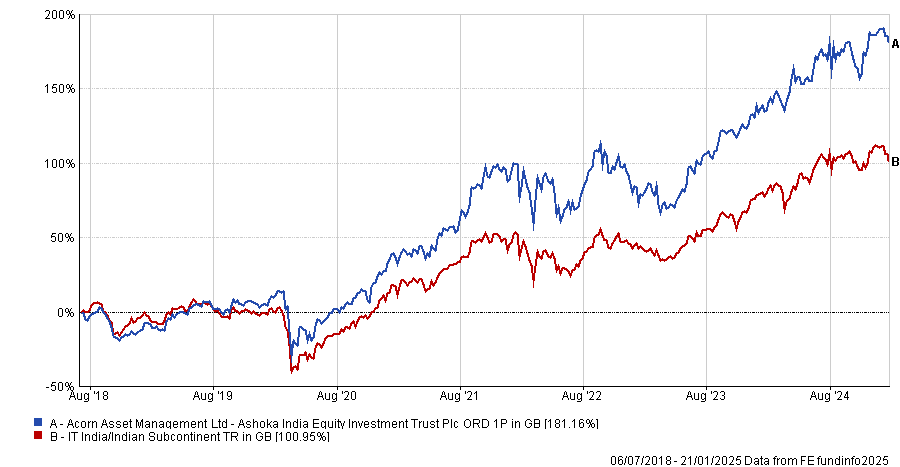

Further afield, the analyst was positive on Indian equities, which he said offer an attractive combination of structurally strong economic growth, a mature and well-developed equity market and a high level of market inefficiency, which has driven outperformance for active managers.

His vehicle of choice is Ashoka India Equity, which convinced him for its “impressive” track record of more than doubling investors’ money since its launch in 2018. More than 90% of this growth is attributable to stock selection, both by market capitalisation and by sector.

Performance of fund against sector and index since inception

Source: FE Analytics

Beyond performance, Leatham appreciated the mitigated discount volatility, the absence of an annual management fee (the trust runs on a performance fee linked to alpha generation over discrete three-year periods) and an annual redemption facility, enabling investors to redeem at around NAV.

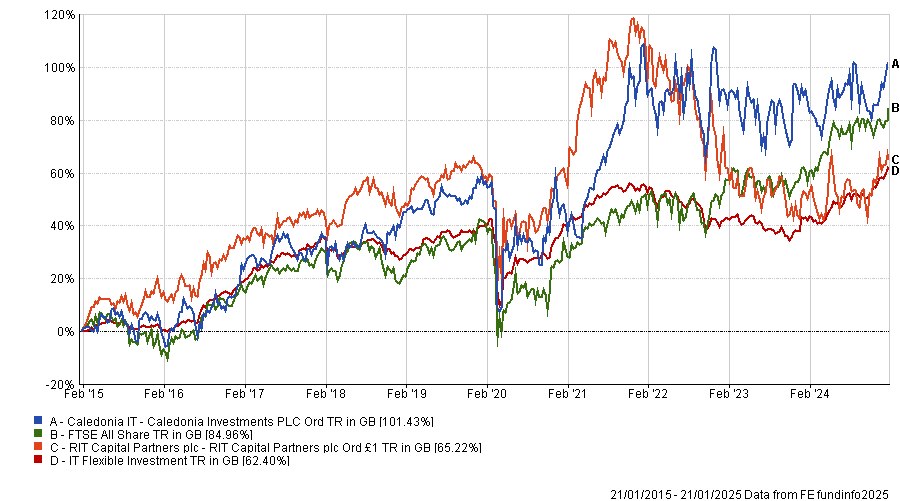

Investors who choose to invest in mixed assets might want to take a look at Caledonia and RIT Capital Partners, both of which have delivered competitive long-term returns to shareholders, despite widening discounts in recent years.

Performance of fund against sector and index over 10yrs

Source: FE Analytics

The former invests in a mix of public and private companies as well as funds and was highlighted for its robust balance sheet position; the latter also takes positions in absolute return, credit, real assets and hedge funds.

“The ability to invest for the long term can be at least partly attributed to the closed-ended structure and the significant family shareholdings by the Rothschild and Cayzer families (49.5% shareholding as at end-September 2024) respectively,” Leatham said of RIT Capital Partners.

“While this can reduce the effective free float of the trusts and potentially lead to concerns around shareholder concentration, we also see the long-term holding period as supportive of the strategies’ approach to blending private and public investments.”

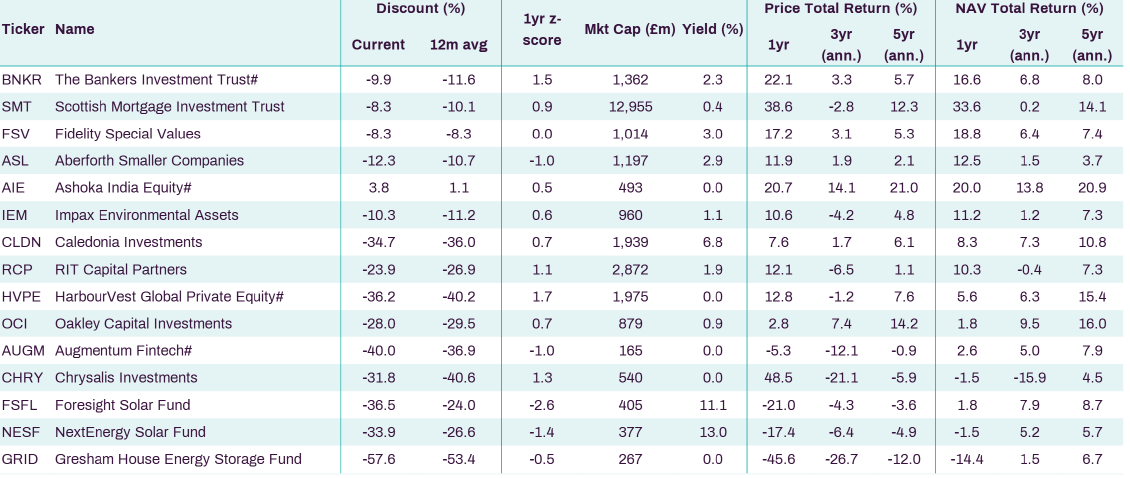

The report also included the specialist fund Impax Environmental Assets, four private equity trusts and three infrastructure recovery plays, as shown in the table below.

Source: Peel Hunt