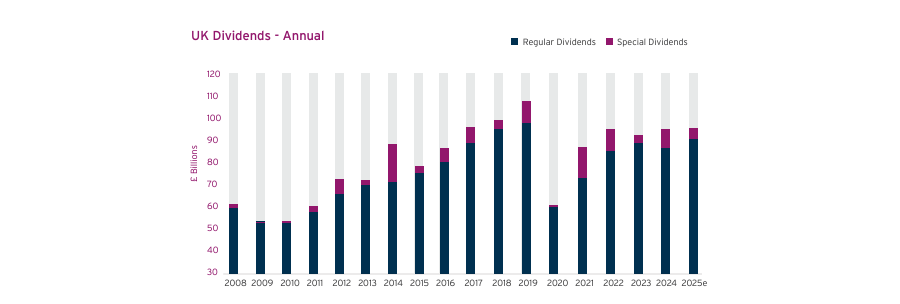

UK dividends rose to £92.1bn in 2024, a headline increase of 2.3% compared to 2023, according to the latest Computershare Dividend Monitor report.

This was driven by a £5.6bn in special dividend payouts, primarily from companies such as HSBC and Ithaca Energy. With these one-offs removed, underlying payouts declined by 0.4% to £85.6bn.

This follows Computershare’s April report, which predicted that one-off payments would drive dividend growth in 2024.

The report also explained that an increase in share buybacks further limited the cash that would have been available for dividends. Analysts at Computershare estimated that companies carried out £42bn-£45bn worth of buybacks in 2024, far above the pre-2020 annual average.

Source: Computershare Dividend Monitor

Mark Cleland, chief executive officer of issuer services for the UK, Channel Islands, Ireland and Africa at Computershare, said: “After a promising start to 2024, the second half of the year saw UK economic and business confidence slip as inflation and taxes rose.”

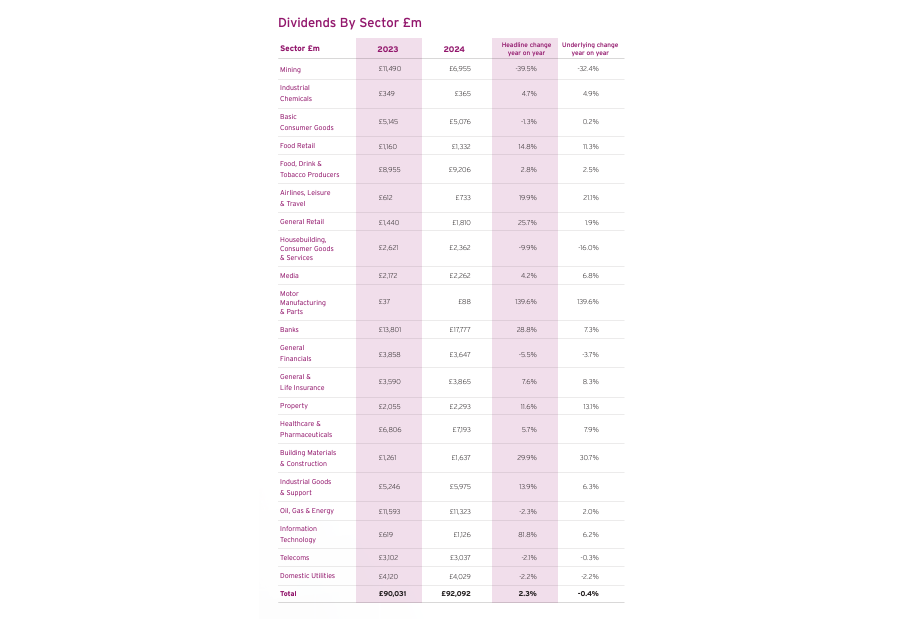

Mining companies continued to reduce their total payouts, with a headline decrease in dividend payouts of almost 40% or £4.5bn. The most notable contributor to this was Glencore, which slashed its dividend by £3.9bn or 75%.

Most other mining companies followed suit, except Rio Tinto, which paid the fourth-largest total dividend last year. The report attributed this to the cyclicality in the mining sector, where high fixed costs and volatile commodities can unexpectedly impact profits.

In the housebuilding sector, dividends fell by a headline of 9.9%. The report attributed this to a slow housing market, which posed challenges for housebuilders such as Persimmon and Bellway. Vistry also chose to dedicate its dividend to share buybacks in 2024.

However, Cleland said: “It is worth highlighting that dividend growth was better outside the highly cyclical mining sector”. Indeed, excluding the mining sector, underlying dividend growth for 2024 was 4%. Moreover, 17 of 21 sectors increased or held dividends steady last year.

Source: Computershare Dividend Monitor

Banks were once again the main positive contributor, in line with the predictions of the April report. They paid a combined £17bn in dividends last year, a headline increase of around 28.8%.

Most of this was due to HSBC, which sold its Canadian arm and paid more than 60% of the £5.6bn as a special dividend. However, even excluding this, other banks such as Lloyds and Natwest also grew their dividend last year. Additionally, underlying payouts in the banking sector were still up by 7.3%

Other sectors paying high dividends included the insurance sector, where headline dividends were up by 7.6%. Most companies increased their dividends last year, with Direct Line restoring its payout after cancelling it in 2023.

Finally, food retailers' dividends surged by a headline 14.3%. This was thanks to large payments from Tesco, as well as Marks & Spencer, which paid a dividend for the first time since the pandemic.

However, despite a stronger dividend performance than it may initially appear, the outlook for 2025 was muted. Cleland explained that the sharply rising borrowing costs will "affect government finances, economic growth, business investment, profit margins and consumer spending”.

He argued that this will negatively impact the ability of both domestic and multinational companies to generate cash for their shareholders.

Indeed, fears over sticky inflation and government borrowing deficits led to the UK's 10-year gilt yield climbing to 4.6%, the highest level since August 2008. With equity yields predicted to remain between 3.5-3.8%, UK gilts may become a more attractive source of income than equities next year.

For 2025, Computershare forecast dividend payouts will reach a headline £92.7bn, a rise of 0.7% year-on-year. Excluding special dividends, the underlying total will to reach £88.2bn.

This is a combination of several factors. Cleland predicted a “4-4.5% typical company dividend growth”, which should remain just ahead of inflation at 3.5%.

However, he acknowledged much of this increase may not manifest, with impending cuts from businesses such as Vodafone, Bellway and Burberry, which could reduce this estimate by around 1.4 percentage points at the year goes on.

Assuming the pound maintains its current level against the dollar, headline growth for 2025 should increase by 0.8 percentage points.

Finally, while special dividends are unpredictable, they rose 174% in 2024, almost tripling their year-on-year average. As a result, analysts concluded that 2025 should have fewer one-off dividends than 2024. This should result in a further decline in the headline growth rate of around one percentage point.