The technology sector has taken the world by storm in recent years and has been the best performing segment of the CT Global Managed Portfolio, a multi-asset portfolio of investment trusts.

Now Columbia Threadneedle Investments’ Peter Hewitt is looking at other asset classes that performed less well last year but which he thinks could rebound strongly in 2025 – namely healthcare, the UK and private equity.

Healthcare

Healthcare – like technology – is a secular growth theme for Hewitt, underpinned by long-terms trends such as ageing populations and innovative drug discoveries. After a tough couple of years following Covid-era supply chain disruptions and election-year uncertainty, valuations appear inexpensive.

“It could be an area that's strong this year, but much depends on the first few months of the Trump presidency,” he said. The sector’s outlook hinges upon the Food and Drug Administration’s propensity to approve new drugs and how the new US health secretary, vaccine sceptic Robert Kennedy Jr, approaches drug pricing and regulation.

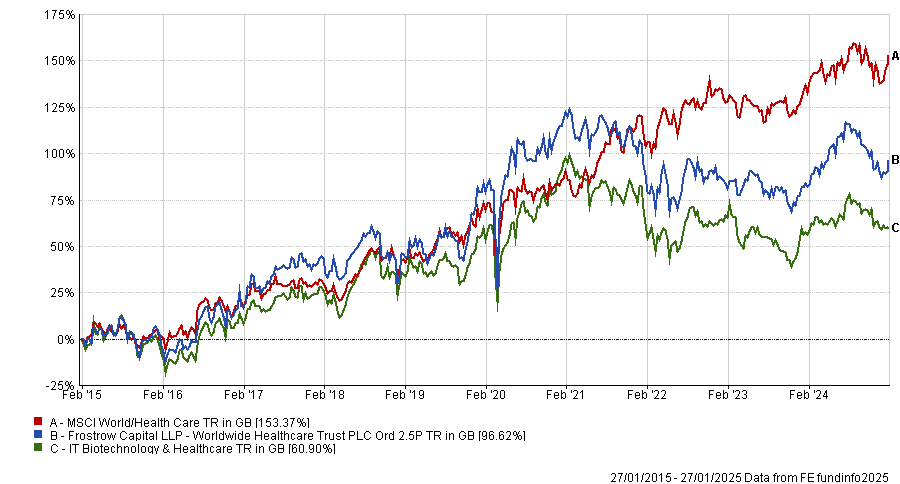

Hewitt’s largest holding in this area is the Worldwide Healthcare trust, which has a 3.1% weighting in the CT Global Managed Portfolio’s growth strategy (the multi-asset trust also has a parallel income portfolio).

Worldwide Healthcare has a market cap of £1.6bn and a net asset value of almost £2bn. It is managed by OrbiMed’s Sven Borho and Trevor Polischuk. Performance is second-quartile within the seven-strong IT Biotechnology & Healthcare sector over one, three and five years, meaning that the trust has consistently beaten its peer group.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

UK equity trusts

Another theme for Hewitt is domestic equities. Far from a conventional growth theme however, this is more about making returns from undervalued stocks that should rebound. “The UK market is really cheap,” he said, adding that UK equity trusts offer great value.

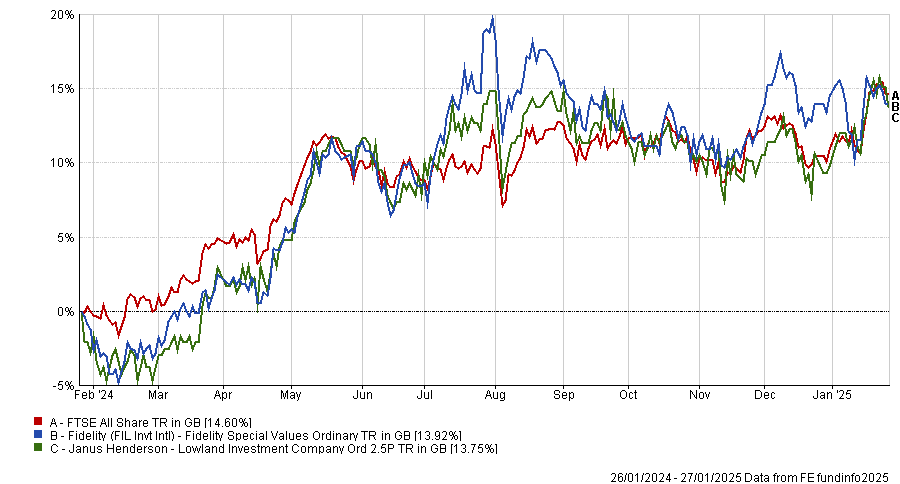

The third-biggest holding in Hewitt’s growth portfolio is Fidelity Special Values, which was trading on an 9.3% discount on 28 January 2025, and he also owns Lowland.

Alex Wright, who manages the £1bn Fidelity Special Values trust, said the UK’s political stability, compelling valuations, high dividends, record buybacks and the spike in merger and acquisition activity create a solid backdrop for performance on a three-to-five-year view.

“In aggregate, our holdings are trading at a meaningful 15-20% discount to the broader UK market, despite resilient earnings, superior returns on capital and relatively low levels of debt. This quality profile gives us confidence that the strategy can continue to deliver,” the Fidelity manager said.

The UK equity market made a strong start to 2024 but came unstuck during the fourth quarter. Investors sold funds and shares in anticipation of capital gains tax increases and negative headlines weighed on sentiment. Hewitt said announcements were drip fed into the market ahead of the Autumn Budget which “were not very popular or equity market friendly”.

Performance of trusts vs benchmark over 1yr

Source: FE Analytics

However, the FTSE 100 soared to a new all-time high earlier this month as exporters benefitted from sterling weakness.

Private equity

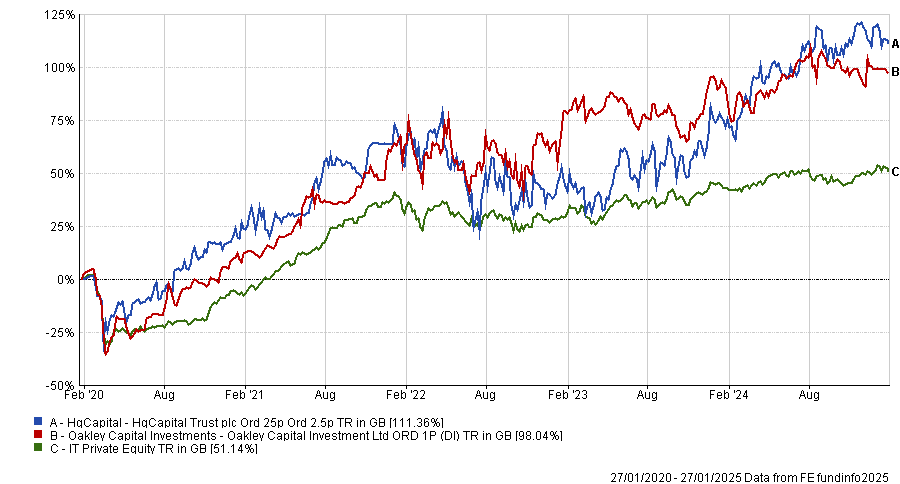

The largest position in CT Global Managed Portfolio is HgCapital*, which mainly invests in software companies in the UK and Europe and has performed strongly. Hewitt also holds Oakley Capital, whose discount of approximately 30% offers “really attractive value”.

Performance of trusts vs sector over 5yrs

Source: FE Analytics

Hewitt has a constructive view on the listed private equity sector. “The exit environment for private companies has improved. There's more buying and selling going on, typically at higher values from what they're held at, and so all of that is positive for net asset value (NAV) growth,” he said. “We're now seeing NAV beginning to get some positive momentum.”

Hewitt is not alone in his views. Ewan Lovett-Turner, head of investment companies research at Deutsche Numis, thinks private equity trusts will be boosted by strong NAV returns in tandem with their discounts narrowing.

Near-term catalysts for an improvement in sentiment include declining interest rates, a thawing IPO market and an uptick in realisation activity. Several private equity trusts intend to return some of the cash they generate by selling companies to shareholders, in a bid to narrow their discounts.

The average private equity trust (excluding 3i Group and the Growth Capital sector) is trading on a discount of 25%, which widens to 33% if HgCapital is excluded. Lovett-Turner deems this to be excessive.

Tech trusts

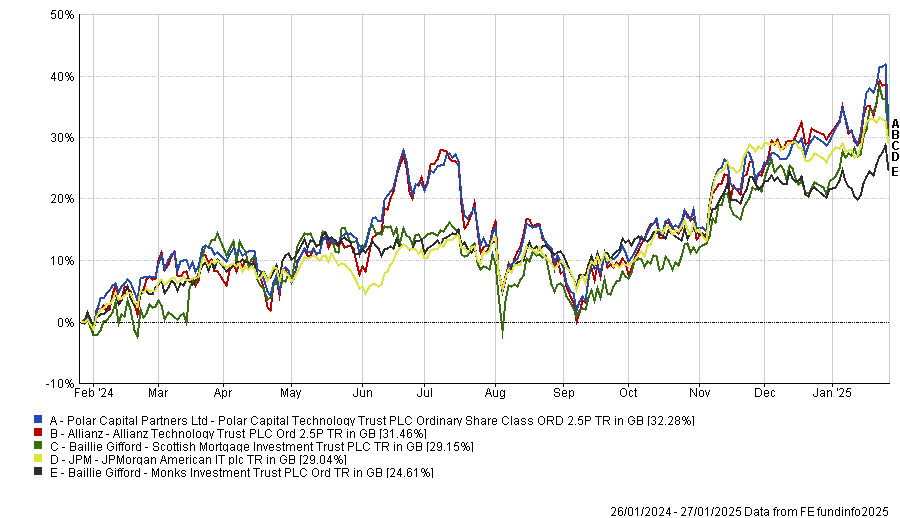

Last year, artificial intelligence was the predominant theme and as such, Hewitt’s top-performing trusts were Polar Capital Technology, Allianz Technology, Scottish Mortgage and Monks. He also has exposure to the Magnificent Seven via JPMorgan American, whose largest positions are Microsoft, Nvidia, Amazon, Meta Platforms and Apple.

Performance of trusts over 1yr

Source: FE Analytics

Given the high valuations of US tech companies, Hewitt told Trustnet last month that he would not be surprised to see a sharp correction in tech stocks, perhaps as early as the first quarter of 2025, and this week he has been proved right.

“At some stage, you'll have -15% or -20% from some of these technology companies. That's not to say they won't regain momentum because there are a lot of positives and the earnings are very strong, but when valuations are up at price-to-earnings ratios of 30x to 40x then you've got to expect volatility. I think that's a given,” he said.

Hewitt also has exposure to small tech stocks as well as media companies via Herald.

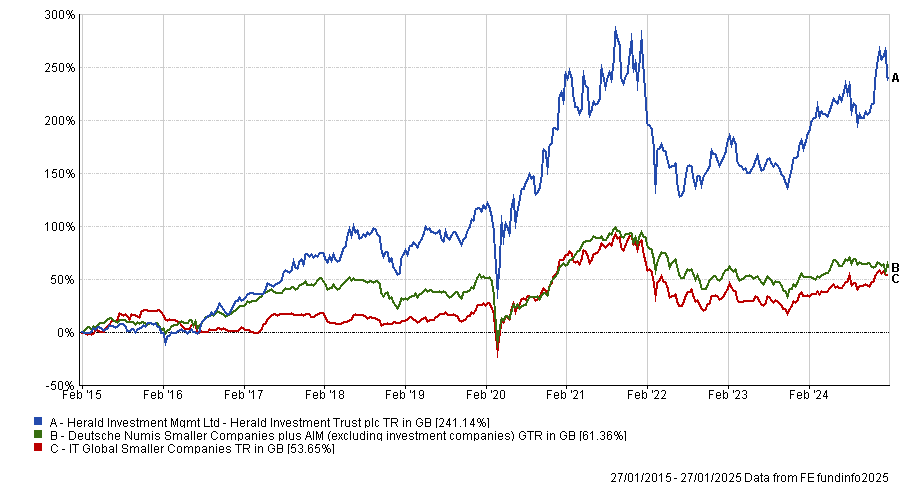

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Saba Capital Management recently attempted to replace Herald’s board and potentially take over as its investment manager, but was defeated when 65% of shareholders voted against Saba’s proposals.

Hewitt, who voted against Saba, said: “It came as no surprise that Saba lost the proposal, I hadn’t come across anyone outside of Saba that was in favour of it. This was an aggressive strategy that sought to change the board and the investment strategy of a trusted company which would benefit no-one but Saba.

“The reason why I hold Herald Trust in my portfolio is because it is unique, no other listed company does what it does. Its long-term track record has been absolutely incredible. The trust’s investment team possess an expertise in small tech and media companies, which is an under-researched segment of the equity market that has great potential.”

*HgCapital is an investor in FE fundinfo, Trustnet’s parent company