With a pool of 88 previously listed funds to re-assess, 10 removals and 10 additions in 2024, AJ Bell’s Favourite Funds list has changed the most when compared to its four main competitors.

The analyst team headed by AJ Bell head of investment research Paul Angell made almost double the number of changes compared with the authors of Hargreaves Lansdown’s Wealth List, Barclays’ fund lists and Fidelity’s Select 50, while the number of changes was close to that of interactive investor’s Super 60 (18). Some 25% of the AJ Bell best-buy list now looks completely different to a year ago.

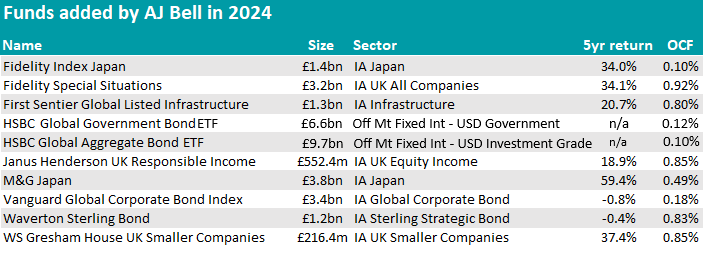

Some of the changes were covered before on Trustnet. Among the several additions, some of the most notable were the Fidelity Special Situations, Janus Henderson UK Responsible Income and WS Gresham House UK Smaller Companies funds – all of which we covered last week.

Source: Trustnet

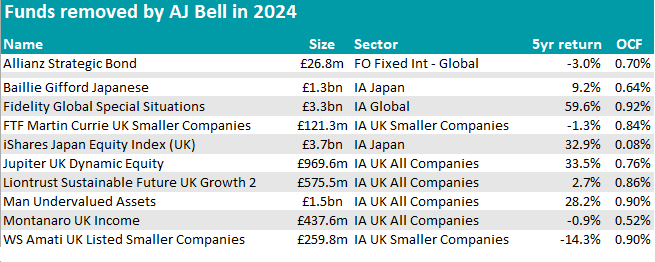

Then there were a few deletions, as we reported two weeks ago. For the FTF Martin Currie UK Smaller Companies and Montanaro UK Income funds, among others, losing AJ Bell’s approval meant that these strategies lost their overall status as best-buy funds, as no other platforms recommend them.

Other vehicles lost out on AJ Bell’s blessing but are still highlighted by others. This is the case for WS Amati UK Listed Smaller Companies, Baillie Gifford Japanese and iShares Japan Equity Index (UK).

Below, we asked Angell why the number of tweaks was so high this year. He explained that the reasons are neatly split across three camps. First: manager changes.

“Invariably any fund list containing active funds will see some turnover over a 12-month period due to portfolio manager departures, and 2024 was no exception,” he said.

In the first half of the year, the analyst waved goodbye to three funds on this basis – Fidelity Global Special Situations (as Jeremy Podger ended his 12-year tenure on the fund), Jupiter UK Special Situations (known as Jupiter UK Dynamic Equity since Ben Whitmore departed to set up his own boutique, Brickwood Asset Management) and Allianz Strategic Bond (in light of Mike Riddell’s move to Fidelity).

“We did not believe the list required replacements for the former two, however we did for the latter, as we welcomed Waverton Sterling Bond”.

This does not necessarily set AJ Bell apart from other best-buy lists, with interactive investor, which also had a exceptional number of reviews of its Super 60 list in 2024, also mentioning manager changes as the main culprit.

However, Angell explained the AJ Bell platform added an “in-depth sector-by-sector review to its research process” over the course of the year, which is the second reason for the edits.

“All Favourite Funds selections are under constant review within our research process. However, in 2024 we supplemented this with an additional monthly sector review process, whereby we take one sector per month and do an even deeper analysis of the funds on our list versus the wider market,” he explained.

“Within this analysis, we also review the blend and quantity of options we have available on the list. This led to some turnover for the first four sectors under the spotlight”.

These were: Japanese equities (bringing in M&G Japan and Fidelity Index Japan in favour of Baillie Gifford Japanese and iShares Japan Equity Index), UK All Companies and UK equity income (adding Fidelity Special Situations and Janus Henderson UK Responsible Income in place of Man Undervalued Assets and Liontrust Sustainable Future UK Growth) and UK smaller companies (where WS Gresham House UK Micro Cap replaced both FTF Martin Currie UK Smaller Companies and WS Amati UK Listed Smaller Companies).

Source: Trustnet

The Amati fund was expunged in October 2024 for concerns that its manager, Paul Jourdan, might be “overstretched” in his multiple positions.

“Jourdan, has shown he is a capable investor with a strong track record investing in the sector,” Angell said. “But we believe he may be overstretched in his roles as lead portfolio manager on this fund, the Amati’s venture capital trust and an inheritance tax offering, alongside his responsibilities as chief executive officer.”

Baillie Gifford Japanese, meanwhile, was the victim of its own signature style.

“Though we still consider the fund to be a solid option for investors, the fund’s growth investment style can, and has, caused long periods of variable performance versus the fund’s core index,” noted Angell. “As such, we view the more balanced investment approach of the M&G Japan fund to be preferable for investors.”

The last factor having an impact on AJ Bell’s best-buy list was its choice to deepen the range of passive options, expressed through the addition of four funds, HSBC FTSE All-World Index Tracker, HSBC Global Government Bond ETF, HSBC Global Corporate Bond Index and Vanguard Global Corporate Bond Index.