Stock markets began the week spiralling downwards after US president Donald Trump announced a 25% additional tariff on Canadian goods and a 10% additional tariff on Chinese imports this weekend. These measures will come into effect on 4 February.

Trump is also planning to levy tariffs on the European Union, although no timeline has been set. The UK might escape if he can reach a deal with prime minister Kier Starmer.

The US president had also announced he would tax Mexico an additional 25% over the weekend but has backtracked on that today after Mexico agreed to supply 10,000 soldiers to the border between the two countries, according to a statement made on social media site Truth Social.

“These soldiers will be specifically designated to stop the flow of fentanyl, and illegal migrants into our country,” he wrote.

“We further agreed to immediately pause the anticipated tariffs for a one-month period,” he added, to allow negotiations between the countries.

Trump’s sudden imposition of tariffs took the market by surprise, said AJ Bell investment director Russ Mould. “Financial markets had assumed that Trump would talk tough on tariffs and back off when he got a deal, so the US president’s plan to act first and then (perhaps) talk has come as a nasty surprise to share prices around the world.”

John Plassard, senior investment specialist at Mirabaud Group, agreed: “Soft power is out. Hard power is the order of the day. These tariffs are not mere trade adjustments: they are a declaration of economic war designed to force the United States’ main trading partners to bend to Washington's will. In this new era, Trump is not negotiating; he is dictating terms.”

America’s trading partners retaliate

Canada will bring in counter-tariffs of 25% tomorrow on a range of US products, including orange juice, peanut butter, wine, coffee, motorbikes and cosmetics. A longer list of US-made products will become subject to tariffs later this month after a 21-day consultation period, including cars and trucks, steel, aluminium, beef and ships.

Mexico had previously made plans to retaliate before the latest development earlier today. President Claudia Sheinbaum had asked her economy minister Marcelo Ebrard to implement ‘Plan B’, which aimed to mitigate the economic impact of tariffs without escalating tensions with the US.

China, meanwhile, has vowed to take “necessary countermeasures to defend its legitimate rights and interests”. Plassard thinks China could impose export controls on key minerals and might restrict market access for US companies. Additionally, China could allow the yuan to depreciate to offset the effects of the tariffs and support exports, he added.

What is the potential impact on Europe?

Trump told reporters this weekend that EU tariffs would “definitely happen”.

“They don't take our cars, they don't take our farm products. They take almost nothing, and we take everything from them – millions of cars, tremendous amounts of food and farm products,” he said, adding the EU is “really out of line” while he will “see” about the UK.

A hypothetical 10% tariff on European goods would equate to a 1% contraction in eurozone GDP, which would reduce corporate earnings per share by 6-7% by the end of 2025, according to forecasts from Goldman Sachs.

Plassard said: “This would not be a minor adjustment, but a direct blow to the heart of Europe's economic engine. But the figures only tell part of the story. Business uncertainty acts like a slow poison, seeping into boardrooms and freezing investment decisions.

“The euro/dollar, often seen as a barometer of global confidence, could plunge if new tariffs are announced, recalling the sharp corrections seen in previous crises.”

Plassard anticipates Europe’s automotive and chemical industries would be hardest hit by tariffs.

What impact did tariffs have during Trump’s first term?

This isn’t Trump’s first rodeo. He initially launched tariffs back in 2018, which raised revenues but harmed US corporate profits and sent the S&P 500 tumbling by a fifth.

Plassard said: “The first wave of tariffs targeted solar panels (30%) and washing machines (20-50%) in January, followed by sweeping tariffs on steel (25%) and aluminium (10%) imports in March.”

China, the EU, Canada and Mexico responded with counter-tariffs on American exports including soya, whiskey and cars.

Then in mid-2018, the US imposed tariffs on $250bn of Chinese products and China retaliated with tariffs on $110bn worth of American products.

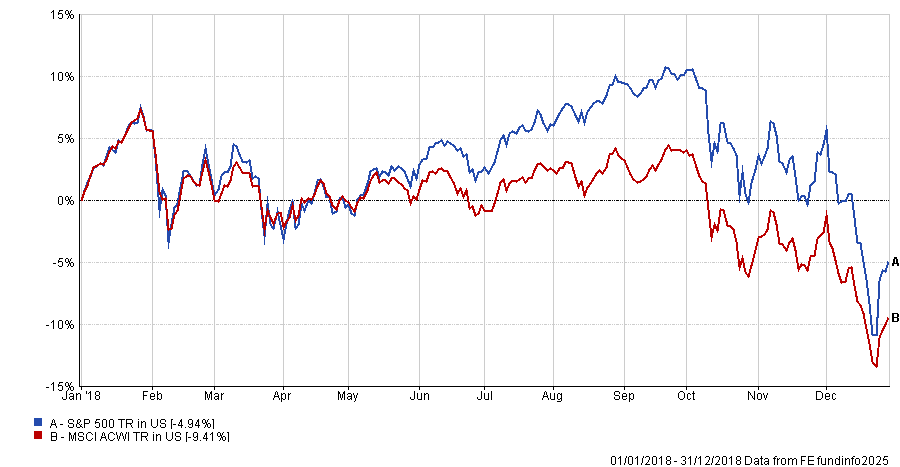

Tariffs and trade wars caused volatility across financial markets, Mould said. “The S&P 500 started 2018 well but finished it badly, as a one-fifth fall in the autumn wiped all of the year’s gains – and more. The US equity market started 2018 on 23x forward earnings and ended it closer to 19x, thanks to the autumnal slump.”

Performance of US and global equities in 2018

Source: FE Analytics

Mould continued: “Ultimately, the S&P 500 gained 56% during Trump’s first term, but that came with a big wobble in 2018, when the index lost 5% overall and endured a mini bear market in the autumn, as threats of tariffs on China became reality.”

Despite current fears about the inflationary impact of tariffs, US prices actually fell in 2018, as the chart below shows.

US price increases for gross domestic purchases and personal consumption of goods

Sources: US Bureau of Economic Analysis, AJ Bell

“This may have been because the best cure for high prices is just that – high prices – with the result that consumers and companies refused to pay them and sought out cheaper options (which is precisely the Trump plan this time around),” he said.

“But it may have also been because American importers and foreign sellers into the US elected to take the hit on margin and did not pass on the cost impact of the tariffs.”

US corporate profits shrank as a percentage of GDP in 2018, which suggests that companies took the margin hit, he continued.

Plassard added that, despite Trump's best efforts to reduce America’s trade deficit, it actually widened to a record $891bn at the end of 2018.