HarbourVest Global Private Equity is taking decisive action to narrow its discount with three new initiatives but will they work and should investors take the plunge now?

The first part of its three-pronged approach concerns share buybacks. A year ago, the board made a pool of money available from asset sales to return to shareholders through buybacks and special dividends. Last week, the trust said it would increase the amount saved into this pot from 15% of proceeds from asset sales to 30%.

This could make as much as $235m available for share buybacks, based on the trust selling 16% of its portfolio this year and money already in the distribution pool.

This strategy is already working. Last year the trust repurchased $90m of its shares, which contributed to a 12.5% uplift in its share price.

Second, the trust is simplifying its investment structure by setting up a separately managed account to deploy capital directly into third-party funds, secondary opportunities and co-investments, thereby removing the fund-of-funds layer.

Anthony Leatham, head of investment trust research at Peel Hunt, said the separately managed account should give HarbourVest more control over portfolio liquidity and reduce leverage.

Finally, a continuation vote will be put to shareholders at the trust’s annual general meeting in July 2026.

Leatham said this will make HarbourVest the only private equity fund-of-funds and one of the few investment trusts to offer shareholders a continuation vote. “It’s a line in the sand. It says: ‘we don’t mind being judged’,” he noted.

What impact will these changes have?

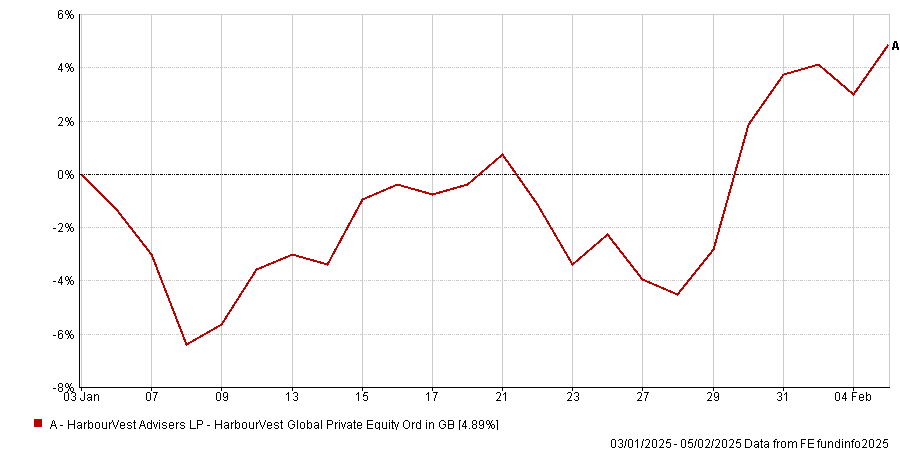

Matt Ennion, head of investment fund research at Quilter Cheviot Investment Management, said the changes are a “bold step” and have “resonated well with shareholders”, judging by the leap in the trust’s share price since they were announced on 30 January. “Hopefully other boards are watching,” he added.

Performance of trust’s share price over 1 month

Source: FE Analytics

The day after the change were announced, the trust’s discount narrowed from about 40% to 36%, according to Deutsche Numis.

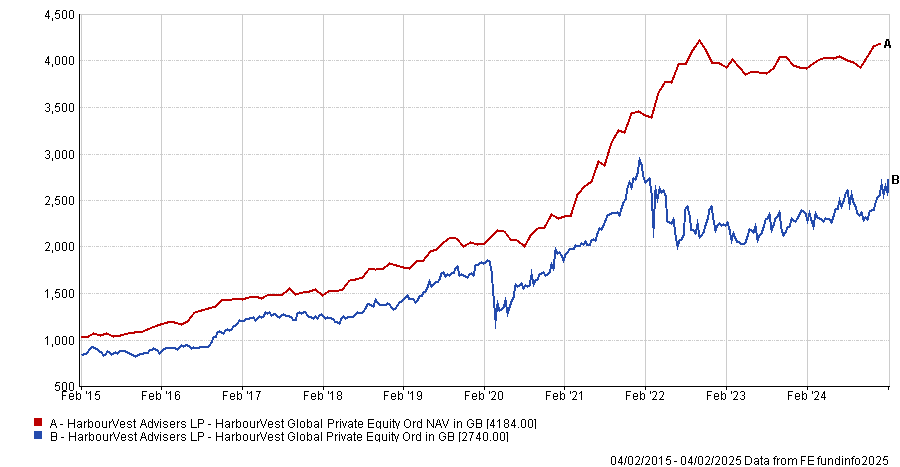

The trust has recovered significantly from the nadir of March 2023 when it was trading at a 53% discount but the current difference between its share price and net asset value (NAV) is still wider than the private equity fund-of-fund peer group average of 33%, Peel Hunt stated.

Leatham expects the discount to come in further, “particularly in an environment of increased realisations and distributions and an improvement in risk sentiment towards private equity strategies”.

“The new initiatives also reveal a simplified and more flexible investment approach and improved corporate governance standards,” he added. Peel Hunt had an outperform rating on HarbourVest before the recent announcement and is maintaining it.

Peter Walls, who manages Unicorn Mastertrust, said buying back and cancelling shares should provide an immediate uplift to the trust’s NAV.

Walls thinks this is a good time to invest in the trust and said the board is serious about tackling the discount, although he believes HarbourVest should be a long-term, buy-and-hold investment.

A lot of HarbourVest’s underlying assets are based in the US, where president Donald Trump is adopting business friendly policies and where interests rates are gradually coming down, creating a supportive backdrop, he explained. The market for initial public offerings (IPOs) has been “moribund” for the past couple of years but is expected to recover, especially in the US, he continued. The secondary market is also quite active and provides an exit strategy.

However, Walls was surprised by the introduction of a continuation vote and he hopes the trust will not become a “hostage to fortune”.

What is the long-term investment case for HarbourVest?

Ennion said HarbourVest is the only one-stop-shop, diversified fund-of-funds left in the IT Private Equity sector, given that other trusts, such as Pantheon International and Patria Private Equity, have been moving towards more direct investments, co-investments and secondaries. That is also the direction HarbourVest will be moving towards over the next five to 10 years with its new separately management account, he added.

HarbourVest provides access to the best managers in an asset class where the performance of the top quartile is meaningfully different from the average and where the best managers tend to outperform consistently, he continued.

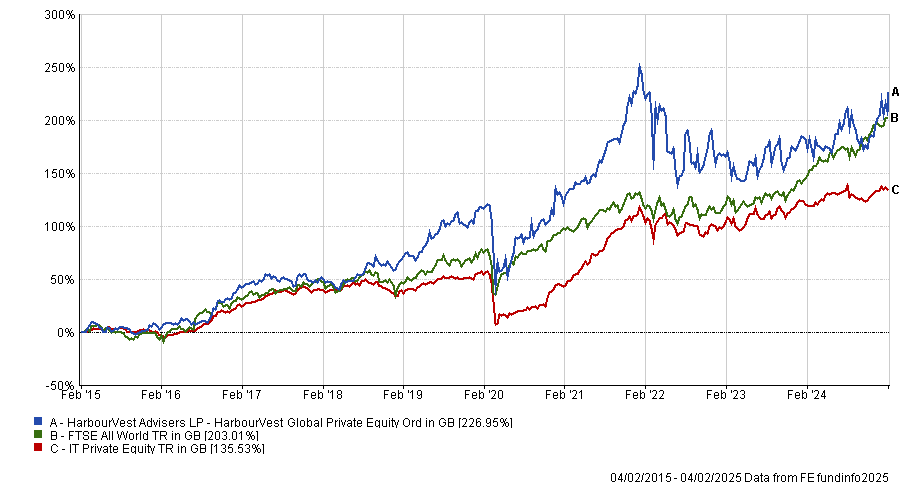

Unicorn Mastertrust has held HarbourVest for almost a decade and Walls is pleased with performance during that time, even despite the past two or three difficult years during which the discount has widened.

Performance of trust vs sector and benchmark over 10 yrs

Source: FE Analytics

Trust’s share price vs NAV over 10 yrs

Source: FE Analytics

Are any other private equity trusts worth considering?

HgCapital* is the “stand out” private equity trust and a top performer, Ennion said. Reflecting this, it trades close to NAV and has been able to sell assets throughout the cycle. HgCapital is the second-best performing trust in the IT Private Equity sector behind 3i Group over one, five and 10 years to 5 February 2025 and the fourth-best over three years.

Ennion also likes Pantheon International for its broad, diversified portfolio overseen by an impressive manager.

Walls owns ICG Enterprise, Patria Private Equity, Oakley Capital Investment and CT Private Equity. He said he invests in private equity because, over the long term, there is plenty of evidence that it outperforms public markets and “if you want to perform differently from the markets, you’ve got to invest differently from other investors”.

*HgCapital is an investor in FE fundinfo, Trustnet's parent company.