The FTSE 100 has gone from strength to strength, and equity income trusts, which usually have high exposure to the index, have soared with it.

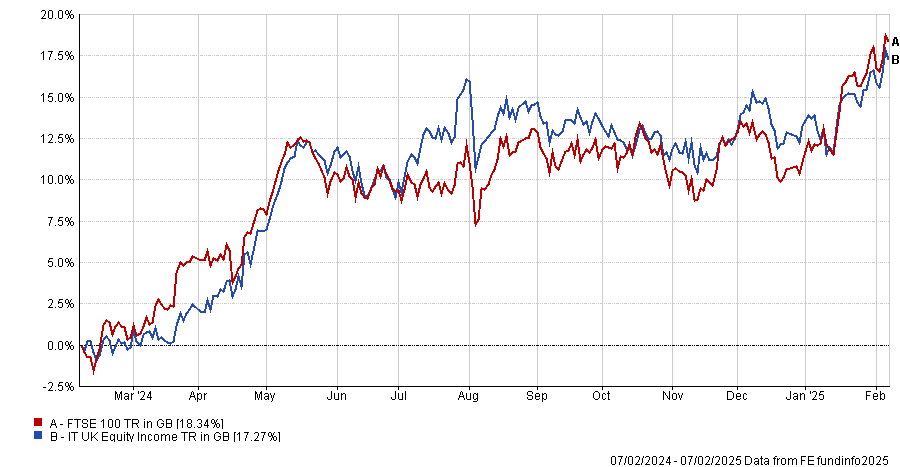

UK large-caps have grown mostly on the back of overseas earnings, reaching record highs in April 2024 and soaring again last week to new highs. Over the past 12 months, the index has risen 20% , while the average IT UK Equity Income trust has generated an almost equivalent net-asset-value (NAV) return for shareholders over the same time, as the chart below illustrates.

Performance of sector and index over 1yr

Source: FE Analytics

This is good news for investors, who have so far failed to acknowledge the potential, as the high average discount at which UK trusts continue to trade demonstrates.

The outperformance might even continue in 2025, according to Iain Scouller and William Crighton, research analysts at American financial services company Stifel.

“With UK equities unloved on a low multiple and investment trusts on wide discounts with high yields, the UK Equity Income and UK All Companies sectors are attractive, at a time when investors continue to focus on highly-rated US equities,” they said.

“As over the past year, when returns on many UK trusts were around 20%, the UK sector continues to offer an attractive opportunity.”

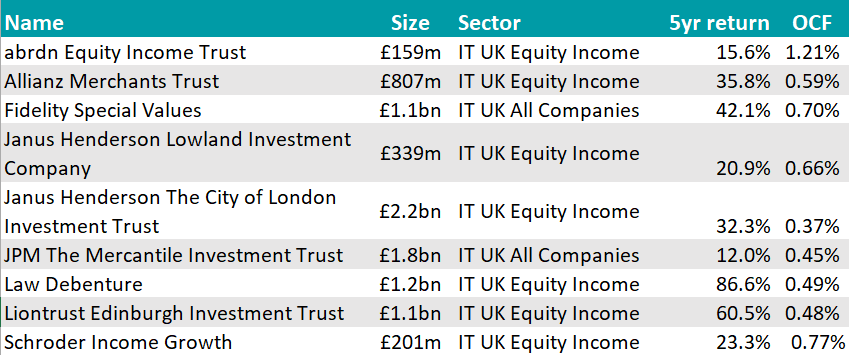

The analysts were positive on the income sector as a whole, as the majority of its members have delivered meaningful dividend growth over the past five years and two-thirds maintained yields at or above the 3.5% of the FTSE All Share, but they were particularly keen on nine names.

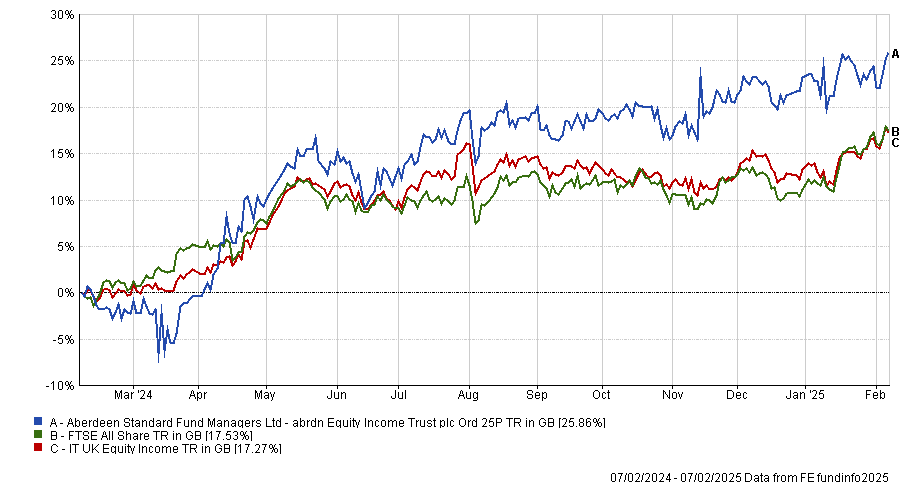

The first one is abrdn Equity Income, which they singled out for paying the highest yield of 7.1%.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Managed by Thomas Moore, this £158.6m portfolio has key overweight positions in tobacco producer Imperial Brands (4.8 percentage points above the benchmark), investment firm Petershill Partners (3.3) and construction group Galliford Try (3.3). Over the past year, the strategy was able to spur its growth through leverage, taking up its gearing to 13%, and to narrow its double-digit discount, reaching the current level of 3.8%.

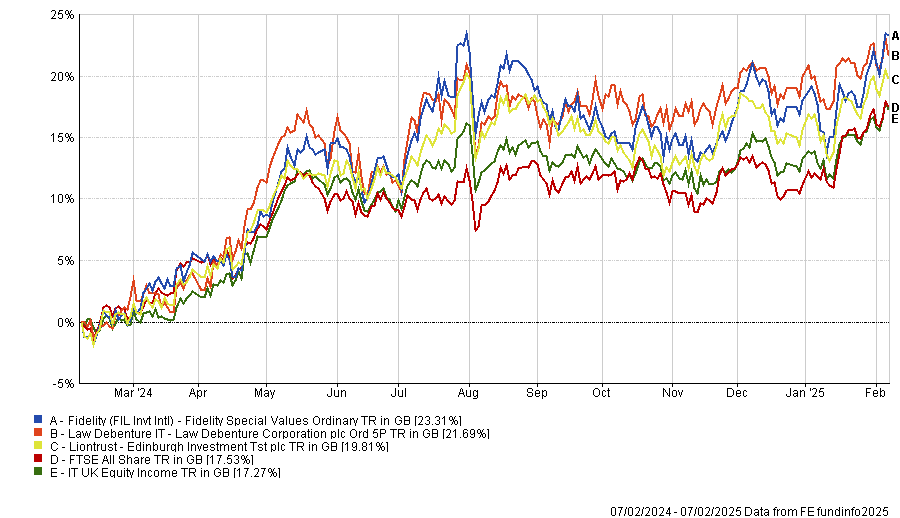

Three vehicles were highlighted for their commitment to dividend growth: Law Debenture, Fidelity Special Values and Edinburgh Investment Trust.

The first is a portfolio of out-of-favour equities and businesses with strong competitive advantages. It is co-led by FE fundinfo Alpha Manager James Henderson and Laura Foll.

It comes with a professional services business attached, which allows for a particularly strong dividend growth – the highest in the sector, at 11.1% per annum over five years.

In second place is Fidelity Special Values, which has also delivered strong dividend growth of 10.7%, although it has a lower dividend yield (3.0%) when compared than many of its peers.

It has a maximum FE fundinfo Crown rating of five and is managed by Alpha Manager Alex Wright, who takes a contrarian approach buying unloved companies.

Performance of funds against sector and index over 1yr

Source: FE Analytics

Square Mile analysts review its as “a compelling proposition run by a highly motivated and passionate investor”.

“Ultimately, there is a lot to like here, especially the fact that the manager has remained consistently true to his investment style,” they said.

“This style of investment can continue to add value relative to its FTSE All Share benchmark but, given the impact that the approach applied can have on returns, it may be better suited to investors with a longer-term investment horizon.”

The five crown-rated Edinburgh Investment Trust was highlighted despite its dividend being cut four years ago, when a new management team was appointed at Majedie (the portfolio is now managed by Liontrust).

Imran Sattar resumed dividend growth when he became lead manager in October 2023, increasing it from a reduced base of 24.8p in the year ending March 2022 to 27.2p in the year ending March 2024, which convinced Scouller and Crighton.

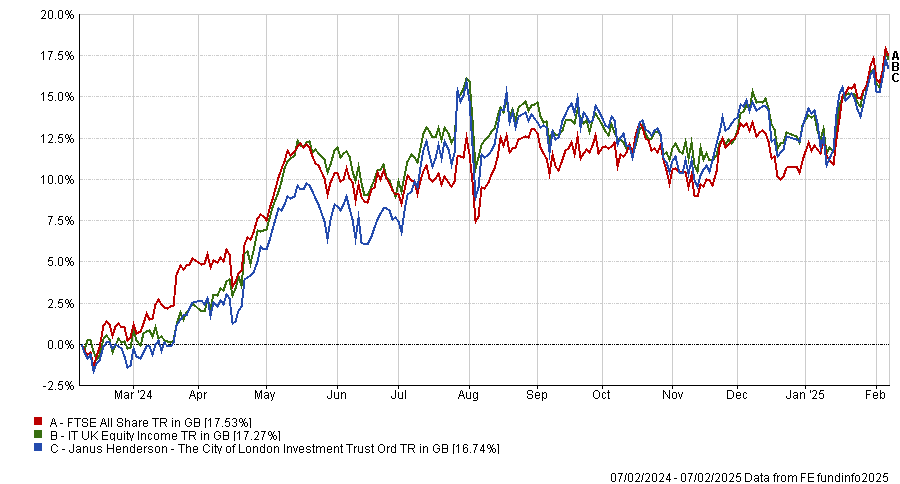

The longest period of dividend growth has been delivered by Job Curtis and his predecessors at City of London, with 58 years of consecutive dividend growth.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The annual dividend was covered 1.02x by revenue earnings per share last year and the trust also has revenue reserves equivalent to 0.46x of the cost of the latest annual dividend.

According to Square Mile analysts, investors in this trust benefit from “an exceptionally competitive level of fees, which provides a material tailwind for the portfolio's ability to outperform the wider UK market and peers.”

“This adds to our high level of conviction in this ability of this fund to meet its expected outcome over the long term.”

Finally, trusts with long-term debt should also benefit going forward, according to Stifel analysts, as the cost of money will currently be lower than the yield on their portfolios of investments.

Among the vehicles using some structural leverage in their portfolios, they highlighted Mercantile, which tends to run with relatively high leverage at 14% of NAV.

Other recommendations included Lowland, Merchants and Schroder Income Growth.

Source: FE Analytics