Asia’s equity markets present a fertile ground for active stock pickers. The diversity of its markets, ranging from emerging economies like Indonesia and the Philippines to more established ones such as Taiwan and Korea, offers a wide array of exciting investment opportunities.

We have identified six themes that offer investors multiple drivers of income and capital growth across the region.

Tech leaders

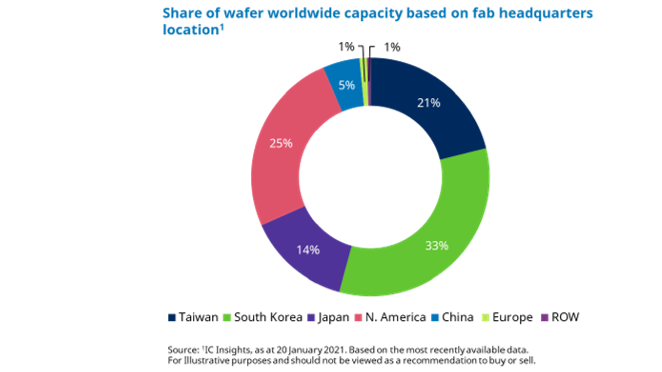

Asia is at the forefront of several significant technology trends, driven by its dominance of the global market for high-performance, leading-edge semiconductors. The region plays a pivotal role in the artificial intelligence (AI) revolution, with companies contributing across the value chain – from chip fabrication and packaging to supplying high-end servers that meet AI’s significant power demands.

While AI has clearly become an important driver in recent years, Asia’s tech leaders are also well-placed to participate in the long-term growth of other important trends such as digitisation, cloud computing and 5G mobile networks.

A cornerstone of this dominance is Taiwan Semiconductor Manufacturing Company (TSMC), the world’s leading semiconductor manufacturer. TSMC’s unmatched scale and relentless focus on innovation enable it to produce the highest-specification chips powering transformative technologies such as AI and 5G.

The company’s strong financial performance, underpinned by robust free cashflow, supports its ability to reward shareholders with a consistent and growing stream of dividends.

Manufacturing excellence

Asia is renowned for its manufacturing prowess, supported by an increasingly well-educated workforce, modern infrastructure and tightly integrated supply chains that allow it to fully harness the economies of scale.

Key manufacturing hubs such as China, Taiwan and South Korea lead the way in producing an extraordinarily wide range of goods for the rest of the world to consume.

Many leading Asian manufacturers remain critical components of global supply chains, despite rising trade tensions. Indeed, the broader Asian region should benefit as the rest of the world seeks to reduce its reliance on China.

This reflects the region’s ability to adapt and innovate, which should ensure its continued resilience and relevance through future global trade cycles.

Hon Hai Precision Industry, often known as Foxconn, is a leading Taiwanese electronics contract manufacturer and a critical component of global supply chains.

Known for assembling a significant portion of Apple’s products, including the iPhone, Hon Hai is also a leading server manufacturer, a segment which is growing rapidly to meet the demand for the high-end servers needed for AI applications.

Domestic consumption

Asia’s domestic consumption story is central to its economic transformation, driven in some markets by favourable demographics and the ongoing rise of a prosperous middle class. This trend is particularly evident in the region’s faster-growing economies, which are rapidly catching up with more mature countries both in Asia and the West.

As incomes rise and urbanisation accelerates, sectors such as retail, real estate and financial services are poised to benefit, with increasing financial inclusion driving demand for banking and insurance products.

This broad-based consumption growth highlights the region’s resilience and its long-term shift towards a more self-sustaining economic model.

Quality financials

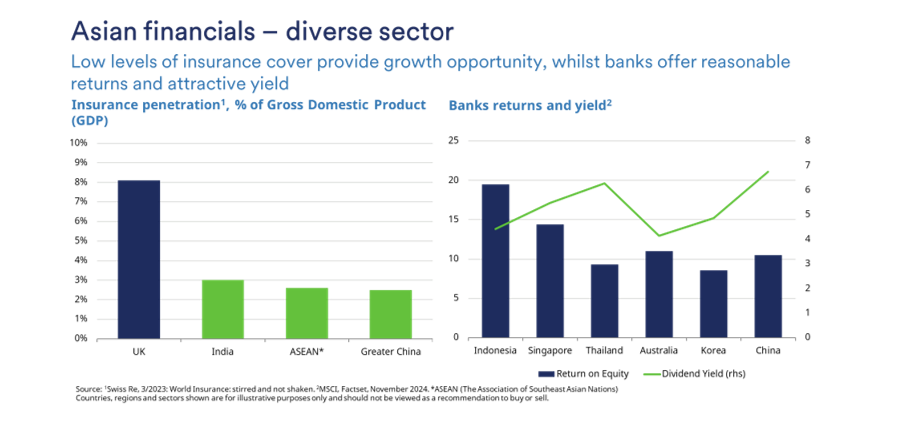

Asia’s financial sector is as diverse as its economies, ranging from established banks and insurers in developed markets, such as Singapore and Hong Kong, to fast-growing and disruptive businesses in emerging ASEAN countries.

This diversity offers a wealth of opportunity, from the stability and income provided by mature financial institutions to the dynamic growth potential of less developed markets.

A focus on quality is key to capturing this opportunity. In the region’s more developed markets, banks and insurers generally look attractive with their resilient business models and a clear focus on shareholder returns.

Elsewhere, rising levels of financial inclusion are transforming the economic landscape in ASEAN countries such as Indonesia, where millions of unbanked individuals are gaining access to banking services for the first time.

Digital connectivity

Asia’s digital infrastructure and capabilities are, in many respects, on par with (or even surpass) those of Western economies. Countries such as South Korea, and China lead in areas like 5G deployment, broadband speeds and fibre-optic coverage, setting global benchmarks for connectivity.

Meanwhile, much of the rest of the continent is fast catching up, with significant investment in digital technologies enabling far-reaching economic benefits, such as enhanced productivity and greater innovation, while previously isolated communities become better connected to global markets. Sectors such as telecommunications, technology and digital infrastructure are pivotal in supporting this transformation.

ASEAN growth

The emerging ASEAN economies offer significant growth potential, driven by favourable demographics, substantial infrastructure investments and regional trade agreements with Singapore a key, albeit more mature, enabler for South East Asia given its well-developed financial system and connectivity.

The region’s youthful and expanding population contributes to a dynamic labour force and growing consumer market, while ongoing developments in transport and logistics enhance connectivity and economic integration.

International Container Terminal Services (ICTSI), headquartered in Manila, Philippines, is one of the world’s largest independent terminal operators. ICTSI operates across six continents, focusing on efficient and sustainable port facilities.

Its strategic presence in key ASEAN and other emerging markets enables it to capitalise on the region’s expanding trade flows. By investing in state-of-the-art infrastructure and fostering strong stakeholder relationships, ICTSI offers long-term growth potential and an appealing dividend.

Conclusion: There are plenty of opportunities for income and growth

The opportunity to invest in Asia today combines its dynamic domestic themes with a growing relevance in the global economy. Investors can gain exposure to several attractive sectors, economies and drivers of growth.

Meanwhile, from the perspective of income, Asia represents a helpful dividend diversifier, particularly for UK investors who may be heavily reliant on the domestic stock market for their income.

Both income and capital growth are achievable in Asia and, if history is a guide, together they should combine to form an attractive potential long-term total return.

Richard Sennitt is portfolio manager of Schroder Oriental Income Fund. The views expressed above should not be taken as investment advice.