Investors who took a punt on new funds investing in Asia had a 50:50 chance of picking either one of the best funds or one of the worst, according to data from FE Analytics.

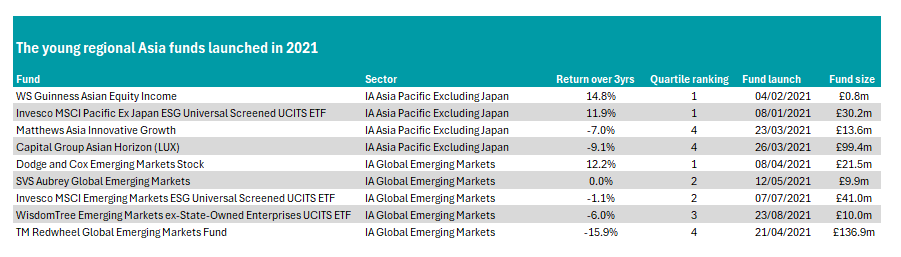

Four funds were launched in the IA Asia Pacific Excluding UK sector in 2021, meaning they went through their three-year anniversaries last year. Comparing the three-year performances to the end of 2024, two made top-quartile returns while two were in the bottom 25% of the peer group.

WS Guinness Asian Equity Income came out on top with a return of 14.8%, the 10th best return in the sector. Managed by Edmund Harriss and Mark Hammonds, the fund has less than £1m in assets under management, although the strategy as a whole runs £234.2m on behalf of investors.

During this time, the fund has never failed to beat its average peer in a calendar year, making a second-quartile return in 2022 before jumping to the top 25% of the sector in 2023 and 2024.

The other fund with a top-quartile return is the Invesco MSCI Pacific Ex Japan ESG Universal Screened UCITS ETF, which tracks an environmental, social and governance (ESG) benchmark.

It performed strongly in 2022, but returns underwhelmed last year when the fund made just 7%, placing it in the third quartile of the peer group. Overall, its 11.9% gain during the entire three years was a top-quartile effort.

By contrast, Matthews Asia Innovative Growth and Capital Group Asian Horizon (LUX) have struggled, making losses of 7% and 9.1% respectively over the past three years.

Source: FE Analytics

Turning to emerging markets, which we have included as most of the MSCI Emerging Markets exposure is in Asian countries, Dodge and Cox Emerging Markets Stock was the best performer. Up 12.2%, it was the only young fund from the IA Global Emerging Markets sector to make a top-quartile return.

In this sector, investors had a slightly better chance of picking an above-average fund but Dodge and Cox Emerging Markets Stock was the only one to make a positive return.

SVS Aubrey Global Emerging Markets was flat over three years while Invesco MSCI Emerging Markets ESG Universal Screened UCITS ETF made a 1.1% loss – both were still better than average.

WisdomTree Emerging Markets ex-State-Owned Enterprises UCITS ETF sat in the third quartile of the peer group, while TM Redwheel Global Emerging Markets Fund – the largest of the table above with assets under management of £137m – lost 15.9%.

The latter is managed by John Malloy, who also runs the £1bn Redwheel Global Emerging Markets fund, which has performed equally poorly, sitting in the fourth quartile of the sector over one, three and five years.

Despite this, analysts at Square Mile Investment Consulting & Research gave the larger the fund an ‘A’ rating. They noted Malloy has an “impressive record” over the longer term, having previously managed money at Everest Capital.

They noted he was a “seasoned emerging market investor” who is “supported by a diverse and experienced team of dedicated analysts”.

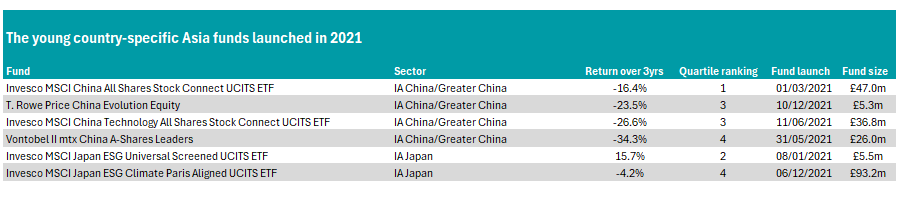

Among individual funds, in Japan investors had a one-in-two chance of picking a winner from the two Invesco funds launched in 2021.

Invesco MSCI Japan ESG Universal Screened UCITS ETF made 15.7%, placing it in the second quartile of the IA Japan sector, while Invesco MSCI Japan ESG Climate Paris Aligned UCITS ETF made a bottom-quartile 4.2% loss during this time.

The former has more in healthcare than the latter and less in consumer discretionary and financials, although sector weightings are broadly similar, while six of the funds’ top 10 holdings overlap. It is a reminder to investors that picking the correct benchmark is crucial when deciding which fund to invest in.

The MSCI Japan ESG Universal Screened index adjusts position sizes based on ESG factors, while the MSCI Japan ESG Climate Paris Aligned benchmark tracks the performance of large and mid-caps in Japan that have met the more stringent requirements of aligning with the Paris Agreement.

Source: FE Analytics

Lastly, China has had a disastrous three years, highlighted by the fact that the best performer of the funds launched in 2021 has made a 16.4% loss in that time.

Another from the Invesco exchange-traded fund (ETF) suite, Invesco MSCI China All Shares Stock Connect UCITS ETF, was the only above-average performer of these new funds.

T. Rowe Price China Evolution Equity and Invesco MSCI China Technology All Shares Stock Connect UCITS ETF fell into the third quartile with losses of 23.5% and 26.6% respectively, while Vontobel II mtx China A-Shares Leaders struggled most, down 34.3% over three years to the end of 2024.