Lloyds has published its annual results this morning, concluding a positive reporting season for the top UK banks.

Despite lagging behind its rivals, Lloyds’ full-year numbers received a positive response by the market and a ‘buy’ note from Jonathan Pierce, equity analyst at Jefferies International Limited – as did Barclays and HSBC.

The UK banking sector is benefitting from high net interest margins, moderate loan losses and helpful investment banking operations (where applicable) which are happening amid buoyant and volatile markets, as noted by Russ Mould, AJ Bell investment director.

“This combination means the FTSE 350 Banks index is shrugging off the uncertain outlook for both the UK economy and that of China, which remains a key area of operation for both HSBC and Standard Chartered,” he said.

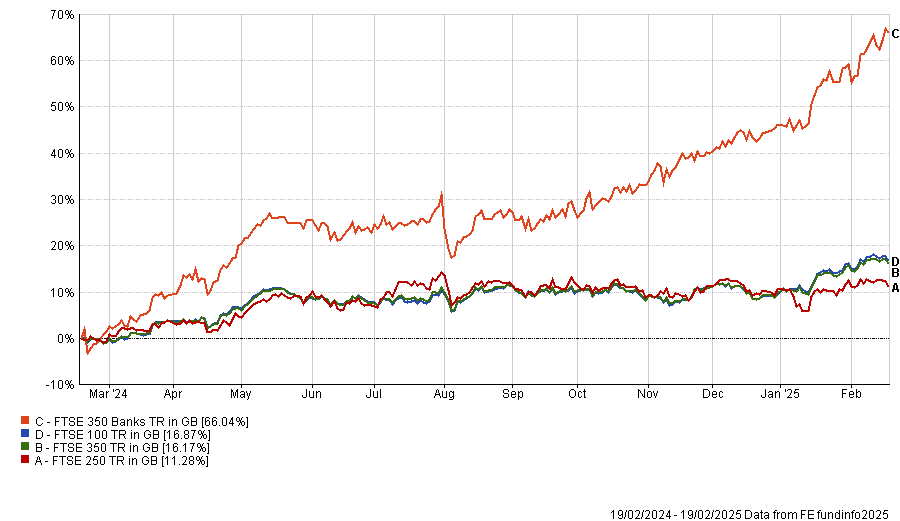

Indeed the FTSE 350 Banks index skyrocketed in the past 12 months and is now up 50 percentage points ahead of the main UK indices, as the table below shows. This made it the single best performer among the 39 industry groupings, now trading at its highest mark since 2008.

Performance of indices over 1yr

Source: FE Analytics

On the back of this growth, investors might be asking themselves whether the sector has run out of steam. Analysts are “taking no chances”, said Mould, and expecting “a slight dip” in the pre-tax profit of the top five UK banks (from £50bn in 2024 to £48bn).

But this is not how Peter Davies, manager of Lansdowne (Lux) Developed Markets, feels. He believes UK and Irish retail banks still provide “a generational investment opportunity”.

He said: “Despite recent returns, the market continues to underestimate the true value of these businesses. As the sector normalises following the extreme stress of the past 15 years, we see significant upside potential.”

Banking represents one of the highest-conviction themes in the fund, which holds a 25% allocation to the sector – a positioning that helped drive strong performance in 2024, when most investors' attention was concentrated on a narrow set of US technology stocks.

Natwest is the top holding in the fund, representing 8.6% of the $167.4m portfolio; Lloyds is also in the top 10 at 4.4%. In the past 12 months, the fund returned 28.6%, 15 percentage points ahead of the average peer. This results put it in 13th place within the 542-strong sector.

Performance of fund against index and sector over 1yr

Source: FE Analytics

There are two basic truths of banking that are often forgotten, according to Davies. First, it is an industry that tends to grow at least in line with nominal GDP over time. Second, economies of scale are “incredibly powerful”, both from cost efficiencies and because new business flows tend to be less profitable than the sticky stock of customers, rendering new entrant economics poor. As a result, incumbents tend to gain market share over time, either organically or via consolidation, the manager explained.

In the UK and Ireland today, exactly this norm is reasserting itself, as businesses have simplified, industries consolidated and interest-rate extremes corrected.

“This normalisation is, understandably, something investors loathe to recognise given recent history but seems to us demonstrable and likely to get more obvious going forward,” he said.

“While UK and Irish banks largely posted positive returns in 2024, those returns remain understated due to interest rate hedges. As these hedges unwind in the coming years, and banks are exposed to higher rates, we expect even stronger returns in the years ahead.”

Deposit growth also returned during 2024 as the one-off effect of a sharp rise in rates worked through.

Meanwhile, the manager thinks the “very high risk premium implicit in current valuations seems increasingly hard to validate” as traditional risks recede, with credit quality proving “exceptionally resilient”.

Additionally customers are more financially stable, as suggested by the low level of provisions during a period of steep rate increases and a severe cost-of-living crisis across Europe.

Regulatory tightening also appears to be moderating materially, if not reversing, something Davies thinks should continue on the back of the new US administration’s deregulatory plans.

“Finally, a tough UK Budget and Irish elections did not yield increased taxes on the sector, which again suggests historic risks are alleviating. With hedges unwinding, balance-sheet growth ahead of cost inflation and share buybacks at low valuations, the growth of earnings possible for the sector is substantial,” he concluded.