Even the best funds will struggle to beat the market year in and year out, which is no different in the UK. Over the past decade, no fund in the IA UK All Companies sector or the IA UK Equity Income sector managed to beat the FTSE All Share in each calendar year.

Ben Yearsley, director at Fairview Investing, said this was because “most funds run to a style and styles go in and out of fashion”. Unlike other markets such as the US, where technology and growth stocks more generally dominated, there has been no obvious theme in the UK over the long term. “It is only natural, therefore, for funds to underperform the wider market,” he added.

However, while no UK fund beat the market every calendar year, a handful got close, beating the FTSE All Share in seven of the past 10 years, most of which were active funds.

For Yearsley, this was a respectable set of results. “I would be pretty happy with a fund which had a 70% hit rate”, he said.

IA UK All Companies

The £3.8bn Artemis UK Select fund, led by FE Fundinfo Alpha Manager Ed Legget and Ambrose Faulk, was the largest fund to match our criteria, delivering a 10-year return of 153.8%.

It failed to beat the benchmark in 2016, 2018 and 2022, but Yearsley argued this was acceptable if the outperformance in the up years made up for the underperformance. Indeed, the fund delivered supranormal returns in 2023 and 2024, meaning it still made top-quartile returns over the past one, three and five years.

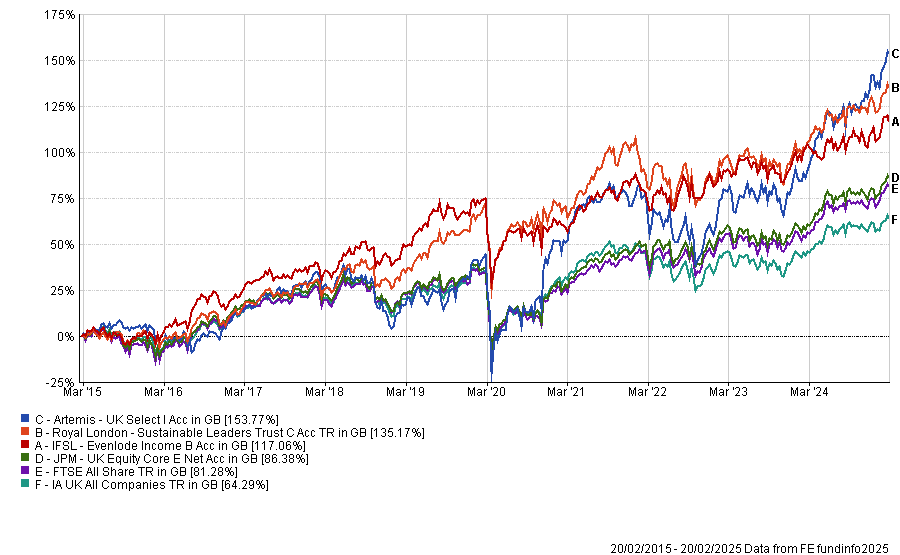

Performance of the funds vs the sector and benchmark over 10yrs

Source: FE Analytics

However, with the sector’s third-highest volatility and a bottom-quartile maximum drawdown, analysts at FundCalibre said it was a portfolio best suited to investors with a high-risk tolerance.

Alpha Manager Mike Fox’s Royal London Sustainable Leaders Trust also qualified. Despite faltering against the FTSE All Share in 2016, 2022 and 2024, the fund is up 135.2% over the past 10 years.

For analysts at Square Mile, Fox is a “pioneer of responsible investment” with a long-term, disciplined and risk-averse focus. Indeed, the fund had the second-lowest maximum drawdown in the sector, making it better at protecting investors' capital than many of its peers.

Analysts conceded the emphasis on sustainable investing means the portfolio has lagged recently when oil and energy stocks have outperformed but, over the long term, it would compound into a "rewarding investment".

Elsewhere, the Evenlode Income fund, led by Hugh Yarrow, stood out. It returned 117.1% to investors over 10 years, despite failing to beat the benchmark in 2021, 2022 and 2024.

For analysts at FE Investments, these years were the result of anti-cyclical sector biases in stock selection, which was a headwind when banks and energy providers began to outperform in 2020.

Nevertheless, the analysts argued Evenlode’s comprehensive approach to stock selection had differentiated it from other fund houses and would be a compelling addition to investors’ portfolios.

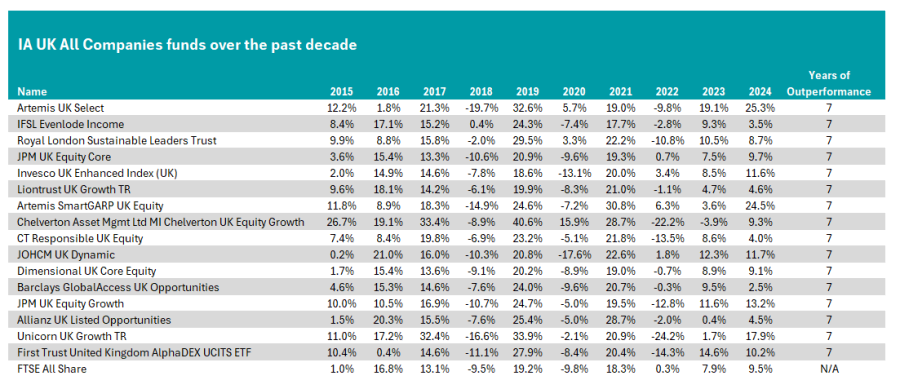

Source: FE Analytics

As seen in the above table, several other funds across a range of styles delivered benchmark-beating returns in seven of the past 10 years, including strategies such as Liontrust UK Growth and Artemis SmartGARP UK Equity.

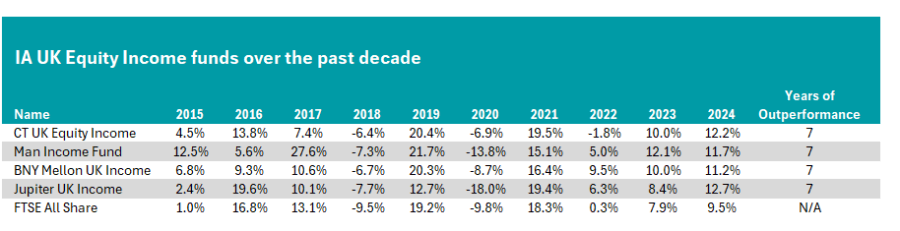

IA UK Equity Income

Four equity income funds also stood out. The first was Alpha Manager Henry Dixon’s Man Income fund, which delivered a 120.3% return over the past decade, the best performance in the sector.

Source: FE Analytics

Analysts at FE Investments explained its periods of underperformance were due to stock-specific events. For example, holdings in “mid-sized, unloved companies” were a headwind in 2016, when these stocks sold off following the referendum. Similarly, allocations towards aviation and energy companies underperformed in 2020 due to the pandemic and global lockdown leading to restrictions on travel.

However, for analysts at Square Mile, this does not detract from the fund’s qualities, such as a “clear and delineated investment approach” and a “cool-headed manager” who was willing to “explore where others fear to tread”.

As a result, they argued it would be best suited to a more contrarian, benchmark-agnostic investor.

The BNY Mellon UK Income fund also qualified, with a 112.4% return over 10 years. Despite faltering against the FTSE All Share in 2016, 2017 and 2021, it has also delivered top-quartile results over the past one, three and five years.

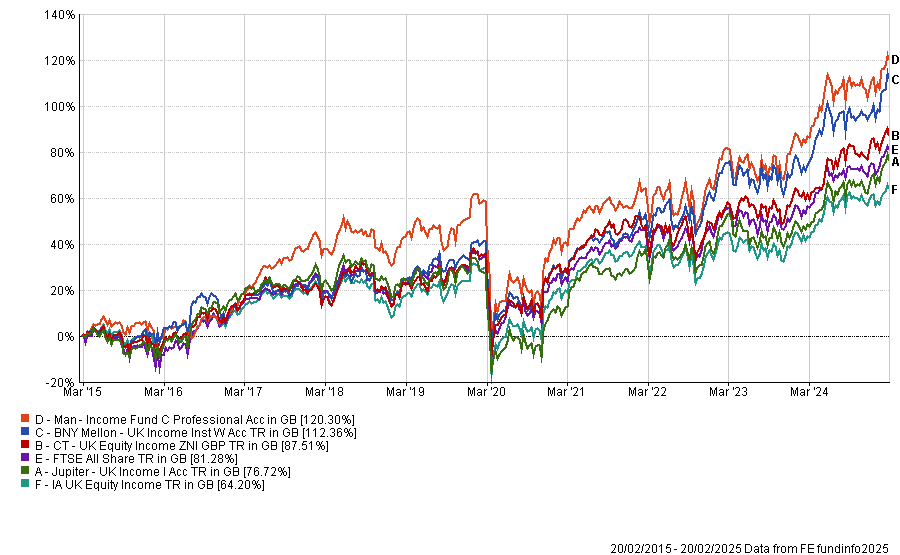

Performance of the funds vs the sector and benchmark over 10yrs

Source: FE Analytics

The £2.9bn CT UK Equity Income fund also proved a consistent choice for income investors. Despite poor results in 2016, 2017 and 2022, the fund was up 87.5% over the past 10 years. However, Richard Colwell retired in 2022, with Jeremy Smith taking charge of the fund since, meaning much of the previous track record is attributable to the former veteran stockpicker.

Like CT UK Equity Income, the Jupiter UK Income fund also qualified but has gone through a raft of changes recently. Formerly run by Ben Whitmore, Adrian Gosden and Chris Morrison came over from GAM to take the reins of the fund last year when it was announced the former manager would be leaving Jupiter.

Additionally, despite delivering benchmark-beating returns in seven years, periods of outperformance did not make up for the years when it struggled, meaning its total 10-year returns lagged against the FTSE All Share.