BlackRock has become more positive on European equities after their strong start to 2025, highlighting a number of positive catalysts for the previously unloved market.

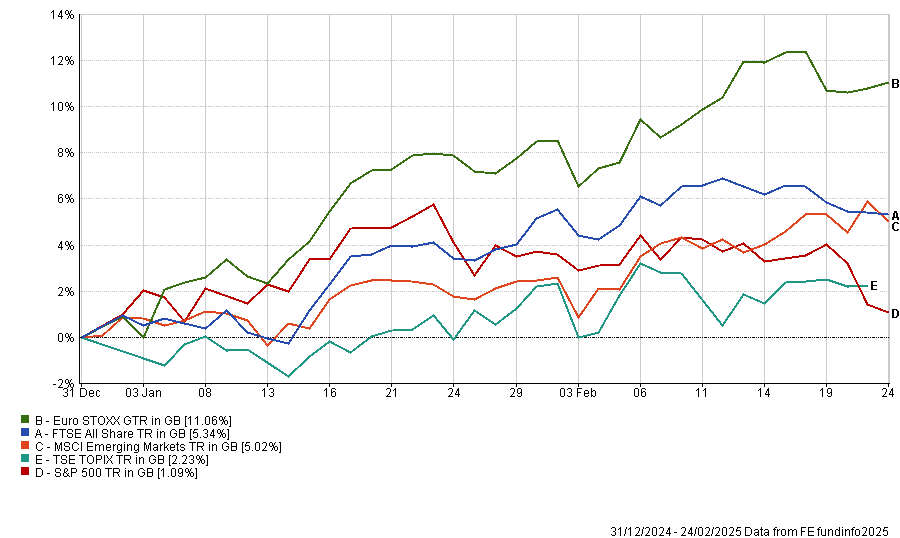

US equities have outperformed their peers for an extended period, driven by surging tech stocks, a resilient economy and the US exceptionalism narrative. However, the S&P 500 has lagged behind other markets during the opening weeks of the new year – with Europe taking the lead.

Performance of regional indices over 2025 to date

Source: FE Analytics

Roelof Salomons, chief investment strategist for the Netherlands at the BlackRock Investment Institute, said the fund house still expects US stocks to outperform in 2025 – again led by tech – and remains overweight.

However, it has upgraded European equities from underweight to neutral after identifying several catalysts that could turn around poor investor sentiment towards the region and narrow some of its return gap with the US.

“With a lot of bad news priced into European equities, even prospects of good news could help them push higher. One example: possible de-escalation in the Ukraine war,” Salomons explained.

“Reduced reliance on Russian gas brought European energy prices down from 2022’s highs. A form of peace agreement could lower energy prices further, boosting European growth and lowering inflation.”

Other positive catalysts for Europe include the expectation of higher defence spending after US president Donald Trump suggested that the security of Europe is no longer a priority. “The EU now has an air of urgency that typically spurs action,” Salomons said.

Meanwhile, the victory of the conservative CDU/CSU party in the German federal elections could lead to some fiscal loosening while the European Central Bank has room to cut rates more this year given sluggish eurozone growth and easing inflation.

“So, we go neutral Europe’s stocks and still favour European financials – a preference that also served us well last year,” Salomons finished.

“Yet Europe still faces multiple structural issues, from lagging competitiveness to potential US tariffs – justifying some of Europe’s hefty valuation discount, we think.”

BlackRock remains overweight US and Japanese equities, while holding a neutral stance on the UK and emerging markets.