FE Fundinfo Alpha Manager Ed Legget and Ambrose Faulks were the most skilled stockpickers in the entire Investment Association universe last year based on their work on the Artemis UK Select fund.

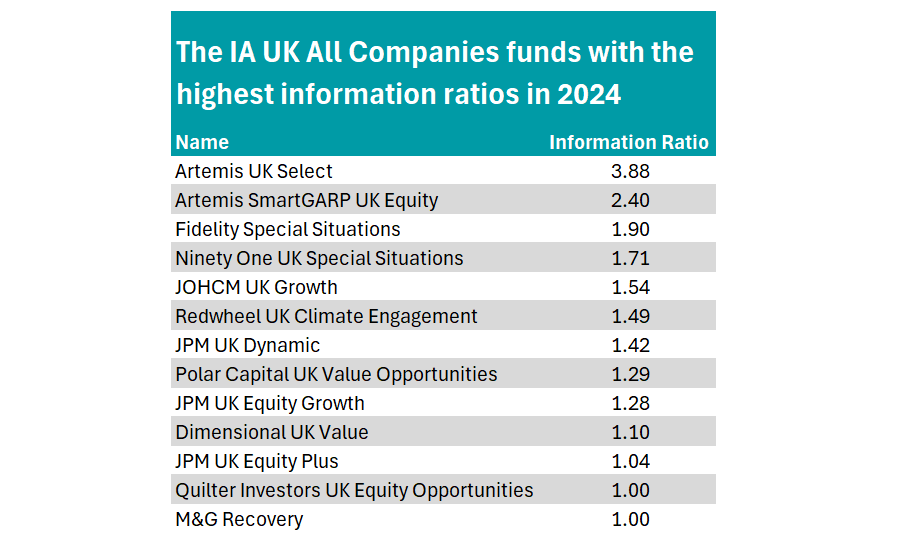

Despite 2024 being one of the worst years for active equity managers in a decade, this fund achieved an information ratio of 3.88, the best result in the universe and far outstripping the IA UK All Companies average of -0.27.

It delivered a 25.3% return last year, adding to an already impressive long-term track record – over 10 years it has made return of 151.3% for investors, the second-best performance in the IA UK All companies peer group during this time.

Analysts at FundCalibre described it as one of "the UK's premier equity funds" due to the "impressive track record of its managers". They added the fund benefits from Legget and Faulks’ “high conviction approach and flexibility in stock selection", as well as their ability to short a small number of holdings to profit even when share prices drop.

Source: FinXL

However, analysts said despite being "nominally style neutral", it tends to invest in value businesses and investors should be "prepared for potential drawdowns during periods of market stress". Nevertheless, it outperformed the FTSE All Share in seven of the past 10 years, making it one of the UK’s more consistent funds.

While 2024 may have been a poor year for active managers, Legget and Faulks' strategy was not the only UK fund where UK managers proved sufficiently skilled.

In the IA UK All Companies sector a further 12 funds achieved an information ratio of higher than 1, which is usually considered a strong indication of manager skill.

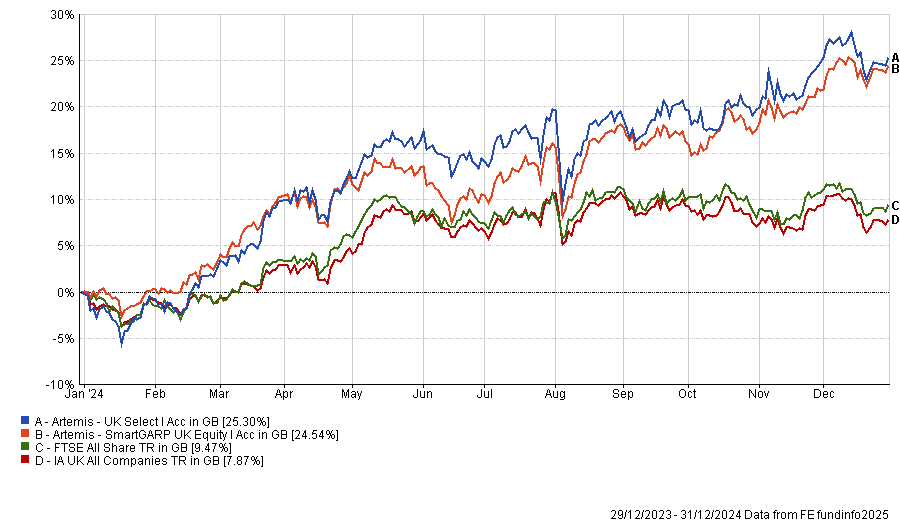

Performance of funds vs sector and benchmark in 2024

Source: FE Analytics

Based on this criteria, the second most skilled UK stock picker in 2024 was Philip Wolstencroft, who achieved a 2.4 information ratio on his Artemis SmartGARP UK Equity fund. Much like its stablemate, the fund posted top-quartile results over the past one, three, five and 10 years.

It came in second last year with gains of 24.5%, its third year out of four when the fund sat among the top five performers in the peer group.

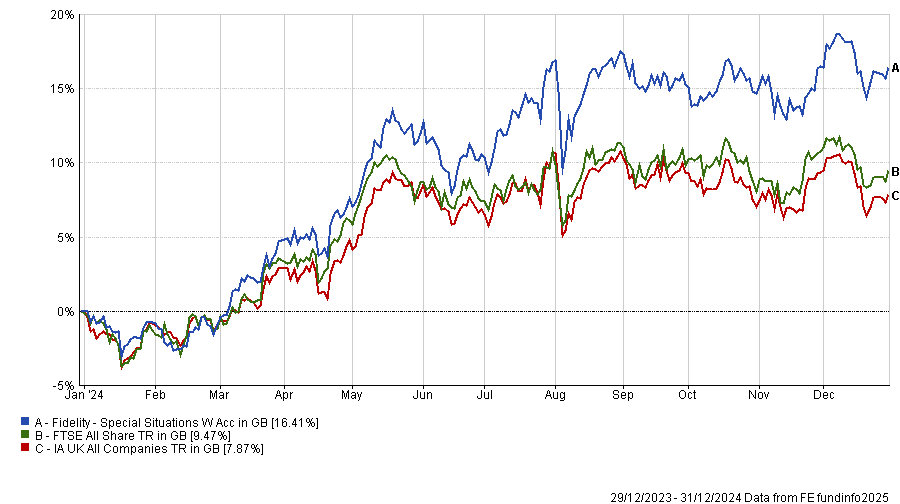

Elsewhere, Alpha Manager Alex Wright and Jonathan Winton were the third-best UK stockpickers last year, with an information ratio of 1.9 on the Fidelity Special Situations fund, despite the portfolio making the seventh-highest returns in the sector.

The fund also has an impressive record over the decade, up 104.4%, and has produced top-quartile results over one, three and five years, gaining it a place on the Square Mile Academy of Funds, with analysts highlighting Wright and Winton's "contrarian mindset" to stock selection.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

Square Mile analysts explained, while the fund is tilted towards small- and mid-caps, is different from its peers thanks to the managers’ willingness to search for opportunities in overseas listed companies.

They concluded: “Ultimately, there is a lot to like here, especially in the fact that the manager [referring to Wright] has remained consistently true to his investment style”.

However, they reminded investors its contrarian style towards stock selection can “significantly impact returns” and so is a fund more suited to investors with a high-risk tolerance and a long-term term time horizon.

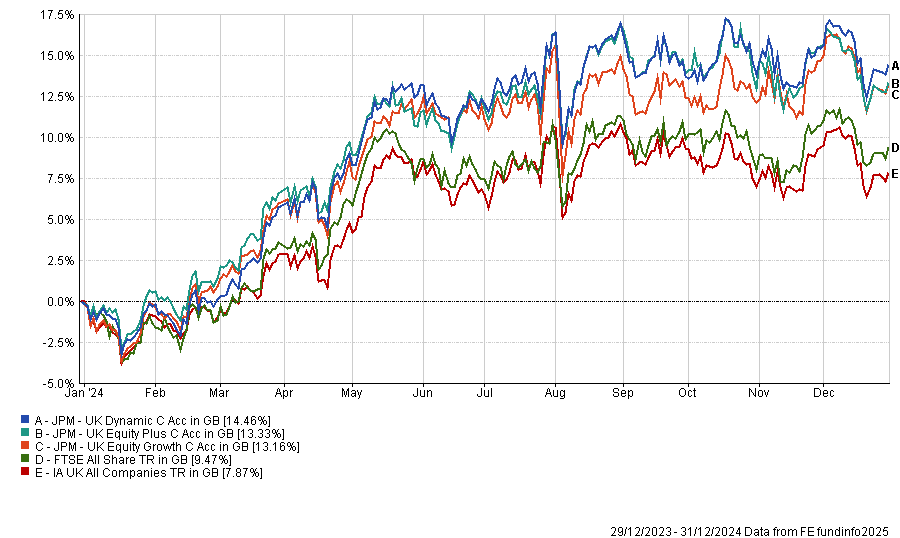

While several other funds achieved a strong information ratio last year, three JP Morgan strategies stood out: the JPM UK Dynamic, JPM UK Equity Growth and JPM UK Equity Plus fund. The funds made between 13.2% and 14.5% and were between the 11th and 15th best performers in the peer group in 2024.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

The best of the three in 2024 was JPM UK Dynamic, up by 14.5%. Managed by Jonathan Ingram, Blake Crawford and Victoria Helvert, it achieved an information ratio of 1.42.

However, for long-term performance Alpha Manager Guy Anderson’s JPM UK Equity Growth pipped it, up 96% over 10 years versus an 87.5% gain for the UK Dynamic fund. Investors should note that Anderson has only been responsible for the fund since 2021.

Several other funds achieved an interview ratio of higher than 1 last year, including: Ninety One UK Special Situations, Polar Capital UK Value Opportunities and JOHCM UK Growth.