Growth investing has been the dominant style in most major markets, headlined by the US where the Magnificent Seven technology companies have been propelled to new heights on the back of an artificial intelligence (AI) wave.

But in the UK this has not been the case. Over the past five years, the value style has come out on top, with the MSCI United Kingdom Value index beating the MSCI United Kingdom Growth index by almost 12 percentage points during this time.

There are many reasons for this. The UK is home to several large banks, which have benefited from interest rate rises, and oil and energy stocks that have shot higher as geopolitics forced the oil price to jump. It also lacks the big tech giants that can be found elsewhere.

For this reason, investors might want to look at value managers when investing in the domestic market. As such, below Trustnet asked fund pickers which strategies they would choose.

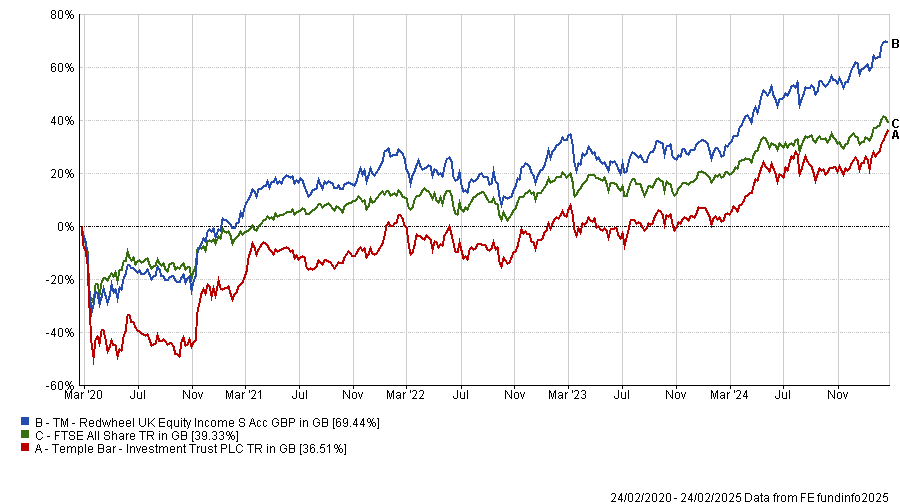

Redwheel and Temple Bar

Bestinvest’s preferred options are TM Redwheel UK Equity Income and its sister investment trust, Temple Bar. Both are managed by Nick Purves and Ian Lance.

Performance of fund and trust vs benchmark over 5yrs

Source: FE Analytics

Purves and Lance seek out companies that appear cheap compared to their intrinsic value. They look for long-term earnings potential, strong balance sheets and capable management teams, said Jason Hollands, managing director of Bestinvest.

“They are attracted to businesses or sectors that have undergone some short-term price dislocation. An example of the latter is banking. The team backed banks in early 2023 when the market had a wobble on the back of problems at Silicon Valley Bank and Credit Suisse. It owns positions in Barclays, Natwest and Standard Chartered, which have generated very handsome returns since,” he explained.

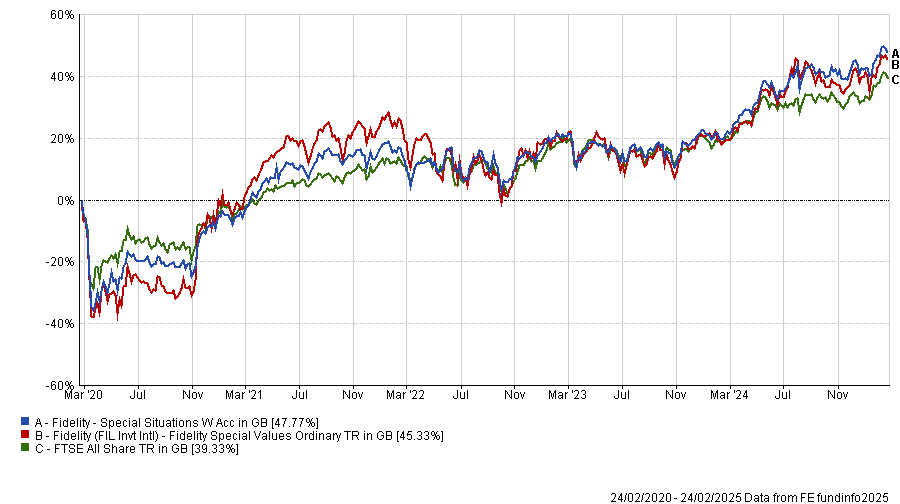

Fidelity Special Situations and Special Values

Another strategy Hollands likes is investment trust Fidelity Special Values, which he suggested for investors who want greater small and mid-cap exposure. It only has about 37% in large-cap stocks.

It is managed by FE fundinfo Alpha Manager Alex Wright and Jonathan Winton, who take a contrarian approach, picking out-of-favour companies they believe are mispriced, with comeback potential the wider market has yet to appreciate.

Catalysts can include new management, turnaround plans or takeover potential, Hollands said. They also pay a lot of attention to downside risks when investing in new companies.

Performance of fund and trust vs benchmark over 5yrs

Source: FE Analytics

Ben Yearsley, director of Fairview Investing, also likes both the Fidelity and RedWheel management teams. He highlighted Temple Bar alongside Fidelity Special Situations, Wright and Winton’s open-ended fund.

“The bit that links the two is the quality of the management. On both funds, the managers have a clear process and idea about the type of stocks they are looking for. They don’t deviate even if they are out of fashion for a period,” he said.

Schroder Recovery and Schroder Income

Perhaps the biggest shake-up in the UK value space in recent years was the resignation of Jupiter Asset Management’s Ben Whitmore, who left to set up his own firm called Brickwood Asset Management, poaching Schroders’ Kevin Murphy to join him.

Quilter Cheviot Investment Management has used Schroder Recovery for most of its UK value exposure for many years. After Murphy joined Brickwood, Nick Kirrage, who previously managed Schroder Recovery alongside Murphy, returned to the fund.

Quilter Cheviot reviewed the portfolio and decided to remain invested because its deep value philosophy, investment process and holdings have not changed and there is still a large team behind the fund, said Matt Ennion, head of investment fund research. “We’ve always seen it as a team approach.”

In a similar vein, FE Investments has kept faith with Schroder Income. UK fund analyst Jack Driscoll said he was reassured by Kirrage’s return given that he, like Murphy, was a founding manager of the fund and co-head of the global value team.

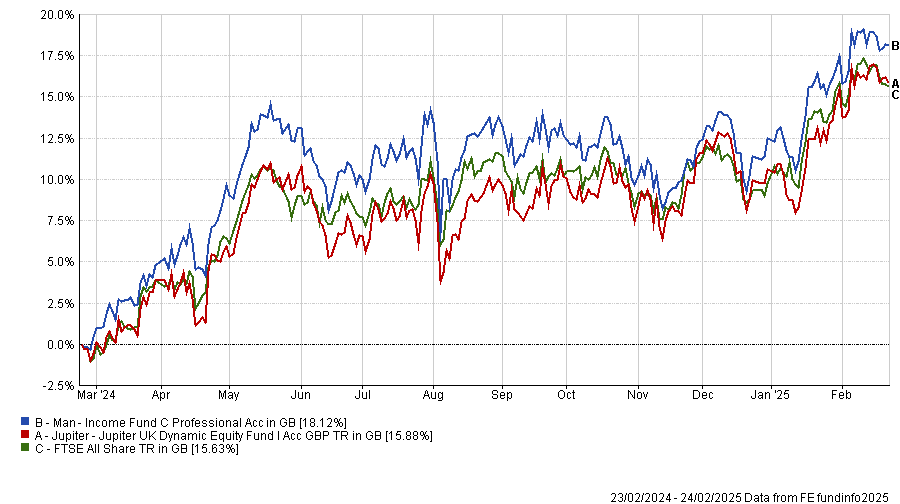

Man Income

AJ Bell had invested with Whitmore at Jupiter but after he left, the firm moved most of its active UK value holdings into Alpha Manager Henry Dixon’s Man Income fund.

Paul Angell, AJ Bell’s head of investment research, said: “To date, this has proved a positive switch for us with the Man fund outperforming both the FTSE All Share and the Jupiter UK Dynamic Equity fund over the subsequent period.”

Performance of funds vs benchmark over 1yr

Source: FE Analytics

Angell described Dixon as “highly pragmatic and analytical”. “Dixon seeks out undervalued and unloved companies through identifying two types of stocks – those trading below their replacement cost and those where the market appears to be undervaluing its profit streams,” he noted.

“Given the focus on generating income, all stocks held must have a yield in line with the market and to avoid value traps, the manager additionally focuses on a firm’s cash, cash flow and assets.”

FE Investments also holds Man Income, which has an even higher dividend yield than Schroder Income, according to Driscoll.

Man Income is “more exposed to ‘smid’-cap companies than Schroder Income, which has proved to be a hindrance in environments when the FTSE 100 is seeing the dominance that it is currently”, he noted.

“But with Dixon running a robust process since 2013, the fund has landed firmly in the first quartile of performers in the IA UK Equity Income sector over the past one, three and five years, as well as in each of the past three years individually.”

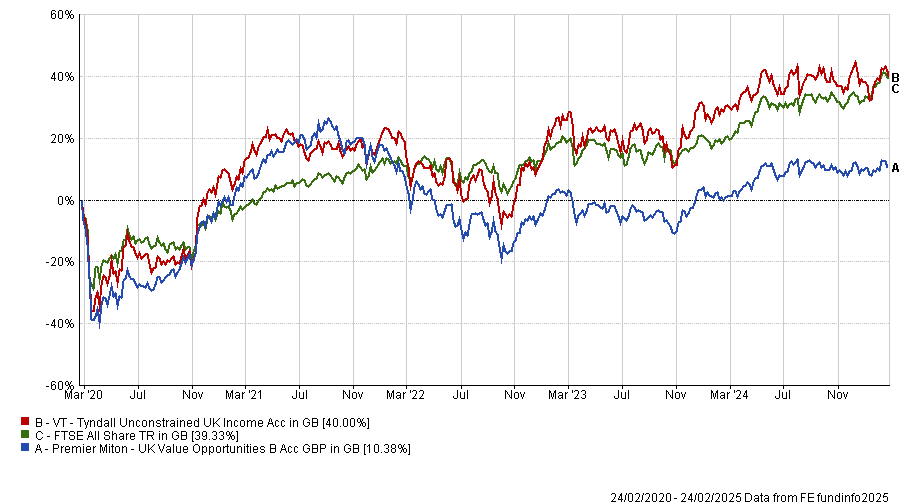

Premier Miton, Tyndall and Dowgate

Simon Evan-Cook, fund manager at Downing Fox, uses a different roster of UK value funds: Matthew Tillett’s Premier Miton UK Value Opportunities; Simon Murphy’s Tyndall Unconstrained UK Income; and Adam Rackley’s Dowgate Cape Wrath Focus.

He described Tillett as “a highly talented stockpicker, who has the ability – and willingness – to go wherever in the UK market offers the best opportunities”.

Meanwhile, Tyndall Unconstrained UK Income offers pure-play exposure to UK mid-caps, but with a value bias. “We like the fact Murphy is an experienced investor, who has found a home at a supportive boutique where he can be genuinely long-term in nature, and the strong performance since he took charge is testament to this new focus,” Evan-Cook said.

Performance of funds over 5yrs

Source: FE Analytics

Finally, Dowgate Cape Wrath Focus is a small-cap value fund led by a talented manager in Rackley, who “has the right process and temperament to make some exceptional alpha”, Evan-Cook concluded.