Multi-asset funds from BNY Mellon and Royal London Asset Management proved to be some of the most consistent funds over the past 10 years, data from FE Analytics has shown.

Despite a tumultuous decade in which multi-asset funds suffered through a global pandemic and sudden bear market in 2022 when both equities and bonds declined, certain funds withstood it all to deliver consistent outperformance.

For this study, we have assessed consistency by comparing funds' annual performance to their sector average, due to a lack of a common benchmark for multi-asset funds.

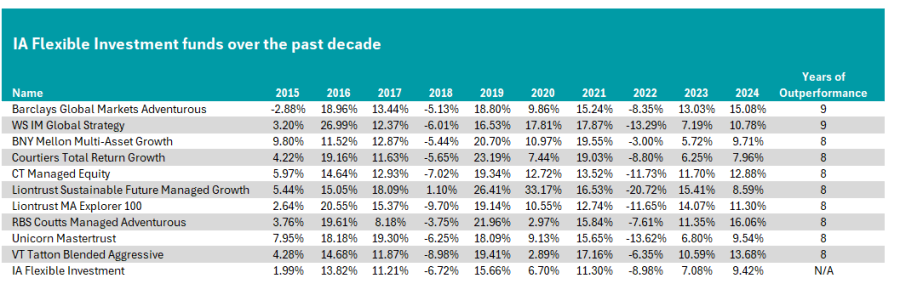

IA Flexible Investment

Starting with the most adventurous sector, no fund in the IA Flexible Investment sector beat their average peer in every year over the past decade.

However, the Barclays Global Market Adventurous and WS IM Global Strategy funds came close, beating the sector in nine of the past 10 years. These funds are up 119.6% and 129.7%, respectively, over 10 years but are both relatively small with less than £200m in assets under management.

Source: FE Analytics

If we broaden our scope to include funds that beat the IA Flexible Investment average in eight years, several more funds qualified.

One notable example was BNY Mellon Multi-Asset Growth, managed by Simon Nichols, Bhavin Shah and Paul Flood, which recently received an A rating from Square Mile.

Despite lagging the sector in 2016 and 2023, it was the fifth best-performing fund over the past 10 years and maintained top-quartile results over three and five years.

Square Mile analysts praised the team for their “conviction-driven approach, the experience and tenure of the lead manager and the well-regarded global analysts” and for delivering consistently strong results.

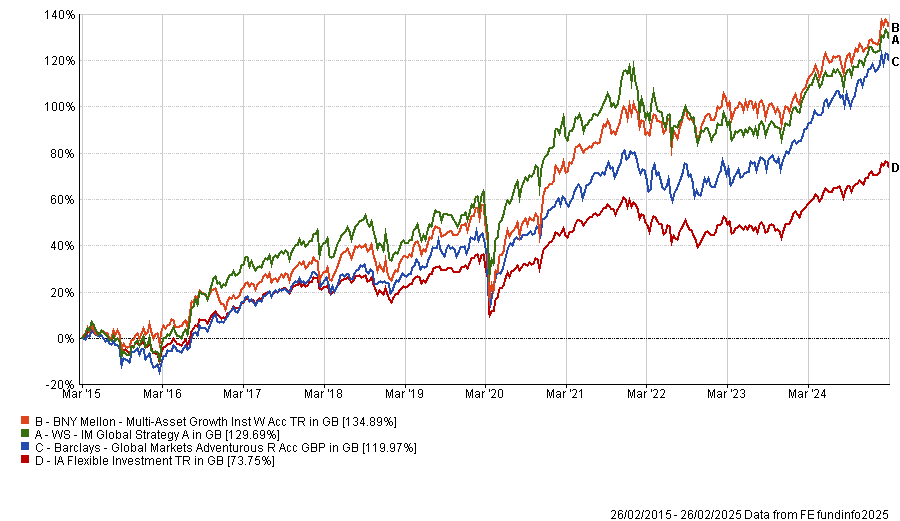

Performance of funds vs the sector over 10yrs

Source: FE Analytics

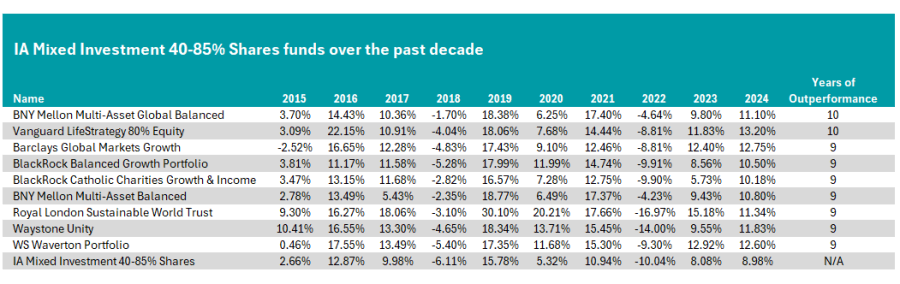

IA Mixed Investment 40-85%

Moving to the medium risk sector, two funds proved their consistency by beating the average IA Mixed Investment 40-85% Shares fund every year for the past decade.

The first was the Vanguard LifeStrategy 80% Equity fund, which invests in the firm’s funds to create a portfolio of roughly 80% stocks and 20% bonds. Over the past 10 years, it is up by 120.4%, the fifth-best performance in the sector.

Source: FE Analytics

Analysts at Square Mile hold the strategy in “high regard” for being one of the “simplest and cheapest ways for investors to obtain exposure to global equity and bond markets”, which makes it highly appealing to investors. Indeed, it was the most purchased multi-asset portfolio last year.

The other strategy which consistently outperformed competitors was another from Nichols’ team, the BNY Mellon Multi-Asset Global Balanced fund, which climbed by 120.5% in the past 10 years.

If we extend our view to include funds which beat the market in nine of the past 10 years, its larger sibling, the £3.5bn BNY Mellon Multi-Asset Balanced fund, also qualified, only faltering against the sector in 2017.

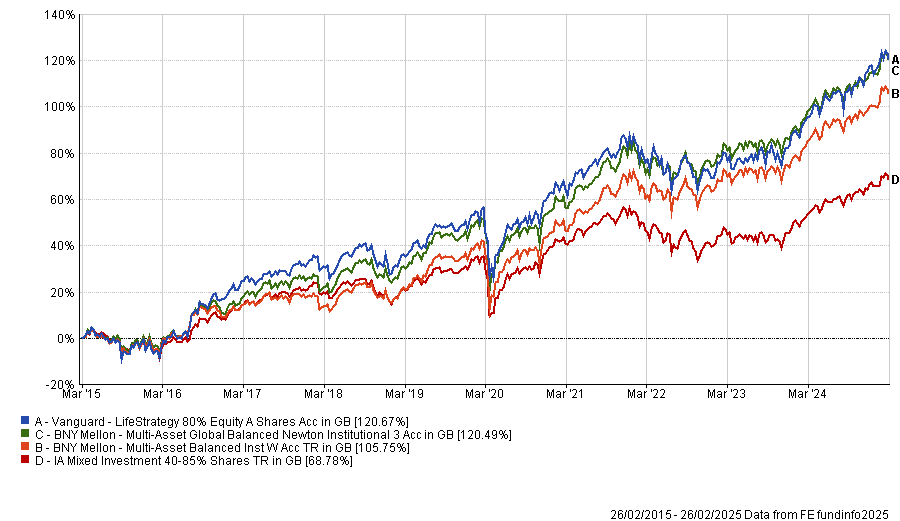

Performance of funds vs the sector over 10yrs

Source: FE Analytics

Analysts at Hargreaves Lansdown said: “Nichols is a naturally conservative investor, which typically leads his multi-asset funds to not fall during market sell-offs as much as peers.” They also praised the strategy for “keeping pace during market rallies”.

Several other funds, such as FE fundinfo Alpha Manager Mike Fox’s Royal London Sustainable World Trust, as well as the portfolio also beat the average balanced fund in nine out of 10 years.

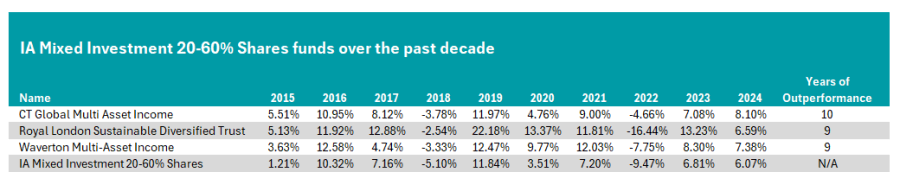

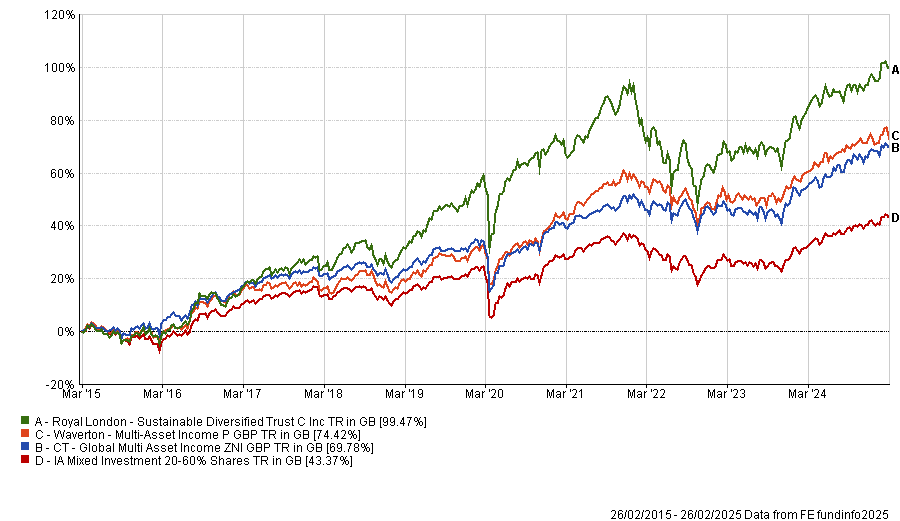

IA Mixed Investment 20-60% Shares

For more cautious investors, the only fund in the IA Mixed Investment 20-60% peer group to beat the sector average consistently was the CT Global Multi-Asset Income fund.

Managed by Ben Rodriguez, it was up 69.8% over the past 10 years, the seventh-best result in the peer group. However, Rodriguez has only managed the fund since 2022 and so cannot be held entirely responsible for this long-term performance.

Source: FE Analytics

While just one strategy beat the sector in 10 years, two more outperformed over nine years. The first was another strategy from the Royal London team – the Royal London Sustainable Diversified Trust.

Despite underperforming the sector average in 2022, when rising inflation and interest rates led to negative performance for bonds and equities, it was up by 99.5% over 10 years, which was the sector’s best total return.

Performance of funds vs the sector over 10yrs

Source: FE Analytics

The £436m Waverton Multi-Asset Income fund also stood out, with the third-best result in the sector over the past 10 years, despite underperforming in 2017.

Analysts at FundCalibre credited the fund for its “collegiate approach and focus on managing downside risk”. They said the team's willingness to invest in assets such as infrastructure and renewables brought “true diversification” to the portfolio and ensured returns were linked to inflation.

IA Mixed Investment 0-35%

Finally, in the IA Mixed Investment 0-35% shares sector, the Royal London Sustainable Managed Growth Trust was the most consistent strategy of the decade, beating its average competitor each year and delivering the sector’s best 10-year performance of 51.5%.