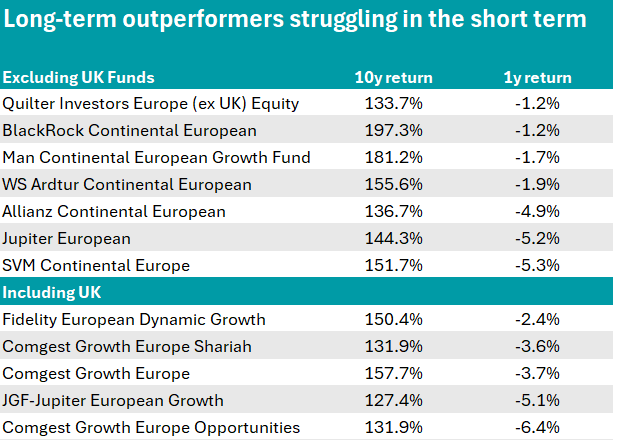

Europe is in a difficult place on the world stage at the moment and some 12 funds are finding it similarly hard to emerge to the fore in the IA Europe Excluding UK and IA Europe Including UK sectors despite former successes.

No manager can outperform forever, but the past 12 months have been particularly harsh on many known names in the market.

We begin with the Jupiter European and JGF-Jupiter European Growth funds, down 5.1% and 5.2%, respectively. The former has gone from the first quartile of relative performance against the IA Europe excluding UK sector over 10 years to a consistent fourth quartile return over shorter time frames.

FE fundinfo Alpha Manager Mark Heslop and Mark Nichols, who have run the fund since Alexander Darwall left the firm to set up Devon Equity Management in 2019, will be replaced by Alpha Manager Niall Gallagher and his team from GAM Investments, who will move over in the summer.

Source: Trustnet

In the list of IA Europe Including UK fund, the €2.4bn Fidelity European Dynamic Growth portfolio is following a similar downward pattern. Manager Fabio Riccelli is a stockpicker with a growth bias, who runs the fund with a completely bottom-up approach.

The 52 positions in the fund (including Experian at 6.6%, Relx at 6% and Germany’s SAP at 4.6%) were selected for their long-term growth potential that is mispriced by the market.

This doesn’t mean Fidelity’s Europe team is wholesale struggling, with Fidelity European recently added by interactive investor to its best-buy list.

Another long-term success story struggling more recently is BlackRock Continental European, run by Alpha Manager Giles Rothbarth, who focuses on growth companies, mainly large-cap.

RMSR analysts consider it a “good, solid core” European equity fund focusing on sustainable cash returns and unique franchises, with top holdings including Novo Nordisk (7%), ASML (6%) and Hermes International (5.8%).

Its good fortunes over 10 and five years, when it was a top-decile fund in the IA Europe excluding UK sector, faded over three years when it fell to the third quartile and over one year when it sank to the sixth-worst position in the whole sector with a 4.3% loss against the 11% rise of its benchmark, the FTSE World Europe ex UK index.

Its income sibling, the BlackRock Continental European Income fund is among the 20 funds recommended by most best-buy lists in 2024.

Also falling down the rankings is Comgest, which had a tough 12 months with three strategies showing up in the list above. Alpha Manager Franz Weis has been on the managing team of all three since 2009 and achieved good 10-year returns, which have softened more recently.

Over the past 12 months, as the MSCI Europe index has risen 12.1%, Comgest Growth Europe and Comgest Europe Opportunities lost 5.1% and 8.7%, respectively.

But the list of struggling Alpha Managers goes on. Rory Powe’s Man Continental European Growth fund has been the fifth-best performer in the then 96-strong sector over the past 10 years but sits in123rd position out of 130 vehicles over one year.

The £867.1m portfolio, concentrated in 24 positions, is ranked by FE Investments analysts for its punchy way of investing in the European market.

“Since Powe took over the fund in 2014, he has significantly outperformed its benchmark and has done so consistently due to his excellent stock selection through a cycle. The fund has struggled in periods where cyclical and cheaper parts of the market outperform, such as in the last quarter of 2016 and the first half of 2021. The fund’s growth bias leads to interest rate sensitivity, which caused strong underperformance as inflation and interest rates rose in 2022,” they said.

“We like the concentration feature of the portfolio, which however can lead to greater volatility if several of its companies fall at the same time. The fund has been a consistent performer through time but is best suited to a patient, long-term investor as it will be subject to bouts of volatility.”

The Quilter Investors Europe (ex UK) Equity, WS Ardtur Continental European and SVM Continental Europe funds concluded the list.

This article is part of an ongoing series. Previous instalments include: global emerging markets, UK small-caps, IA UK All Companies and IA Asia Pacific Excluding Japan.