Political stability, reliable application of the rule of law and robust regulatory structure are the three elements that investors seek from an emerging market. This principle was popularised by Mark Mobius, sometimes referred to as the godfather of emerging market investing, who would only invest when he could observe these three factors, among others.

Yet each of these elements is under threat in Donald Trump’s US, according to Brian Dennehy, managing director of FundExpert. In his weekly newsletter, he was worried by the head of the Department of Government Efficiency (DOGE) Elon Musk calling for a “wholesale removal of regulations”, among other things.

“If those three elements were still evident, most investors would act unsentimentally and overlook personal repugnance of Trump. But in this new presidency, we seem to be way beyond that point and concerns abound about US debt, distrust of American leadership, geopolitical risks and the global shift away from the dollar,” he said.

“The dismantling of protections introduced after the 2008 financial debacle have already begun. Trust in the US government to meet its commitments, whether within the US or globally, is fundamentally blown away.”

Jacob de Tusch-Lec, manager of the Artemis Global Income fund, didn’t go as far as to say that the US is riskier than other markets on a relative basis.

“I’m wary of anyone who says the US is like an emerging market now. You still have property rights in place and a government that is collecting taxes. If you read the headlines, you might think the US is falling apart, but there are still lots of adults in the room and we have to be very careful not to overestimate the amount of actual change going on,” he said.

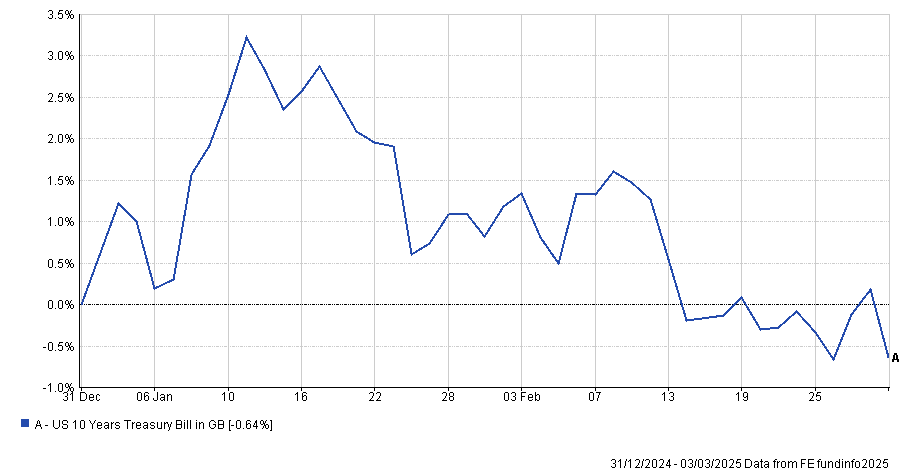

If 10-year US treasuries are a good proxy for country risk, the yield decline over the year to date suggests people are still happy lending to the US government and that the US risk premium has actually gone down, the manager noted.

However, shorter-maturity yields have been trading below 4% this week for the first time since October, as economic growth concerns intensified. De Tusch Lec admitted that the US is riskier in absolute terms.

“Lower yields are driven by a higher probability of an ‘accidental recession’ which in turn could be blamed on recent DOGE policy initiatives leading to lower consumer confidence and companies holding back on near-term investments due to uncertainty,” he said.

Performance of index over the year to date

Source: FE Analytics

The growth-focused US market is the highest allocation in the Artemis fund but represents less than half its share of the MSCI AC index.

Emerging markets are a bigger relative allocation, especially China, which is favoured for its cheapness and some optionality on a “less bad” domestic economy, the manager explained. That said, the overweight to emerging markets was also influenced by the new US administration.

“In a world of tariffs and deglobalisation, where it’s no longer possible for everyone to trade with everyone else, you need companies to fill the gaps. Chinese auto manufacturers have become the main supplier of electric vehicles for emerging markets, replacing Tesla and German manufacturers,” De Tush-Lec said.

“Similarly, once you might have bought European luxury goods producers to get exposure to the wealthy Chinese market, but with the Chinese middle classes increasingly wanting to buy Chinese products, you need more local companies.”

For Alessandro Dicorrado, manager of the Ninety One Global Special Situations fund, the Mobius principles apply to emerging markets because they have companies that are mostly domestic, meaning investors can get hurt by the currency very quickly, as well as by a spiralling political instability hitting the local economy.

Many US companies are not only globally diversified by revenues, but also global leaders in their businesses, which makes a difference to Dicorrado.

“While Trump and Musk seem bent on removing plenty of the checks and balances on which the US was built, they haven't done so yet. It is quite possible they will hit resistance, and it appears, by the behaviour of some republicans and by falling approval numbers, that we may already be there,” he said.

“Plus, the dollar is still the reserve currency of the world, so you have to mess with it much harder to turn it into an emerging market currency. Overall, yes, I am worried, but I am not sure we should jump straight to the bear case with this.”