Stockpicking is an exceptionally difficult skill to master and it was even more so last year, with 2024 registering as the worst year for active managers in a decade. But there were still some active managers able to outperform.

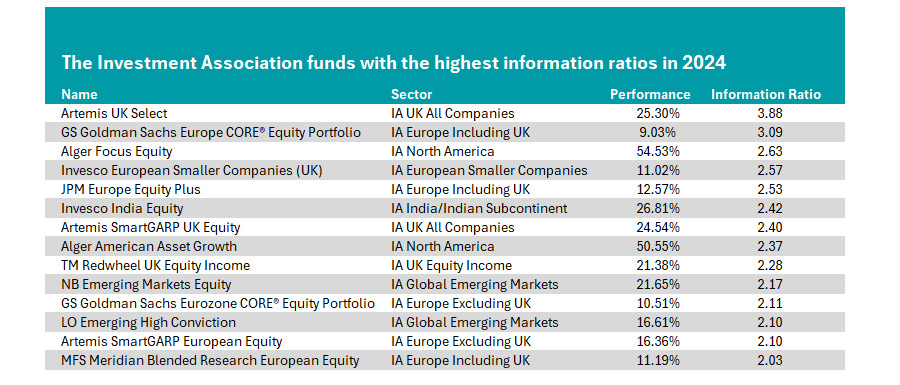

Below, we looked the funds in the Investment Association universe to determine who the most skilled stockpickers of 2024 were overall. In total, 14 funds achieved an information ratio of more than two last year, indicating significant stock-picking skill.

Some fund houses were home to several exceptional active managers, with three Artemis funds achieving best-in-class information ratios in their respective sectors, while close behind were Invesco, Goldman Sachs and Alger, with two strategies being recognised for their managers’ skill.

Source: FinXL

UK

As a recent Trustnet study found, Ed Legget and Ambrose Faulks’ Artemis UK Select and Philip Wolstencroft’s Artemis SmartGARP UK Equity fund had some of the highest information ratios among actively managed funds in 2024.

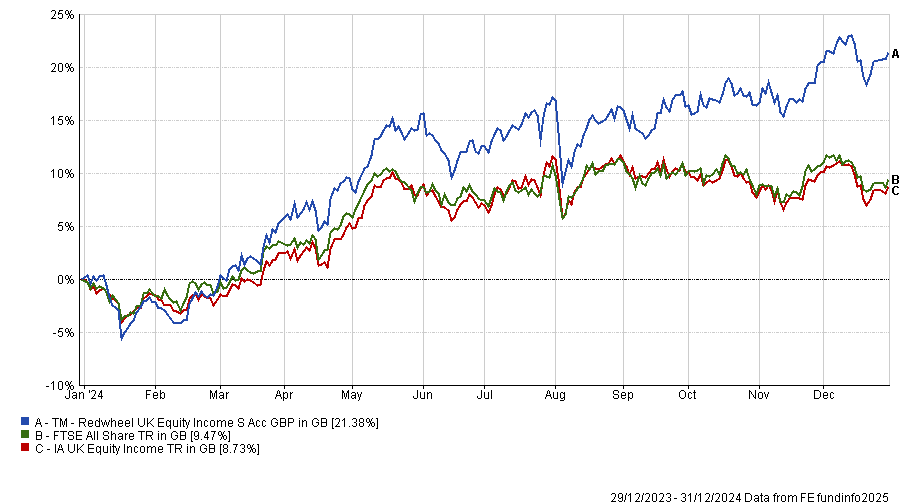

However, they were not the only UK managers who proved their skills. Ian Lance and Nick Purves’ Redwheel UK Equity Income fund paired a return of 21.4% with an information ratio of 2.28 in 2024, the best result in the IA UK Equity Income sector.

The fund also has an impressive record over wider timeframes, with top-quartile returns in the sector over the past three and five years.

Performance of fund vs sector and benchmark in 2024

Source: FE Analytics

This strong performance makes the fund a popular choice for analysts at Bestinvest, who praised Lance and Purves for a “strong and clear philosophy” and “repeatable and methodological approach”, allowing the fund to avoid value traps that might trip up competitors.

North America

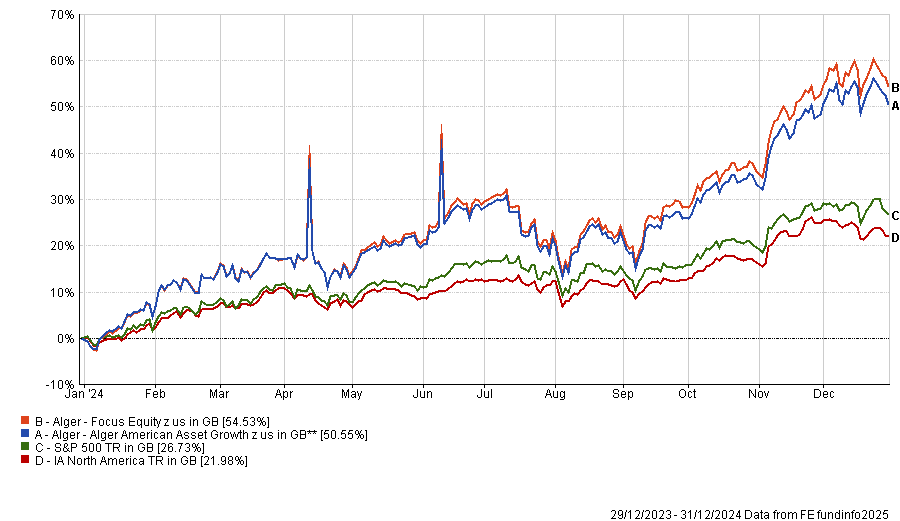

Despite the average IA North American fund having a negative information ratio last year, two portfolios led by FE fundinfo Alpha Managers Patrick Kelly and Ankur Crawford achieved supranormal returns through skilled stockpicking: the Alger Focus Equity and Alger American Asset Growth funds.

Both performed well last year, rising 54.5% and 50.6%, the first- and third-best results in the IA universe. Additionally, both almost doubled the return of the S&P 500, which FE Investment analysts recently argued was notoriously difficult for active managers to beat due to the 5/10/40 rule of portfolio construction.

Performance of funds vs sector and S&P 500 in 2024

Source: FE Analytics

This outperformance can be explained by looking at their top 10 holdings, with both funds holding significant allocations to the Magnificent Seven (Microsoft, Nvidia, Apple, Tesla, Alphabet, Amazon and Meta), including overweighting top performers such as Nvidia and Microsoft.

Europe

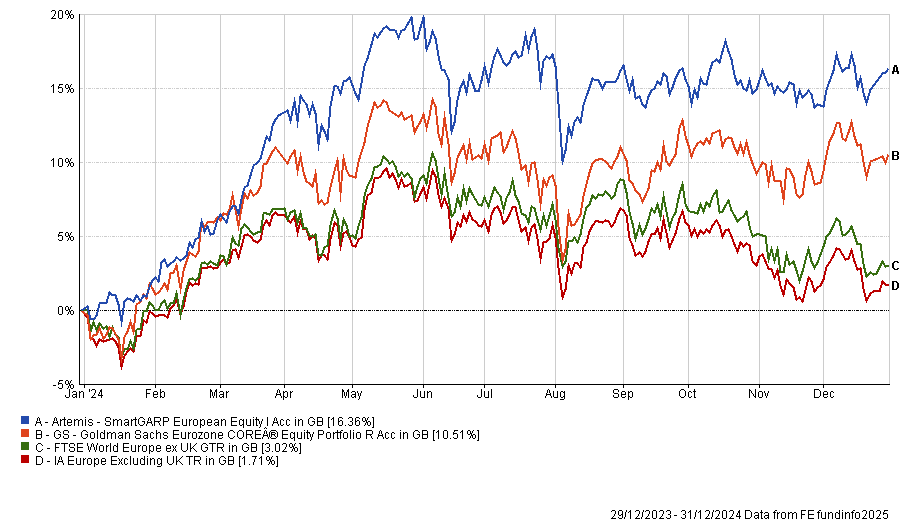

European stockpickers also proved their mettle last year. In the IA Europe excluding UK sector, Wolstencroft’s Artemis SmartGARP European Equity fund was the best-performing strategy by six percentage points and had an information ratio of 2.10. Its long-term record was also strong, beating the index in eight of the past 10 years, making it one of Europe’s most consistent strategies.

The Goldman Sachs Eurozone Core Equity portfolio also qualified, with a total return of 10.5% and an information ratio of 2.11. Its cousin strategy, the Goldman Sachs Europe Core portfolio, had the second-best information ratio in the IA Universe at 3.09, which it paired with an index-beating return of 9% in the IA Europe including UK sector last year.

Performance of funds vs sector and benchmark in 2024

Source: FE Analytics.

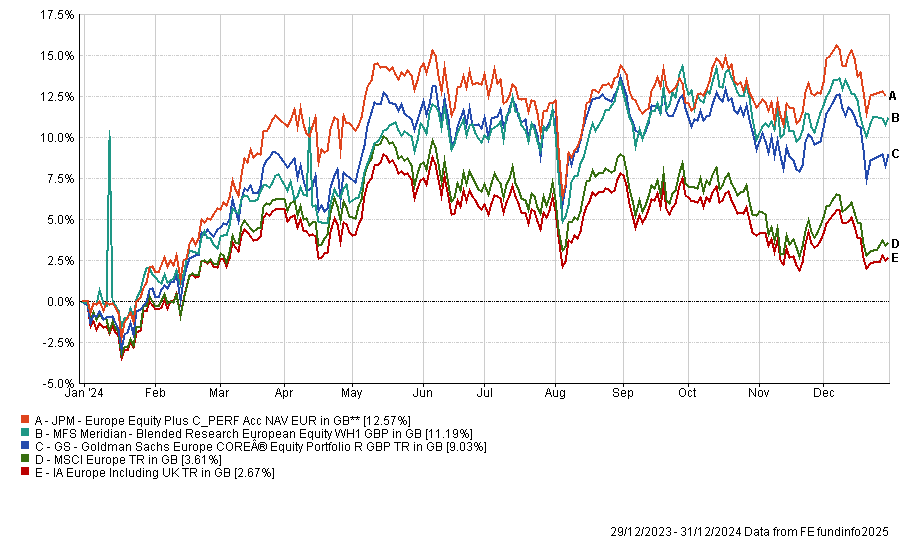

Two more funds in the IA Europe including UK sector, qualified: JPM Europe Equity Plus and the MFS Meridian Blended Research European Equity.

The former delivered an information ratio of 2.53 and a total return of 12.6% last year, while the latter posted an information ratio of 2.03 and an 11.2% return.

Performance of funds vs sector and benchmark in 2024

Source: FE Analytics.

One smaller companies fund also qualified: Alpha Manager James Matthew's Invesco European Smaller Companies (UK) fund, which rose by 11% in 2024, had an information ratio of 2.57, the fourth highest in the IA universe.

Emerging Markets and India

Elsewhere, one emerging market fund matched our criteria – the LO Emerging High Conviction fund. Managed by Ashley Chung, Faye Gao and Wee Jia Low, it climbed 16.6% in 2024 and posted an information ratio of 2.10, despite the negative average information ratio of global emerging market funds last year.

This was the second-best performance in the sector, a remarkable turnaround from its status as a former long-term underperformer.

Finally, Shekhar Sambhshivan proved to be the most skilled stockpicker in the IA India/Indian subcontinent sector last year. In a market where the average fund had an information ratio of 0.77, Sambhshivan’s Invesco India Equity fund went above and beyond, delivering a top-quartile performance of 26.8%, along with the sixth best information ratio in the wider universe.