Becoming an ISA millionaire is no mean feat. To do so, investors would have likely had to maximise their allowance in most, if not all, years since the inception of the tax wrapper in 1999.

There were 4,850 ISA millionaires by the end of the 2022 financial year, the latest figures available. As of last month, 1,607 ISA accounts with more than £1m invested with interactive investor (ii), the UK’s second-largest investment platform.

Myron Jobson, senior personal finance analyst at the firm, said: “The not-so-secret recipe for building a seven-figure ISA portfolio is patience. The fact that the average ISA millionaire is 73 years old underscores a simple truth: time in the market is key to building long-term wealth.”

To become an ISA millionaire from here, ii calculated how much first-time investors at different ages need to invest each year to reach the magic number by age 65. The assumptions are 5% annual investment growth, contributions increasing by 2% per year and investments made at the start of each year.

A 25-year-old would need to invest £6,000 in the first year, increasing contributions annually by 2%, leading to total contributions of £362,400 over time. This rises to an initial contribution of £11,400 by age 35 and £16,400 for a 40-year-old.

Those above the age of 42 would be required to contribute more than the permitted ISA allowance to become a millionaire by 65.

Jobson said: “Time in the market is your best friend when it comes to building wealth. The sooner you start investing, the more you can harness the power of compounding returns, making it significantly easier to reach the coveted ISA millionaire status.

“Consistency is key – regular contributions, even modest ones, can snowball over the years into a substantial pot, especially with the generous tax benefits ISAs offer.”

But longevity and consistently saving each year is only half the battle. The other part is picking the right investments that can increase your cash pot to the magic million-pound figure.

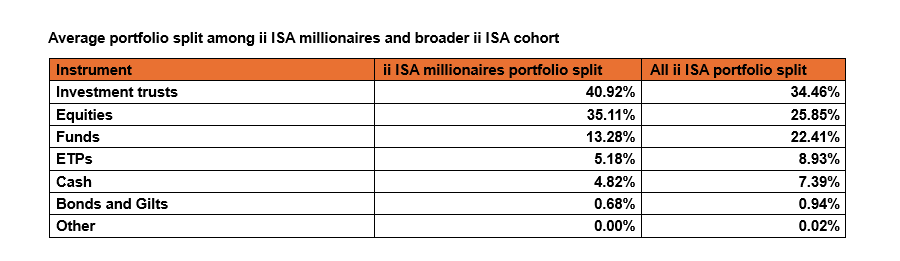

So how do ISA millionaires invest? Investment trusts, stocks and funds are the among ii’s ISA millionaires – but their portfolio weightings differ significantly.

Investment trusts are the most popular option, making up some 41% of an average million-pound ISA. Direct equities are second at 35%, while open-ended funds are third with just 13%. Cash holdings and exchange-traded funds (ETFs) – both at around 5% – round out the list.

Source: interactive investor

The most popular investment for ISA millionaires is Alliance Witan. The £4.8bn trust, headed by Craig Baker, Mark Davis and Stuart Gray, employs external managers to run different sleeves of the portfolio.

GQG Partners has the largest portion (18% of assets), while Veritas (15%), Sustainable Growth Advisers (11%) and Metropolis Capital (10%) all have double-digits allocations.

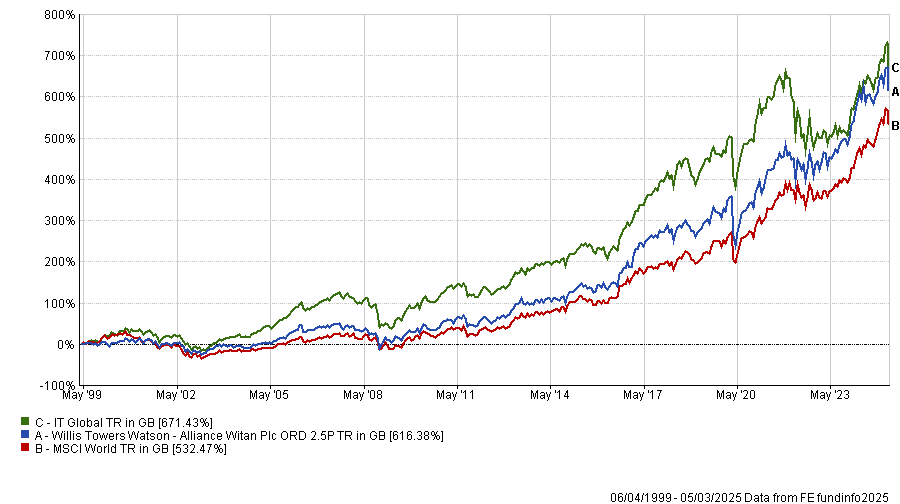

Since the invention of ISAs on 6 April 1999, the trust has made investors 616%, more than 130 percentage points ahead of the MSCI World index, although slightly behind the average peer.

Performance of trust vs sector and benchmark since April 1999

Source: FE Analytics

In second place is Scottish Mortgage, which may have pulled the whole peer group’s performance upwards since ISAs were created. It has made a lot of money for investors over the past two and a half decades, up 1,759.6% since 6 April 1999.

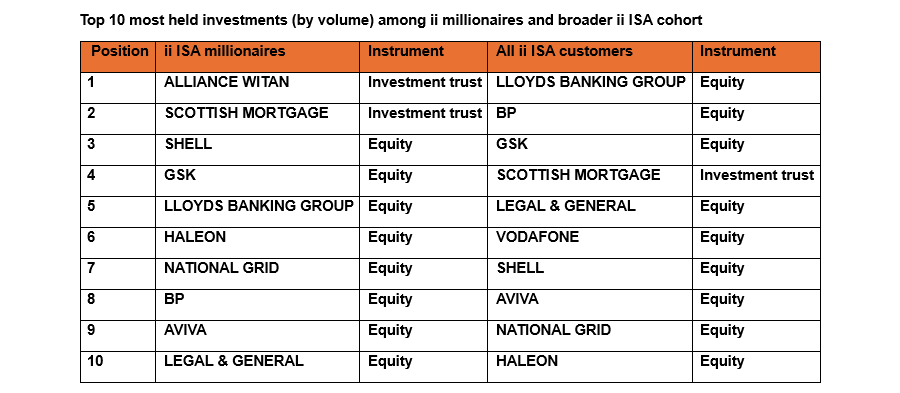

These allocations are starkly different to the general ISA investor, however. Scottish Mortgage places fourth on that list, as the below table shows, while Alliance Witan is nowhere to be seen among the top 10.

For ISA millionaires, the remainder of the top 10 are individual UK companies, with oil giant Shell, pharmaceutical titan GSK and domestic banking firm Lloyds rounding out the top five.

Source: interactive investor

Richard Hunter, head of markets at ii, said the key for most investors is compounding – the effect of an initial lump sum plus interest earned.

“Over time, compound interest becomes an increasingly powerful engine of growth, leading Albert Einstein to describe the phenomenon as the eighth wonder of the world,” he said.

“This is certainly not lost on our ISA millionaires, whose portfolios are littered with high-yielding shares which support this narrative.”

Examples of companies with high yields among the top 10 include Legal & General (dividend yield 8.4%), Aviva (6.6%), BP (5.7%), National Grid (4.8%), Lloyds Banking (4.4%) and Shell (4.1%).

“While some have also reaped the benefit of exposure to what has been a burgeoning tech sector in the US through Scottish Mortgage, the income theme is the one which clearly shines the brightest among these shrewd investors,” he concluded.