The end of the financial year is only a month away, giving savers limited time to make the most of their £20,000 ISA allowance. However, with so many choices available, investors may struggle to determine where the best opportunities are and what to look for in new additions to their portfolio.

Below, Trustnet asks experts to pick one fund they believe investors should consider for their ISAs ahead of the 5 April deadline. Suggestions ranged from UK equity income, global equity and Japan.

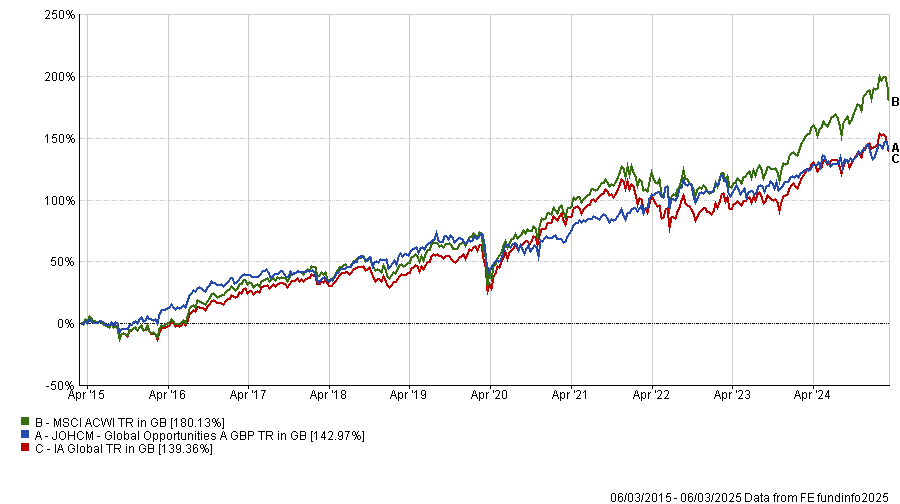

Rob Morgan, chief analyst at Charles Stanley Direct, identified JOHCM Global Opportunities as a compelling option.

Investors have “reaped the rewards” from growth stocks and technology funds in recent years due to the Magnificent Seven (Microsoft, Nvidia, Apple, Tesla, Alphabet, Meta and Amazon) dominating performance.

However, with these businesses now representing more than 25% of the MSCI World index, Morgan argued investors would benefit from adding a fund to their ISAs with a different approach. Indeed, the JOHCM portfolio has a distinct set of holdings in its top 10, with no appearances from the Magnificent Seven.

Morgan explained this differentiated portfolio construction was because managers Ben Leyland and Robert Lancastle are more cautious than many of their peers, prioritising capital preservation and businesses with strong balance sheets rather than chasing top performers.

As a result, it was one of the best funds in the IA Global sector at protecting investors from recent market drawdowns.

Performance of fund vs sector and benchmark over the past 10yrs

Source: FE Analytics

While this approach meant performance was “very different from market returns”, Morgan argued investors should not just pick winners for their ISAs.

He explained choosing recent top performers from different sectors gives an “illusion of diversification” but they are likely to share a similar investment style. “It may feel uncomfortable to invest in areas that are faring poorly but investments often move in cycles and when things turn around, you could be in the right place at the right time,” he added.

As a result, he concluded it was a strong pick for investors’ ISAs to complement more aggressive growth funds or trackers.

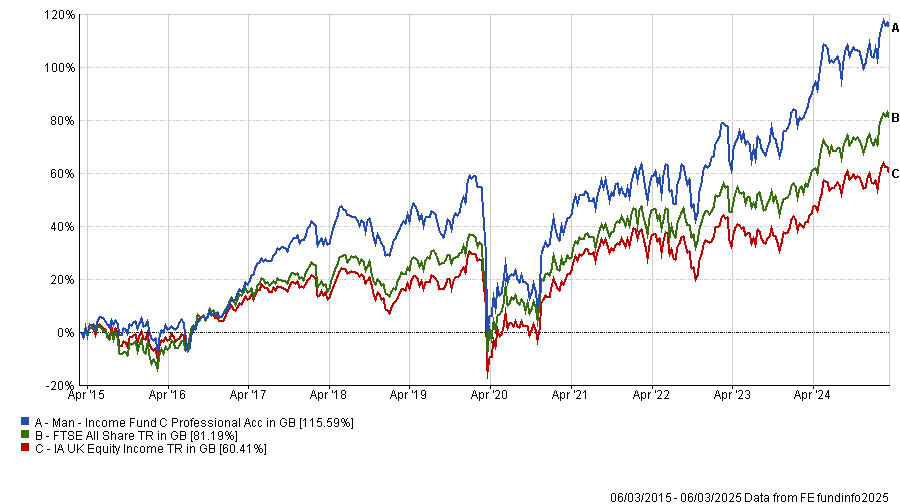

For UK investors wanting to stick to the home market, Paul Angell, head of investment research at AJ Bell, pointed to the Man Income fund.

Led by FE fundinfo Alpha manager Henry Dixon, the fund invests across the UK market cap spectrum, looking for “undervalued and unloved companies, of which there are plenty in the UK market at present”, Angell explained.

It primarily targets companies trading below their replacement cost (the amount of money a business spends to replace an asset) or those where the market undervalues their profit streams.

Angell praised Dixon for his “significant pragmatism” and “analytical mindset”, which has allowed him to guide the strategy through difficult market conditions. For example, it has delivered top-quartile returns in the IA UK Equity Income sector over the past three, five and 10 years, despite challenges such as the Covid-19 pandemic and a sudden, sharp bear market in 2022.

It paired this strong performance with a top-quartile yield in the sector, which was a result of its focus on stocks with strong dividend growth potential or a high yield.

Performance of the fund vs the sector and benchmark over 10 years

Source: FE Analytics

Angell concluded: “This is a very actively managed UK equity fund, which can diverge significantly from the index and have high levels of turnover.” While he conceded this meant the fund was prone to periods of volatility, he argued it was still an attractive play on the UK market, led by a very experienced manager.

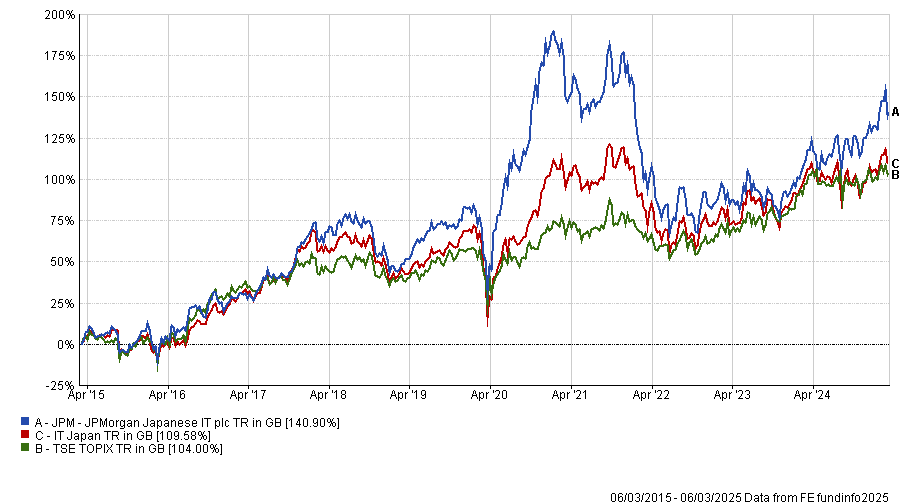

For investors with a higher risk tolerance, Tom Bigley, fund analyst at interactive investor, identified the JPMorgan Japanese Investment Trust as worthy of consideration.

“For investors who already hold a well-diversified portfolio with several core holdings, this would represent an adventurous position aiming to benefit from the innovative growth companies in Japan,” he said.

Bigley explained the portfolio is a “tried and tested strategy” targeting high-quality companies that compound over the long term, which allowed it to outperform the TSE Topix by more than 30 percentage points over the past 10 years.

Performance of fund vs sector and benchmark over the past 10yrs

Source: FE Analytics

Bigley praised the fund for its strong management team, supported by on-the-ground analysts, which gives the managers an advantage in stock selection that competitors may lack.

Additionally, he explained it was “competitively priced”, with a tiered management fee (meaning charges fall as asset levels rise), leading to an ongoing charge of 0.73% in the past financial year.

While he conceded the strategy was volatile, with performance having slid in 2021 when growth stocks fell out of favour, he argued it was a successful strategy “appropriate for those investors who have a large allocation to the US market and are seeking to increase exposure to other developed markets”.