Nvidia, AstraZeneca and London Stock Exchange Group are among the stocks that Hargreaves Lansdown’s equity research team considers attractive opportunities ahead of this year’s ISA deadline.

Derren Nathan, head of equity research at the investment platform, said: “There’s plenty of scope for uncertainty in the markets, as concerns circle around the trajectory for interest rates, restrictions on international trade and the sustainability of investment in artificial intelligence (AI).

“Despite this, we still believe that best-in-class companies with strong customer propositions and resilient business models are best placed to ride out fluctuations in the market and prosper over the longer term.”

Below, Hargreaves Lansdown’s equity research team highlights five companies that investors could consider adding to their ISA.

Airbus

First up is aircraft manufacturer Airbus. Its market is largely dominated by just two companies, with Airbus having about a 60% share and Boeing taking the other 40%.

However, Hargreaves Lansdown’s analysts think Airbus is well-placed to take even more market share from its rival following a dip in confidence in Boeing’s safety culture. This stems from two fatal crashes of its 737 MAX aircraft and last year’s Alaska Airlines’ midair blowout incident.

“We think recent events will see airlines place more orders with Airbus over the coming years, tilting the balance more in its favour. High barriers to entry also help keep outside competition at bay,” Nathan said.

Airbus’ backlog of commercial aircraft orders

Source: Airbus full-year reports

“Demand is strong as airlines try to upgrade their fleets after years of Covid-19 underinvestment. As a result, the order backlog swelled to 8,658 aircraft at the end of 2024. That’s more than 11x the number of planes Airbus managed to deliver in 2024 (766 aircraft), giving the group great revenue visibility.”

However, investors should be aware that some of Airbus’ suppliers have struggled to keep up with demand, which is holding back near-term production volumes and could cause some weakness until they are resolved.

AstraZeneca

Hargreaves Lansdown’s analysts also like pharmaceutical giant AstraZeneca because of a strong outlook thanks to its existing medicines as well as the pipeline of potential new products, on which it has an “impressive” history of success.

“2025 has already seen a string of regulatory approvals for the group’s cancer therapies. That builds on a cornerstone of the company’s offering,” Nathan explained. “After approval, sales of cancer drugs can build incrementally for many years as patient access improves, approvals are gained in new markets, and clinical trials prove their efficacy in additional diseases.”

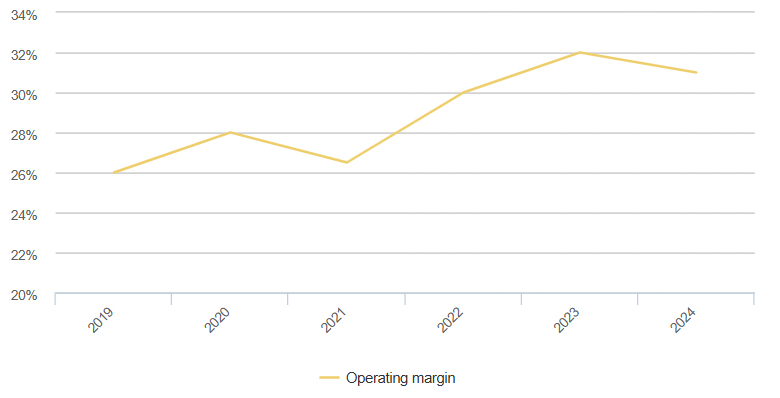

The analysts also think the target to deliver annual revenue of $80bn by 2030 does not look too demanding, while the high-value nature of its products has led to improved profitability in recent years, with “scope for more to come”.

AstraZeneca’s core operating margin

Source: AstraZeneca full-year reports

However, the group’s shares were hit by allegations of fraud by key staff in Astra’s Chinese operation, although Hargreaves Lansdown thinks “the market might have overestimated the potential repercussions of this unfolding saga”.

London Stock Exchange Group

After making its name as a major stock exchange, London Stock Exchange Group is now a global leader in financial data and technology – it earns most of its revenue from providing essential tools and services to financial professionals.

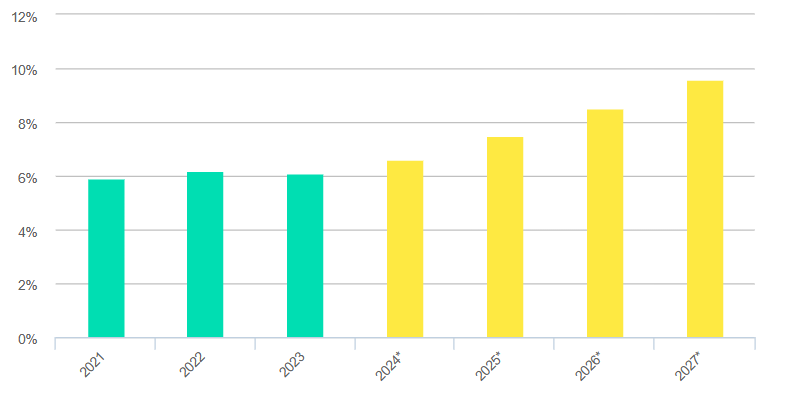

“What’s exciting about LSEG is its growth potential. The company has been working hard to boost profitability, with cashflow and efficiency both expected to improve over the next few years,” Nathan said.

“Analysts predict a noticeable increase in LSEG’s return on invested capital, a measure of how well a company uses its capital to generate profit. We see this as a key area for improvement that could help bridge the valuation gap between LSEG and some of its US peers, if it can deliver.”

London Stock Exchange Group’s return on investment capital

Source: Redburn Atlantic, accessed Jan 2024 (2024/25/26/27 are estimated)

Hargreaves Lansdown’s analysts expect London Stock Exchange Group to continue growing as it expands its offerings and benefits from trends such as the electronification of trading, embedding tech into capital markets and growth in demand for data and tools to analyse investing.

Issues investors need to watch, however, include regulation and the costs that come with keeping up with cutting-edge technology.

Nvidia

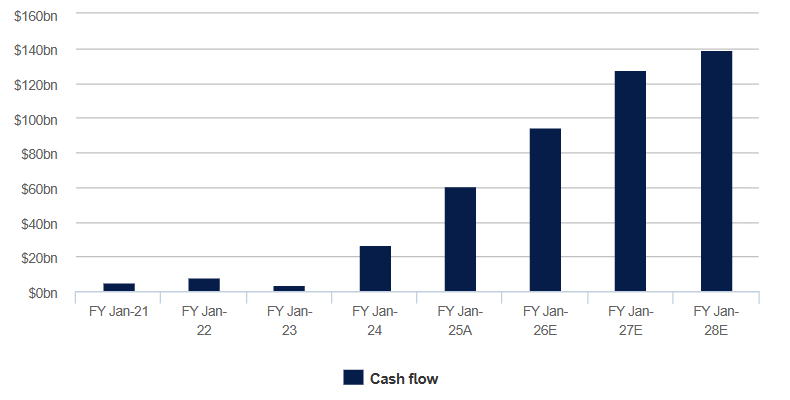

Nvidia has become one of the most valuable companies in the world through its dominance in supplying the accelerated computing and artificial intelligence (AI) fields with high-performance chips. Hargreaves Lansdown described it as a “once-in-a-generation company”, pointing to its impressive sales growth, cashflow and profit progression.

Nvidia’s free cash flow ($bn)

Source: LSEG Datastream, 3 Mar 2025

Nathan said: “Nvidia is confident that the upgrade cycle of outdated data centres represents a $1trn opportunity. We think new cloud deployments could generate a similar sized prize and the emergence of dedicated AI infrastructure adds further blue-sky potential.”

The company’s shares have been hit by the recent market volatility as well as the emergence of the Chinese AI engine DeepSeek-R1, which does not need cutting-edge chips. Other risks include the impact of trade restrictions and tariffs, emerging competition and capacity constraints in the supply chain.

However, Nathan pointed out that Nvidia’s valuation is currently below its long-run average, despite a track record of strong profit growth, while it is incentivised to continue delivering given the fact it is so closely watched by investors.

Unilever

Hargreaves Lansdown’s analysts like consumer goods giant Unilever because of the “significant transformation” being driven by its new leadership. This will see the company focus on its ‘power brands’, or the household names behind the majority of its sales, to help it recover from a period of lacklustre growth.

“Investments in these core brands are delivering stronger sales growth and improving efficiency across the business. The message is clear – Unilever is prioritising long-term success by focusing on what works best as opposed to pushing for scale at all costs,” Nathan explained.

“The company is also streamlining its operations to support this strategy. Rather than simply cutting costs, it’s reinvesting in high-potential brands to ensure sustainable growth. This shift signals confidence in its ability to deliver stronger results over time.”

But he added that the company’s turnaround is still in its infancy and said a key risk is how carefully the transition can be executed to avoid unnecessary disruption.