Investors worried by the US stock market going into correction can diversify their portfolios with funds that focus on value stocks or niche areas of the bond market, according to Wealth Club.

US stocks have underperformed since the start of the year as investors worry about high valuations, wobbles in the US tech growth story and uncertainty created by the new Donald Trump-led government.

The market dipped into correction territory last week – defined by a peak-to-trough loss of more than 10% – after the US ratchetted up trade tensions with tariffs on goods from China, Canada and Mexico. Trump also spooked the market by refusing to rule out that the US was heading towards recession.

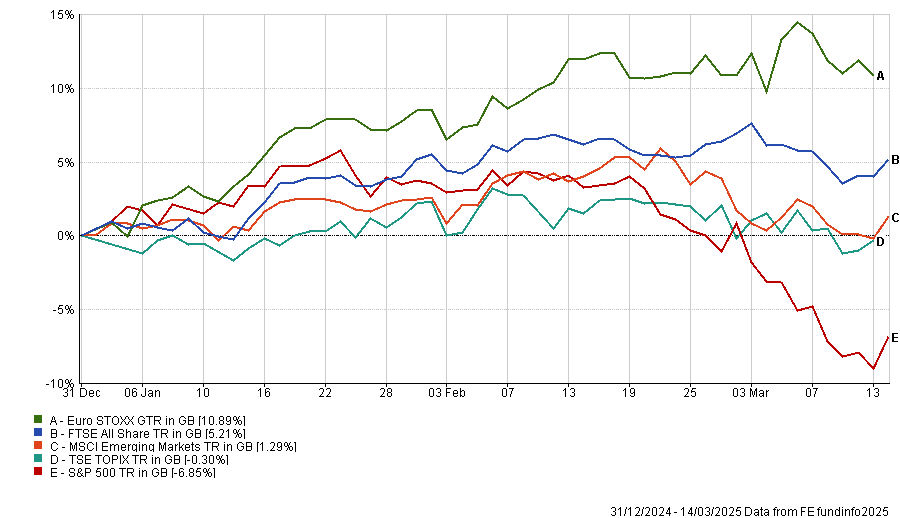

Performance by geography over 2025 to date

Source: FE Analytics

US tech names such as Nvidia and Tesla, which had been the darlings of the stock market for an extended period, were among the hardest hit in the correction as investors worried future growth would struggle to justify their lofty valuations.

Isaac Stell, investment manager at Wealth Club, said: “With the excitement about US tech stocks fading, investors may be looking at corners of the market that have long been ignored. Although predicting the future is a futile exercise, being diversified and prepared for all outcomes is not.”

Below, Wealth Club suggests three funds for investors looking to diversify their portfolios.

Dodge & Cox US Stock

For investors who want to retain exposure to the US, Stell pointed to the Dodge & Cox US Stock fund. Managed by the firm’s US equity investment committee, which includes chief investment officer David Hoeft, the $3.9bn fund is in the IA North America sector’s top quartile over 2025 to date, one year and five years.

Founded in the 1920s, Dodge & Cox was relatively young when the Wall Street crash of 1929 tanked markets and the world was plunged into the Great Depression, so it established a culture of protecting investors from economic turbulence.

Performance of Dodge & Cox US Stock vs sector and index over 5yrs

Source: FE Analytics

“Their value-focused investment philosophy is applied consistently and without compromise across their small suite of funds to this day,” the investment manager added.

“The investment process means the fund’s holdings have valuations below market averages and tend to have relatively little invested in highly valued technology companies.”

Although technology comprises around one-third of the S&P, Dodge & Cox US Stock has less than 7% in this sector. Instead, it is overweight areas like financials, healthcare and industrials.

Lightman European

While investors have been pulling back from the US, they have been more bullish on Europe. European equities have enjoyed a strong start to the year on the back of attractive valuations, Germany’s proposal to launch a €500bn special infrastructure fund and the prospect of higher defence spending.

Against this backdrop, Stell opted for the Lightman European fund. Lightman Investment Management was launched by Rob Burnett in 2019 and is a specialist European fund manager solely focused on this deep value strategy.

Performance of Lightman European vs sector and index over 5yrs

Source: FE Analytics

“The Lightman European fund looks for businesses that have been through challenging periods but where the light at the end of the tunnel is in sight and earnings growth is returning,” Stell said.

“Lightman focuses on those investment characteristics that have historically led to the most consistent returns over the longest timeframes, namely lowly valued companies with strong balance sheets and high free cashflows.”

The fund is also top quartile of the IA Europe ex UK sector over 2025 to date, one year and five years. It is currently overweight consumer staples, communication services, materials and energy stocks, while holding around 10% in cash.

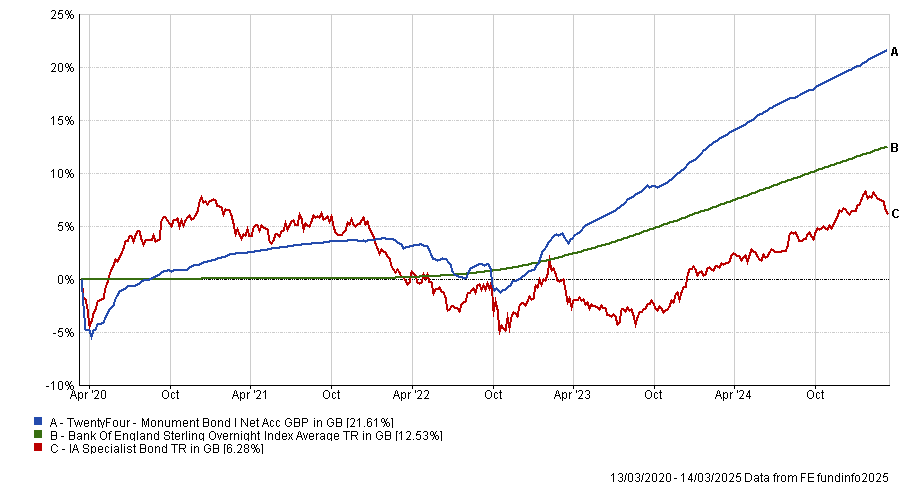

TwentyFour Monument Bond

Stell also suggested investors could diversify away from the US stock market correction by looking at bond funds, as higher interest rates mean more opportunities in the fixed income space.

Although bonds fell with stocks in 2022, Wealth Club believes the negative correlation between equity and bonds has been reset and argued that an allocation to fixed income is now “prudent” given heightened economic and geopolitical uncertainty.

“When looking for fund managers, we always seek experts within their chosen field. TwentyFour Asset Management specialise in a relatively niche area of fixed income known as asset-backed securities (ABS),” Stell said.

“ABS tends to offer higher yields than government or corporate bonds, whilst also demonstrating lower volatility thanks to their lower interest rate risk.”

Performance of TwentyFour Monument Bond vs sector and index over 5yrs

Source: FE Analytics

The £1.9bn TwentyFour Monument Bond fund invests in a wide range of asset backed securities, from residential mortgage-backed securities through to auto-loans and credit cards.

It has around 70% of its portfolio in AAA- and AA-rated securities while yielding more than 6%, leading Wealth Club to see it as offering potentially attractive returns while helping to dampen volatility.