Investment platform Tillit has dumped the European Opportunities Trust from its platform, citing “doubts about the manager’s ability to deliver sustainable long-term returns”.

Tillit is unique in its approach, only allowing customers to buy into funds and trusts recommended by an investment committee headed by chief investment officer Sheridan Admans.

While customers can continue to hold non-recommended funds (for instance if the funds have been removed or if clients have moved their portfolios from another platform), they are unable to buy more.

These funds are part of the ‘dark’ investible universe, meaning they can only be held or sold. It means Tillit customers will no longer be able to buy more of the European Opportunities Trust’s shares.

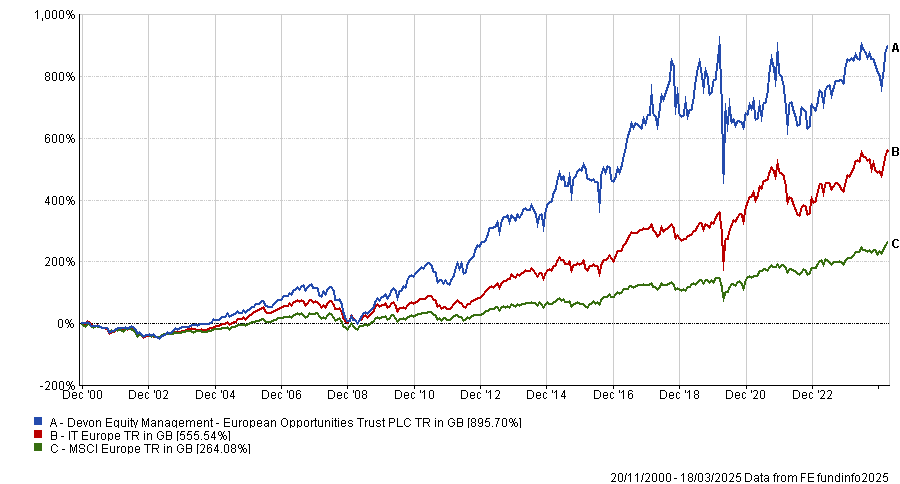

Headed by veteran stockpicker Alexander Darwall since 2000, the £558m market capitalisation trust has been excellent for investors, up 895% over its lifetime, more than three times the returns of the MSCI Europe benchmark.

Performance of trust vs sector and benchmark since launch

Source: FE Analytics

However, more recent performance has fallen away. It is the second-worst trust in the six-strong IT Europe sector over the past 10 years, making 76% versus a 119.9% return for the average peer, lagging the benchmark’s 107.2% gain.

“While the trust’s focus on innovative, cash-generative companies is appealing, it has faced challenges in delivering consistent outperformance against its benchmark and peers over the past decade,” said Admans.

“The shift towards large-cap stocks, coupled with struggles in a higher-rate environment, has moved the trust away from its mid-cap bias and attraction to its original investment proposition.”

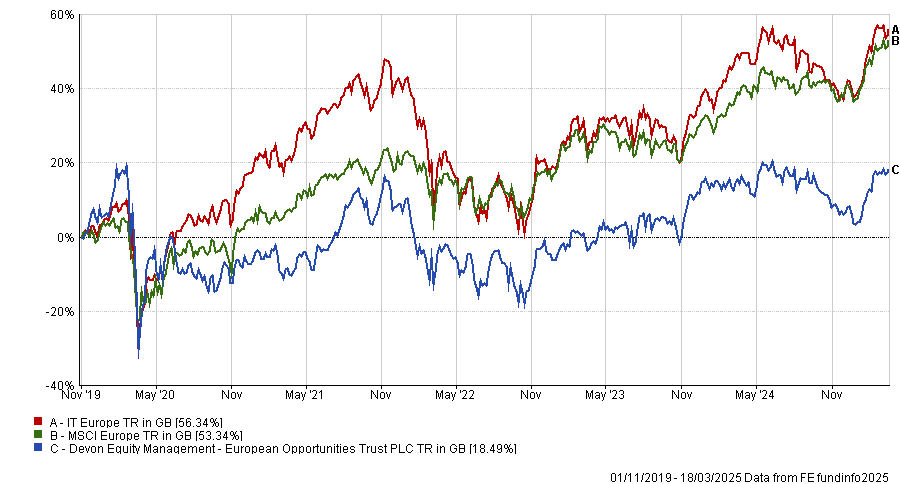

The trust, formerly a part of Jupiter Asset Management, was moved over to Devon Equity Management in 2019 when Darwall left Jupiter to set up his own fund house. Since the start of November 2019, when the trust changed over, it has been the worst performer in its sector, with both the average peer and benchmark making three times its return.

Performance of trust vs sector and benchmark since November 2019

Source: FE Analytics

In the trust’s latest half-year results, the board said it would give investors the option of a tender offer worth 25% of the trust’s shares in the second quarter of 2025 to address its 12.3% share price discount to the net asset value. It is not the first tender offer to address the discount, however.

“The announcement of a further tender offer for 25% of the share capital later this year amplifies the risk of forced asset sales at unfavourable prices, potentially disrupting the trust’s investment strategy,” said Admans.

European Opportunities Trust has also been under scrutiny from activist investor Saba Capital, something which the Tillit CIO suggested could “lead to continued short-term decision-making that further undermines performance”.

The trust also struggled to win over investors during its 2023 continuation vote, although ultimately they decided to keep the trust running.

“This reflects declining confidence in the current management team and their strategy, with nothing yet to suggest waning confidence has been restored,” said Admans.

“With no clear catalyst for recovery and continued headwinds, Tillit has concluded that the trust no longer meets the criteria for inclusion in the Tillit Universe.”

The firm also removed First Sentier Responsible Listed Infrastructure due to “persistent underperformance since inception and concerns about its long-term viability”.

Launched in 2021, the £23.7m fund run by Rebecca Sherlock and Peter Meany has made 13.3% since inception, slightly behind the 16.5% gain for the average fund in the IA Infrastructure sector.