Some 13 funds have been dropped from the Bestinvest Best Funds list, according to the firm’s bi-annual report, with nine new names added.

There was a clear preference for passives, with seven of the names added being exchange-traded funds (ETFs), while 12 of the funds dropped are actively managed.

Among the notable deletions, the firm has given up on WS Lindsell Train UK Equity. Run by FE fundinfo Alpha Manager Nick Train, the fund has been a strong long-term performer but its returns have waned of late.

It sits in the bottom quartile of the IA UK All Companies sector over one and five years and is below average over three years. It has failed to beat the average peer since 2020. So deep is its underperformance, the fund was included in the Bestinvest ‘Spot the Dog’ report for the second consecutive time in February.

Despite this, it remains a top-quartile fund over the past decade thanks to a stellar run between 2017 and 2020, when the fund was always in the first or second quartile of the peer group.

It is not out of favour with everybody, however, with analysts at interactive investor and Barclays both still recommending the fund.

Analysts at Barclays Smart Investor said they liked the “robust process” that has been in place for nearly 20 years. “It gives us confidence about what to expect from this fund going forward,” they said

WS Lindsell Train UK Equity was joined by Liontrust UK Growth as the two UK funds to be dropped by Bestinvest in the latest edition of its Best Funds list, as the table below shows.

Source: Bestinvest

Three global funds were also cut from the list, headlined by Baillie Gifford Global Discovery. The £350m fund is run by Douglas Brodie, Svetlana Viteva and Alpha Manager John MacDougall and aims to beat the S&P Global Small Cap index by at least 2% per annum over rolling five-year periods.

The small-cap portfolio has struggled to keep pace, however, with the wider global sector and has been the worst performer in the peer group over five years. It has sat in the bottom quartile of the sector over one, three, five and 10 years and has lost more than 40% in three years.

Analysts at FE Investments continue to back the fund. They said: “The team’s consistency and focus on the long term is a valuable trait when investing in smaller companies. This is because they can be vulnerable to short periods of speculation and large price swings.

“Although in isolation the fund is high risk, it could be well suited as an addition to an already-diverse global equity allocation that is lacking smaller company exposure.”

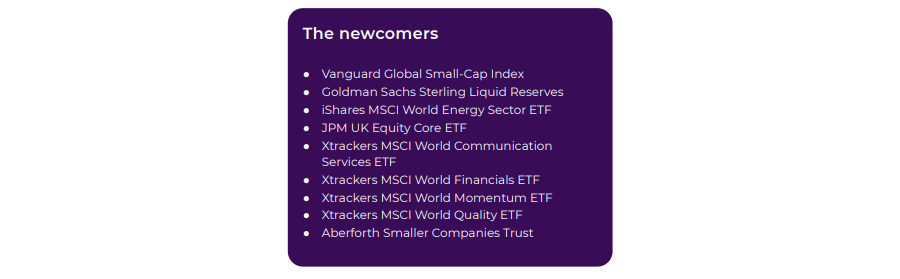

Among the newcomers to the Bestinvest Best Funds list, only two active funds made the list. The £1.1bn Aberforth Smaller Companies Trust was added on the back of a strong past half decade. The trust has sat in the top quartile of the 20-strong IT UK Smaller Companies sector over three and five years and was above average over one and 10 years as well.

It was joined by Goldman Sachs Sterling Liquid Reserves as the only active funds added in the latest edition of the report.

Source: Bestinvest

The list is published twice a year but investments are added or removed throughout the year. Jason Hollands, managing director of Bestinvest, said: “Deciding which actively managed funds qualify as ‘best’ is a process that relies on the expertise of our investment specialists. They not only meet the fund managers on a regular basis to understand their philosophy and approach, but also carefully assess the type of market environment that might benefit from a certain manager’s style.

“The risk management process, the size or liquidity constraints of the fund, the longevity of the manager and how scalable a fund is are other considerations.”

The list now includes 133 funds and investment trusts, but Hollands noted investors still need to “take their time to make their investment choices”, adding that the list is to be used for “inspiration”.