There has been a sea change in recent months as multi-asset managers and global stockpickers have begun to consider options outside of the US. But Will McIntosh-Whyte, multi-asset manager at Rathbones, is doing the opposite.

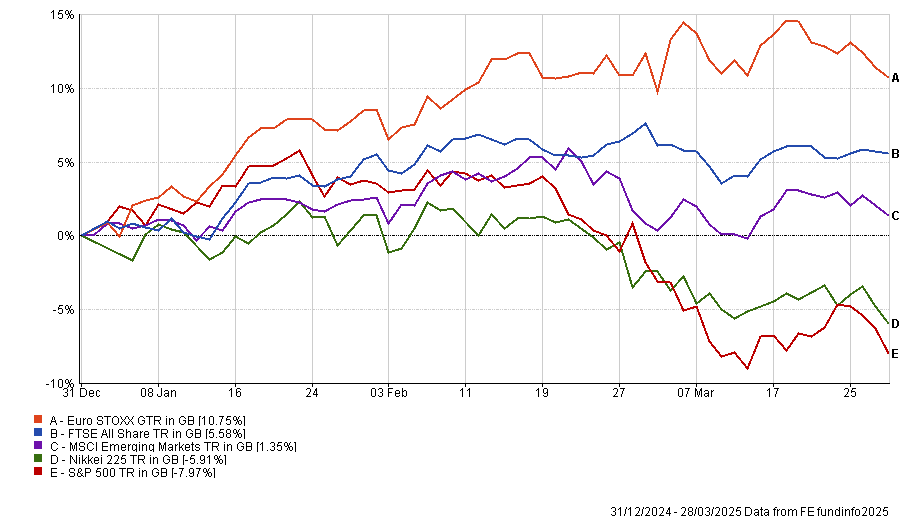

Last year, investors would have done well by betting on the US. In 2024, the S&P 500 was up by around 26.7%, the best performance of all major equity markets. This year, its fortunes have turned, with the S&P 500 down 8% so far in 2025, while former underperformers such as Europe have turned around, surging 10.8%.

The origins of this pivot away from the US are varied, but McIntosh-Whyte said perhaps the biggest driver is that “investors cannot get away from tariffs”. As president Donald Trump continues to levy tariffs, delay them or bring them in with exceptions, investors have become increasingly uncertain about the future.

“We’ve got Liberation Day to worry about, but the honest answer is that no one quite knows what will come out on 2 April”, McIntosh-Whyte added.

Performance of equity markets YTD

Source: FE Analytics

However, while many investors have been pulling back from the US, McIntosh-Whyte and his team have done the opposite, increasing their exposure to US businesses while reducing their allocations towards Europe.

He said: “The fact people are talking about the end of American exceptionalism tells me it is not a bad time to pick up a few new investments in the US.”

Despite the recent pullback, McIntosh-Whyte said America was still an “exceptional economy, with many of the best businesses in the world that you cannot find anywhere else”.

American businesses have consistently proven they can defy earnings expectations, deliver high margins, and have returns on capital which many of their competitors fail to match, he said.

“None of these things have changed”, he added.

While he conceded valuations had got “a bit frothy” recently, particularly as the hype around artificial intelligence (AI) has grown and continued strong performance had caused a surge of enthusiasm, comparisons towards the tech bubble were inappropriate.

He said recent market developments, such as uncertainties around tariffs and the emergence of competitors such as DeepSeek, led to investors taking a pause and “reassessing some of their optimistic expectations”, which was “quite healthy for the market”.

Salesforce is a good example of this. McIntosh-Whyte explained its valuation had surged as people became excited by Trump’s pro-business agenda, rising to unsustainable levels. Now, it is on a “far more sensible” multiple of around 25x.

He said: “I am not going to sit here and scream that it is a dirt-cheap business, but it is at a much more attractive point than before.”

Even Alphabet and Microsoft, which he conceded had become overvalued due to the AI hype, now looked more appealing, he said.

“Alphabet is trading at around 17x and we think when it trades around the high teens it is usually an attractive time to pick it up”. While Microsoft had not experienced the same pullback, now only just below 30x earnings, McIntosh-Whyte felt this was reasonable given the strength of the business.

He explained, despite the launch of competitors, Microsoft has continued to take market share and successfully sold products such as Copilot and Teams, despite “not being the strongest offering out there” because of its market position.

“We have always been big fans of the US. I cannot predict what next year will look like, but I can tell you some of the best businesses in the world are now looking attractively valued. If you are a long-term investor, I think this is an opportunity to start putting money to work”, he said.

By contrast, while investors have become more bullish on Europe, McIntosh-Whyte remained hesitant. Despite the resurgence of European stock markets this year, he warned investors may be overreacting.

“I am very cautious about people rushing into these businesses that were not given the time of day this time last year,” he explained.

Europe is on a much stronger footing, boosted by recent events in Germany, as well as European countries committing significant budgets to defence, which will aid businesses such as Rheinmetall.

However, while investment is still left to come, “there is also probably some capacity issues”, he warned. For starters, Germany cannot introduce these reforms overnight. It will take time and patience for many of these reforms to come to fruition, meaning investors may not see immediate success.

“There are a handful of stocks have been revalued significantly and are starting to price in expectations which may not pan out,” he said. As a result, the pivot towards Europe and away from the US is "not as game changing as some of the market reactions may imply”, he concluded.