Anyone who invests in China will have woken up to the news that the Shanghai Composite index dropped 7.3% in a Donald Trump-triggered sell-off.

Even before China retaliated against US tariffs announced on Liberation day last week, Jonathan Pines, FE fundinfo Alpha manager of the Federated Hermes Asia Ex Japan Equity fund, warned investors against putting their money in the region – although he is keeping a significant stake himself.

The Chinese market is Pines’ main overweight, currently making up close to half (46%) of the £2.7bn of assets in the portfolio; in comparison, the fund’s benchmark, the MSCI AC Asia ex Japan IMI index, has 31.8% in China. The fund’s top holding is also a Chinese company, the tech and videogames specialist Tencent (7.4%).

This overweight was risky even before the tariff skirmishes, and Pines admitted: “Our significant overweight makes me nervous”.

The manager can envisage multiple situations where his investments in China won't be great – not just around trade but also increased geopolitical tensions and “activity” between China and Taiwan.

“But still, on a risk-adjusted basis, China is a risk worth taking and therefore we are overweight. It's not without nervousness, however – it is very news-dependent what might happen with that market,” he said.

“For this reason, I wouldn't put all my money into our fund because of the large overweight. Instead, as part of an investment portfolio, this fund produces good risk-adjusted returns.”

So why maintain such a large overweight if that means sleepless nights? The main reasons Pines remains invested are valuations and a lack of confidence in the alternatives. On a bottom-up basis, the manager claims Chinese valuations are still “remarkable”, even after the recent rally. Plus, the investment proposition in China is “clearly better” than in India and Taiwan.

“The easiest call that we make in our portfolio is to be significantly underweight India, the most expansive market in the world,” he said. “On the other hand, the Taiwan Stock Exchange has moved almost in lockstep with the US market over the past 10 years, and some of the excesses that you see in the US are in Taiwan too.”

Pines has been overweight China for more than four years, making losses almost every single year until 2024.

“It's been very painful for us. But now, at the signs of the bottoming of the economy, the government is coming in with major support measures.”

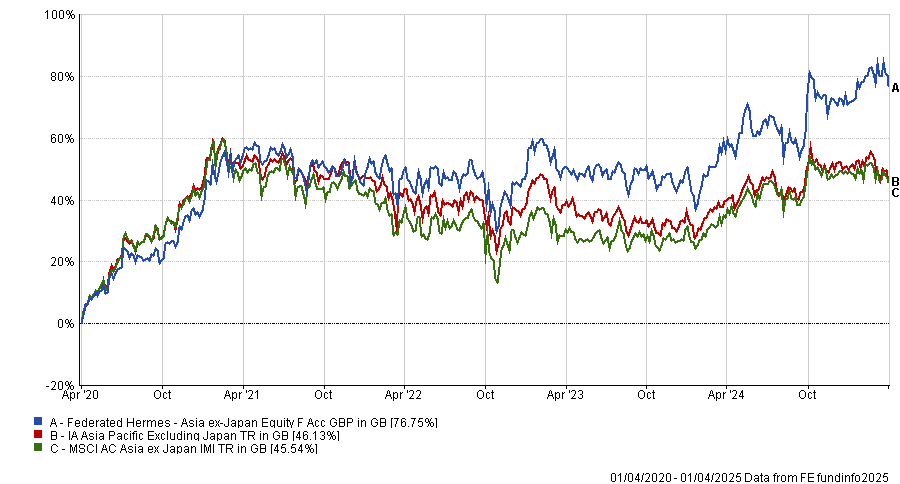

Despite the losses from the Chinese stocks, the fund itself maintained a large advantage against both its benchmark and the peer group, as the chart below shows, making top-decile returns in the IA Asia Pacific Excluding Japan sector over all main timeframes and becoming the top fund in the 113-strong peer group over the past three-years, as previously covered on Trustnet.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

Until today, Pines was enjoying the rally in the market. “We feel we deserved it after being wrong for four years. We don't want to sell too quickly, but have been trimming positions,” he said.

So far, he has trimmed about 300 basis points, taking the relative overweight to China to about 16 percentage points (without selling, it would have been 19); the money is being reinvested mainly in Korea, a market the manager has been most excited about since the beginning of last year. However, 2024 was “a disaster” for Korea, which fell 19%, as the chart below shows. “We were early, but now we like it even more.”

Performance of indices over 1yr

Source: FE Analytics

There are a couple of caveats. Korea is cheap because corporate governance is very poor. Pines has been campaigning to try and improve it and is hopeful that the Korea Commercial Act, which will introduce judiciary duty for the first time in the country, will pass.

“Korea is now the stand-out underperformer in our region as it fell 19% in absolute terms last year. But there is positive news is on the horizon, which makes me very hopeful.”

The Federated Hermes Asia Ex Japan Equity fund is a contrarian fund, which today means it is mainly focused on value stocks and value markets. This explains the focus to cheaper markets such as China and Korea, but this strategy isn’t set in stone, Pines explained.

“We look like a value fund now because to be value is to be contrarian, but we could envision a situation in the future where growth stocks are only trading at a very slight premium to value stocks, in which case growth would be the big deal, and we would look like growth managers,” he concluded.