Trade disruption and sluggish global growth are the main takeaways from Donald Trump’s Liberation Day tariffs, but too many market participants are forgetting the longer-term inflationary implications of the new regime, according to Trevor Greetham, head of multi-asset at Royal London Asset Management.

“Trade wars are stagflationary but rather than factoring in the prospect of higher long-term inflation, markets have focused on the potential for greater near-term economic weakness – a deflationary shock that is bad for stocks and commodities and good for government bonds,” he said.

“It’s not beyond the realms of possibility that this situation becomes similar to the Covid pandemic – a short-term deflationary panic that gives way to an inflationary recovery.”

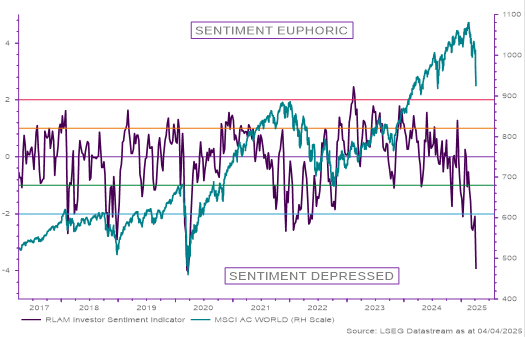

Investor confidence nosedived last week. On Friday 4 April, Royal London’s investment sentiment indicator registered “one of the top-10 most panicked daily readings” since 1991, he said..

While it often pays to ‘be greedy when others are fearful’, as Warren Buffett’s investment mantra goes, Greetham warned that volatility is “likely to remain high”.

Positive policy change would be needed for a sustained turnaround to happen, the signs for which are “not encouraging”, he said.. Equity weakness and the risk of recession seem to be part and parcel of Trump’s strategy to put pressure on trading partners over the coming weeks and months.

Deeply depressed investor sentiment

Source: RLAM investor sentiment indicator, measured in standard deviations from normal.

The head of multi-asset believes we are still in an inflationary overheat phase of the global business cycle, when central banks most often increase rather than decrease interest rates.

“Structural changes in the world economy, including populism and deglobalisation, have ushered in a regime in which periods of low stable inflation are interrupted by sudden price level shocks that central banks are unable to prevent and unwilling to reverse,” he said.

“Central banks are unlikely to ease policy unless they see hard evidence of financial system stress or economic weakness, which could take a while. Weighing up the short-term deflationary pressures against longer-term inflation risks will require careful monitoring.”

During the pandemic, investors had to contend with news flow around the virus and vaccines, whereas in 2025, they are “trying to second guess the policy pronouncements of a president with a highly idiosyncratic world view”.

A more uncertain geopolitical world calls for broad diversification, said Greetham, who encouraged investors to look at inflation hedges such as commodities and to adopt an active and disciplined approach to tactical asset allocation.