Imagine creating an investment strategy that enhances performance potential without increasing your exposure to smaller, riskier companies. Many of us would likely find this appealing. However, it seems that many investors don’t take this approach when it comes to mid-capitalisation (mid-cap) stocks.

Even though mid-caps have a history of outperforming their large- and small-cap peers, most investors are underexposed to this category.

Why mid-cap stocks are worth your attention

In some ways, mid-caps are like the unappreciated middle child. Large companies are often high-profile names that everyone recognises. Meanwhile, smaller companies may benefit from industry buzz and offer the alluring potential of getting in on the ground floor.

Mid-cap companies, on the other hand, are sometimes overlooked. With market capitalisations between roughly $11bn and $65bn, many successful mid-cap companies have proven business models, capable management teams and established customer bases and brands. While they have evolved from small-cap stocks, many still possess significant growth potential.

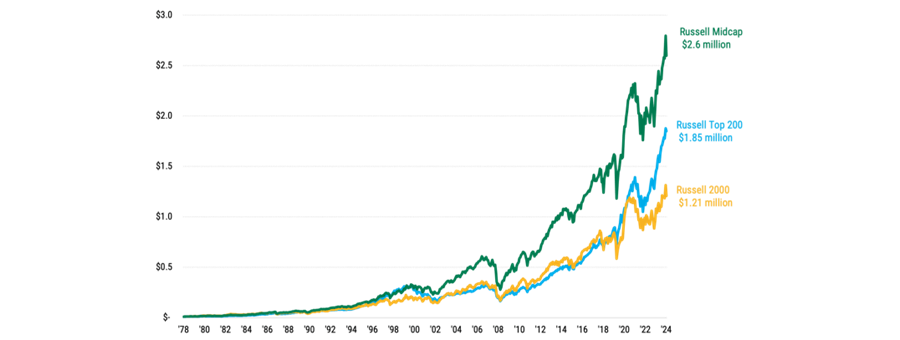

In our view, it is a mistake to overlook mid-caps in favour of the stock market’s largest and smallest companies. The chart below shows the growth of hypothetical investments in large-, mid- and small-cap stocks since the 1978 inception of the Russell Midcap Index.

Mid-cap stocks would have generated more than twice the wealth of small-caps and approximately 40% more than large-caps. During that time, a $10,000 investment in mid-sized companies would have grown to nearly $2.6m compared to $1.8m for large-cap stocks and $1.2m for small-cap stocks.

Mid-cap stocks have historically outperformed large- and small-caps

Source: FactSet. Data from 12/31/1978 - 12/31/2024. The Russell Midcap® Index represents mid-cap stock performance. The Russell Top 200® Index represents large-caps, and the Russell 2000® Index represents small-caps. The indices are not investment products available for purchase. Hypothetical Growth of $10,000 (in millions).

The historical success of mid-cap stocks

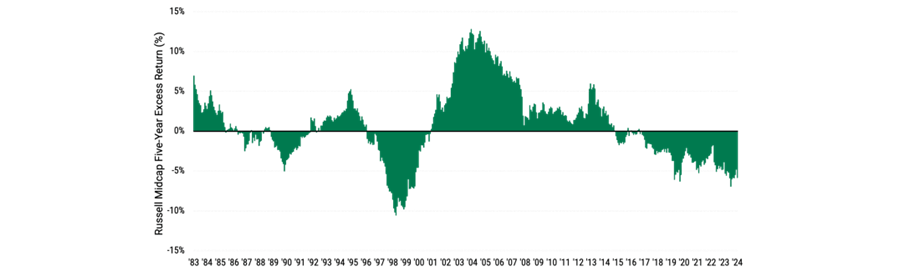

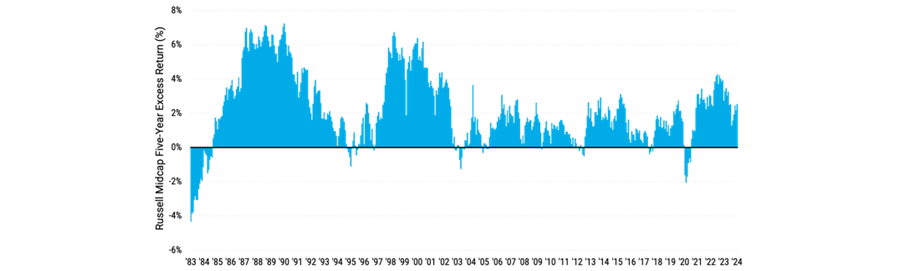

Mid-cap stocks have a historical pattern of outperformance compared to large- and small-cap stocks. It becomes clear when we analyse rolling five-year performance snapshots, which typically capture rising and falling stock market environments.

As shown in Figure 2 Panel A, mid-cap stocks have outperformed large-caps in 54% of rolling five-year periods since 1983. Mid-caps also outperformed small-caps 89% of the time during the same period, as Panel B illustrates. These rolling observations include periods of negative investment returns.

A closer look at the data reveals that mid-caps historically outperformed large-caps when the market favoured smaller stocks. Similarly, they outperformed smaller stocks when investors preferred the stocks of larger companies.3

Rolling returns demonstrate a history of mid-cap outperformance

Mid-Caps vs. Large-Caps

Mid-Caps vs. Small-Caps

Source: FactSet. Data for both charts from 12/31/1978 - 12/31/2024. The performance period began on 12/31/1978, with the first five-year return observation on 12/31/1983. The Russell Midcap® Index represents mid-cap stock performance. The Russell Top 200® Index represents large-caps, and the Russell 2000® Index represents small-caps.

Investors may be underexposed to mid-cap stocks

Despite mid-cap stocks' track record, investors may have inadequate exposure to this portion of the equity market. Mid-caps account for 23% of the domestic equity universe, yet, as of 31 March 2024, the asset class represents only 10% of investors' domestic equity mutual fund assets.

Some of the underexposure may be due to a misperception of the Russell 1000® Index's composition. Because the index includes large-cap stocks (the 200 largest publicly traded US companies, based on total market capitalisation) and mid-cap stocks (the remaining 800), investors may believe their index fund or exchange-traded fund provides adequate mid-cap exposure.

In reality, larger companies have an oversized impact on the index's results. At the end of 2024, the 200 largest companies comprised about 90% of the Russell 1000's weight, dwarfing the effect of the index's 800 mid-cap companies.

Faulty diversification strategies may be another reason for underexposure to mid-caps. When building their stock portfolios, investors may overweight the market's largest companies due to their defensive characteristics.

At the same time, they may seek to increase their portfolio's return potential by investing in the market's smallest and riskiest stocks. Such an approach bypasses the attractive risk and return potential of mid-caps.

Mid-cap stocks: A key component of diversification

We think mid-caps represent a time-tested market sweet spot with a history of outperforming large- and small-cap stocks. Their performance and risk characteristics offer the potential to improve stock portfolio returns while reducing risk compared to small-caps.

Rob Brookby and Jonathan Bauman are portfolio managers at American Century Investments. The views expressed above should not be taken as investment advice.